MarketWatch

- Take a large group of people, let’s say 10,000. Send half of them a message that Team A will win the game this weekend. Send the other have a message that Team B will win the game this weekend.

- Whichever team wins, send a message to that group that you were right. Send no further messages to the group you got wrong.

- Repeat.

- To launch a new entrepreneurial venture, often with the backing of the parent firm or organization;

- To assist in the evaluation of potential investments where the entrepreneur has a particular expertise; or

- To provide functional expertise to assist with an existing investment.

-

All the screenshots are so narrow. We all had little, tiny monitors.

-

BigCharts Canada, FTW!

-

Virtual Stock Exchange ended up being bought by MarketWatch, who bought BigCharts.

-

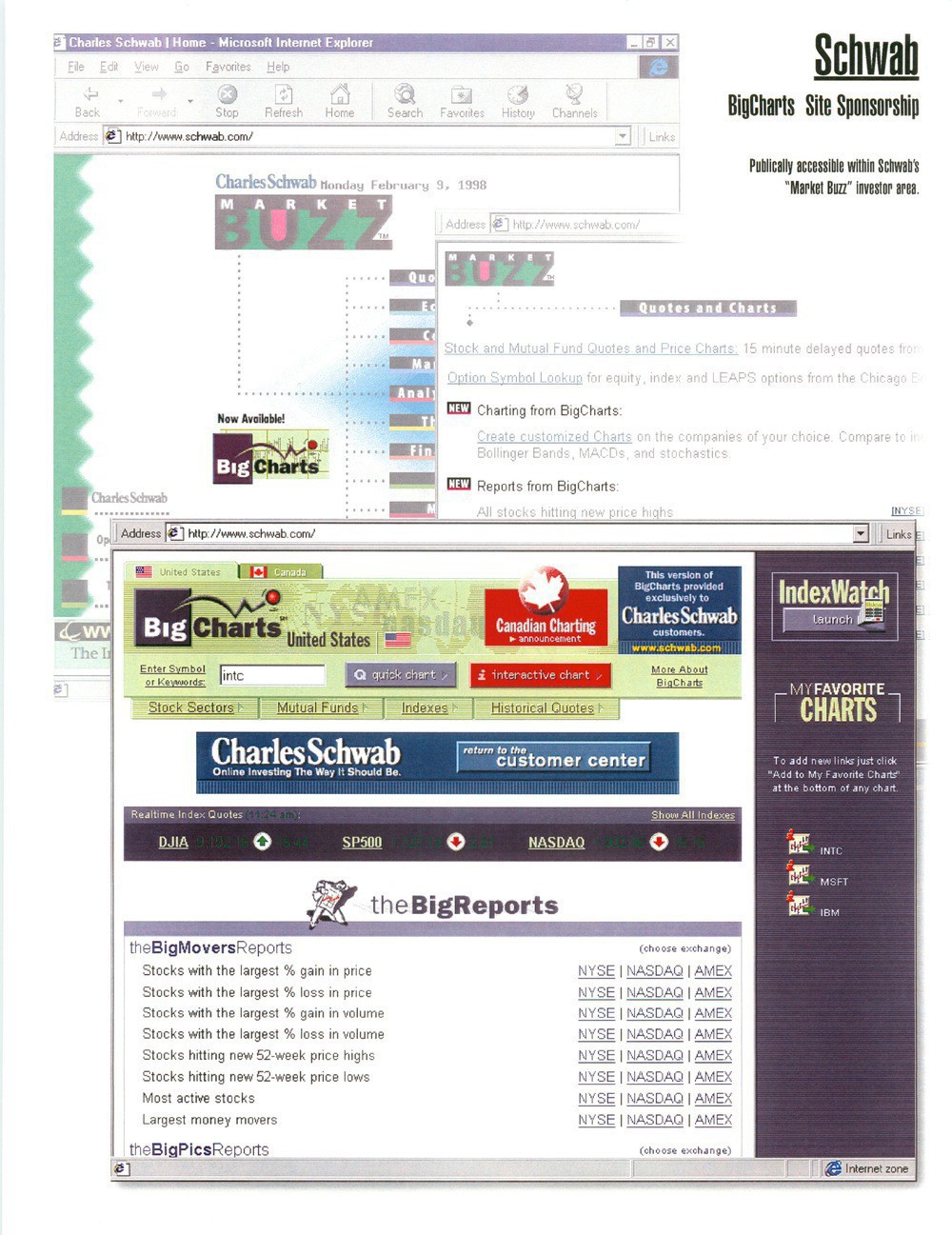

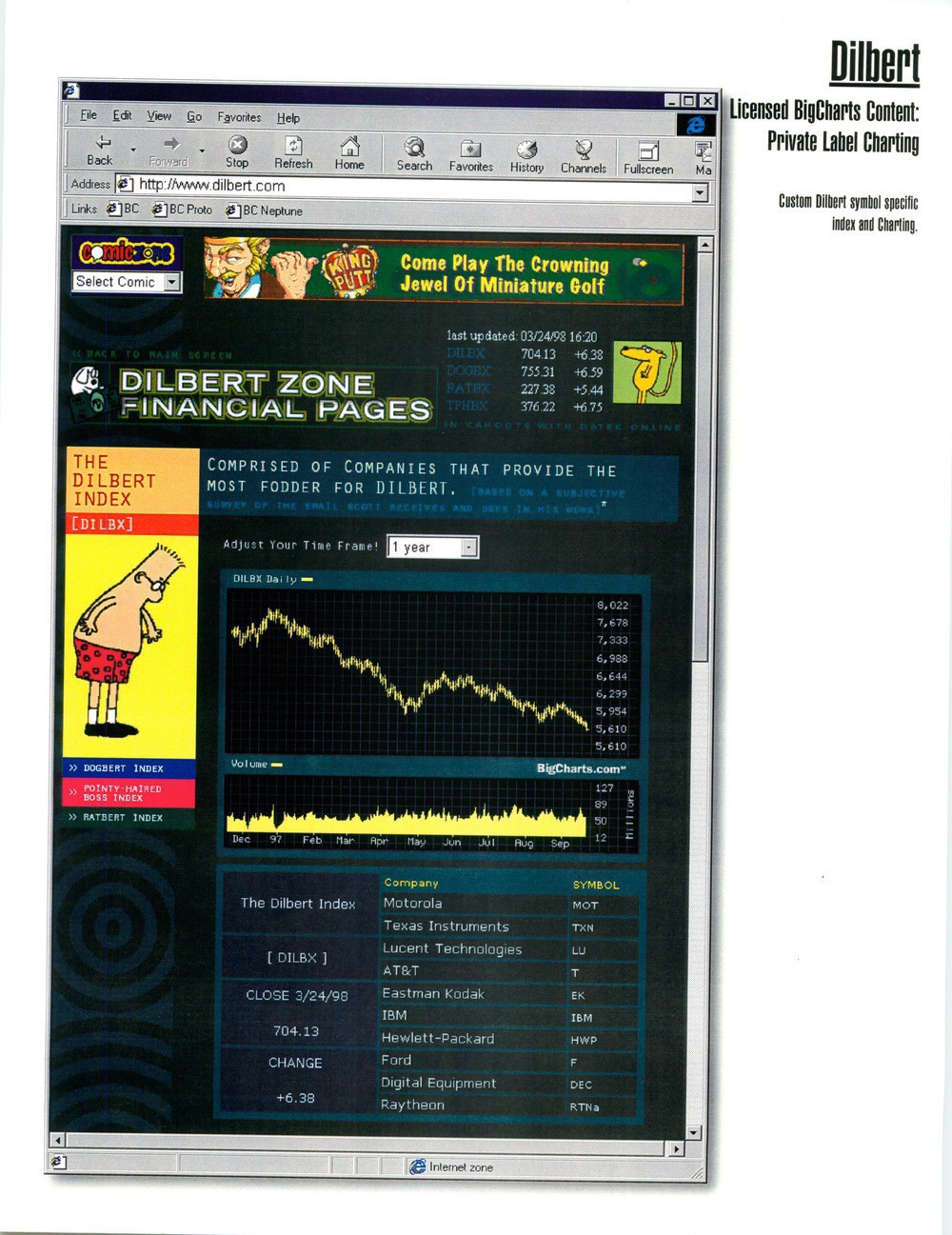

Note the error on the Schwab image (page 10) where the URL is “datek.com”. 🙂

- Really missing espresso.

- Riding on school bus with Mazie.

- Wondering if Jim has had coffee.

- Wanting something…

- Pouting after Jim hurt my feelings.

- Maybe I should drink less coffee.

- Starbucks people are using wireless headsets.

- Stranded in New York Tweets

- Tammy declares that I cannot wear my new fishing shirt to work…

- iPhone Day via Twitter

- Finished cleaning most of the dog puke in minivan.

- Drinking amazing espresso…

- Sitting at my desk, sweating.

- I need a ship.

- Watching Charlotte’s Web with Mazie.

- At the Dolphin Show with Mazie!

- Having lunch with Mazie at Yum!

- Holy crap! Apple TV’s now show up as AirTunes remote speakers.

- Back in hotel room. TV doesn’t work in this room.

- Just calculated that I have 7,624,000 pixels on my desktop.

- Chase just ate half-loaf of banana bread off the counter!

- Just baked three loaves of banana bread. Yum.

- Mazie to Dad using iPhone…

- Updating Vista to SP1. Wish me luck.

- At a dinner with at least 10 doctors.

- Life Tip #845

- I wish time didn’t go so very fast…

- The question isn’t if…

- Feeling fairly stupid…

- Why is it so predictable…

- I sent this tweet four hours ago.

- Drinking from a jug marked XXX.

This chart of SPSC performance since IPO is amazing. Compared to the high growth tech giants — outperforms AMZN, MSFT, GOOG, AAPL. 🤩

Had a super evening with great MarketWatch friends. It has been decades since we worked together, but the stories are were as fresh as ever. Nick, Anna, Jim, Scott – you are all amazing! 🤩🥰

Random Forecasts

We all try to predict the future. Particularly in business, sports, finance, etc. I like to recall a story that Larry Kramer, CEO of MarketWatch, shared with me a long time ago.

Larry had spent a lot of time in finance, but before that had a deep background in sports. Sports betting is a huge industry and people try to prove that they have the edge in picking the winner of any game. So, anyone that can prove that they are a good picker will get attention, or be able to sell their upcoming predictions. Larry shared one of the strategies that he had seen many times.

At the end of three cycles you have 1,250 people that have seen you perfectly predict the last three games. You must be a genius! Will they pay you to get your prediction for the next game? You must have an edge.

So what is the lesson? When someone seems like a fantastic forecaster, make sure you aren’t just one of the people in that third set of people!

Two Second Test

I spent a lot of my career in media and publishing on the web. During that time one of the things that I came to appreciate more completely was the unique journalistic voice that news organizations have. Being responsible for the websites of a number of these sites, I felt it was absolutely critical that whatever Content Management Systems (CMS for those in the business) and other publishing systems we had must allow the journalists to express that unique voice to the reader, via the website. To this end I coined something that I called the Two Second Test.

The Two Second Test is simple. You should be able to show any person the front page of a news website for just two seconds and they should be able to have a feel for what is happening at that moment. Is there big news? Did something great just happen? Something bad? You should be able to intuit it from just those two seconds.

I was reminded of this concept recently when Larry Kramer shared How 9/11 looked on a newly created Internet on that day. His article includes pictures of two framed screen grabs of the MarketWatch page from that day.

I looked at those in Two Seconds you knew something big was happening.

This might seem easy, but the vast majority of news websites even today fail this test. Pick your favorite sites and go to them, look for two seconds, and see what you know. Ask yourself if you know anything? Mostly you don’t.

Most organizations fail this test because of the constraints of their content management system. In order to make their sites work, they have dozens of templates, and they flow articles and blurbs from their CMS into various templates. They change the template for what is going on in the world, but they are always working in a template.

In order to pass the Two Second Test you have to give your newsroom a canvas to work on, not a color-by-numbers template. Along with that power comes risk. The newsroom could put something on the site that has a technical flaw of some sort. Having a strong operational connection between the newsroom and the technology team limits that risk though.

Happy 23rd Birthday BigCharts!

On this day, 23 years ago, we launched BigCharts.com. The time before and after that was fun, stressful, and filled with unknowns. It was a great ride. One of the defining experiences of my life. I love that the site is still around, serving charts for all that want! I’m sure code I wrote is still running on it. 😬

I bet that it is one of the very few sites that can show a graph of the Dow Jones Industrial Average back to 1970. I know because I was the one that backloaded that data into the database!

I love that the size of chart bigger than Large is still called Big! I remember the laughter when we came up with that obvious label.

It still is one of the few sites that will give you a historical quote, with the price info for a given day in the past, backing out splits.

I remember the up2.aspx page that we used for the load balancers to make sure servers were healthy.

Here is a team photo from June 9, 1999. It was a tech team dinner at Buca. What a great team!

I hope the site enjoys its 20s and is around for decades to come!

I also shared this on LinkedIn and hopefully we’ll get some old school BigCharts folks commenting.

Was great to catch up today with friends and MarketWatch colleagues Anna Klombies and Jim Bernard.

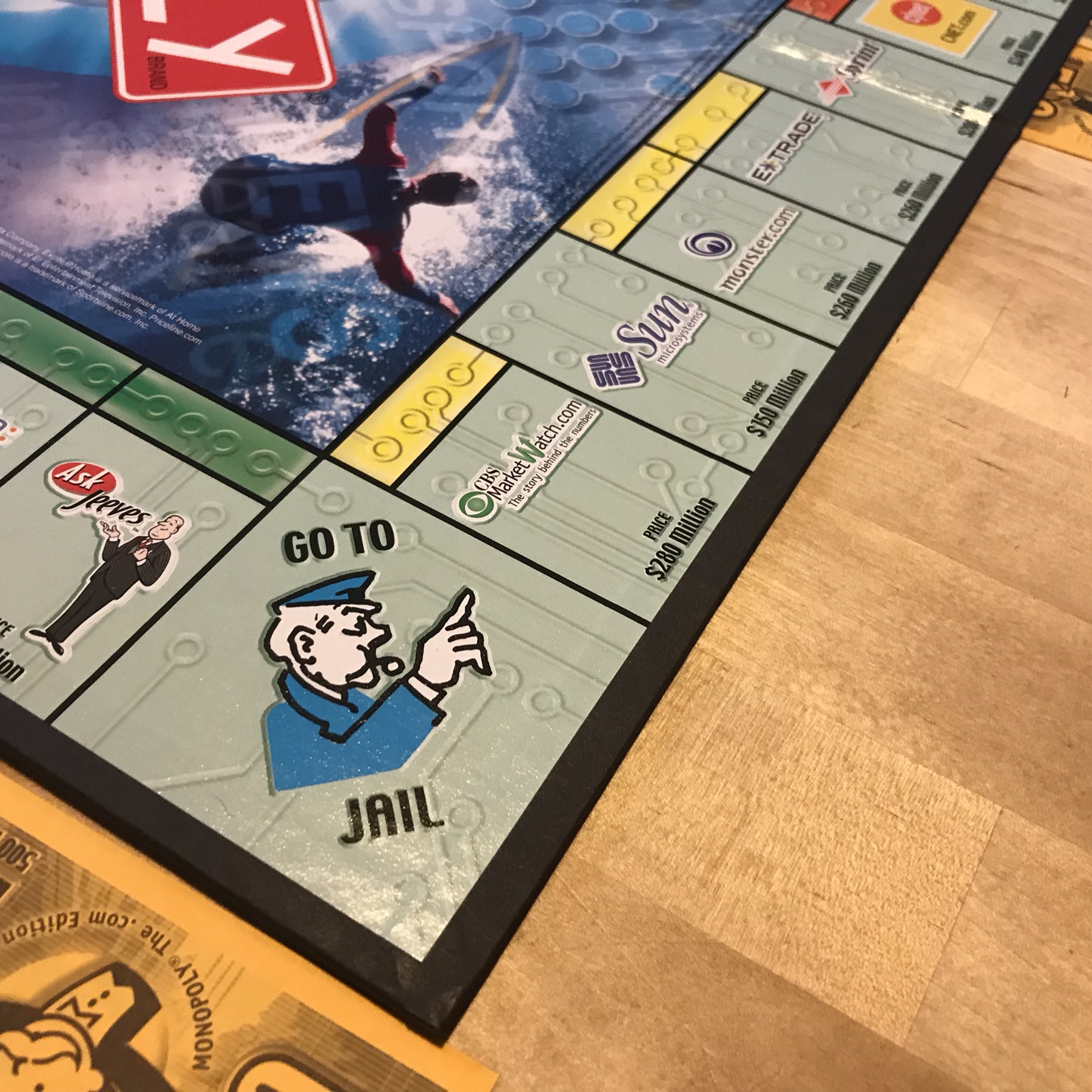

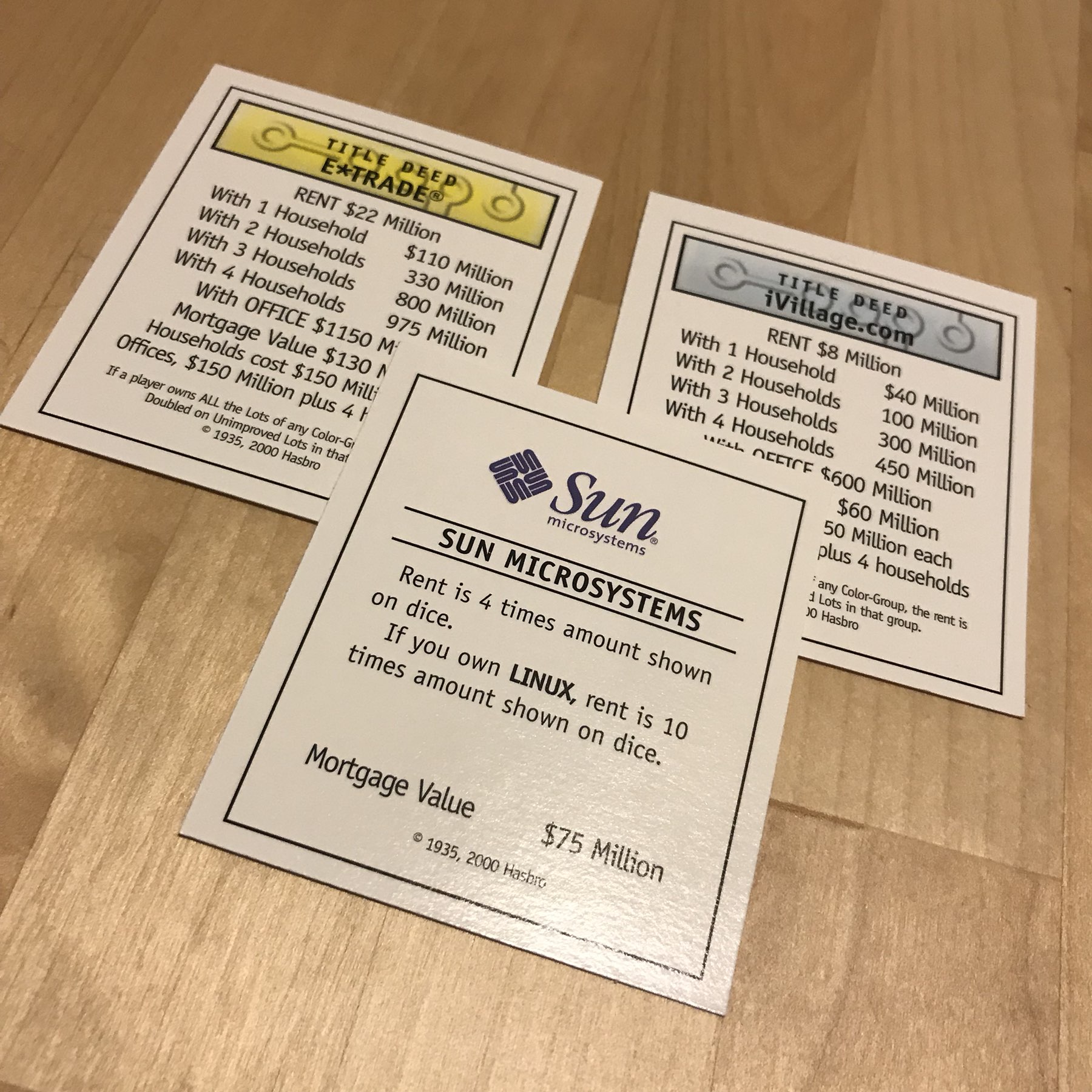

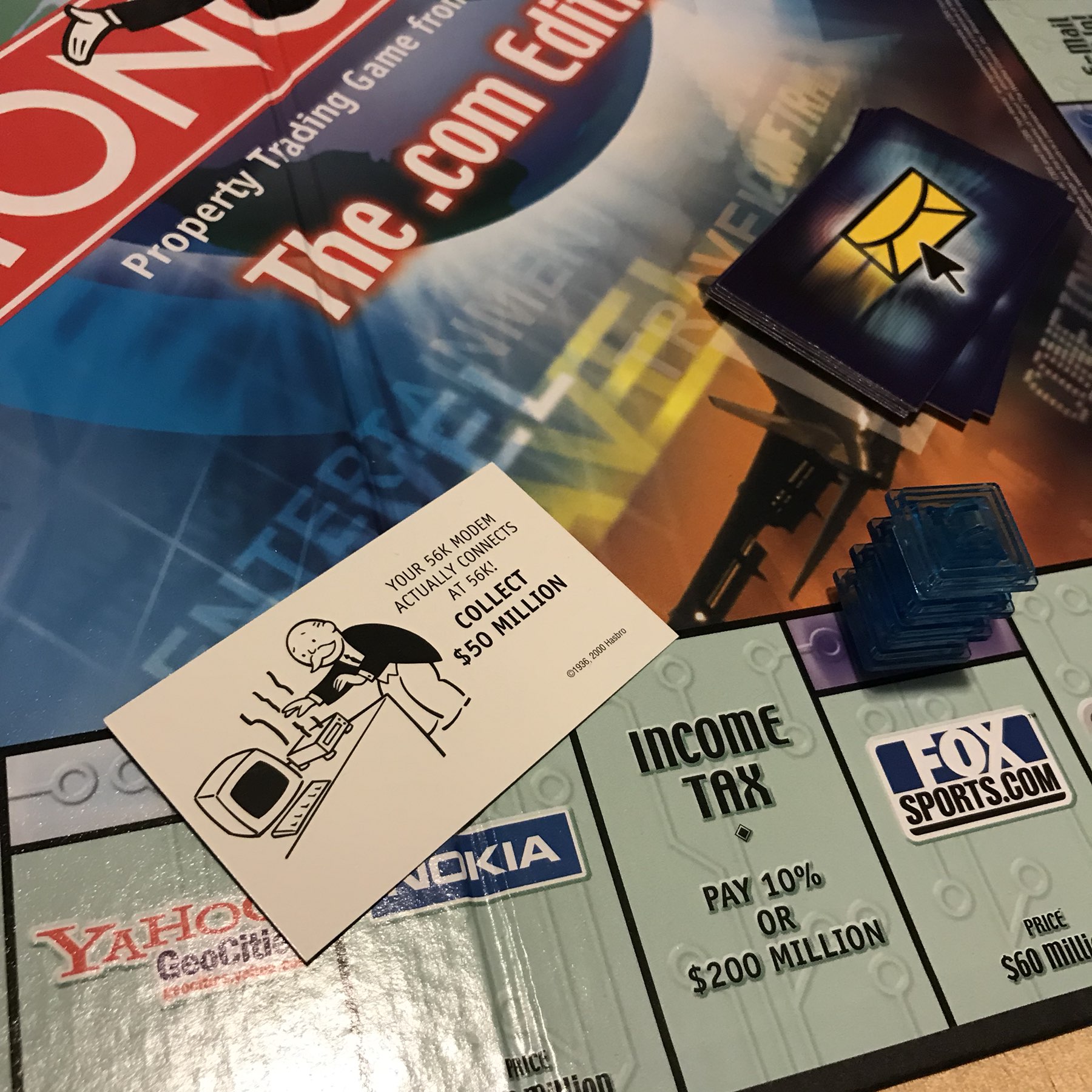

Playing The .com Edition of Monopoly, of course. 😜 Hilarious tiles. Game starts with $1.5 billion per player. 💸 CBS MarketWatch has a tile, right next to Sun Microsystems!

Google and Amazon are not on The .com Edition Monopoly board. 🤷♂️

I had to buy Sun Microsystems in .com Monopoly. 💙

56k modem for the win! .com Monopoly. 😊

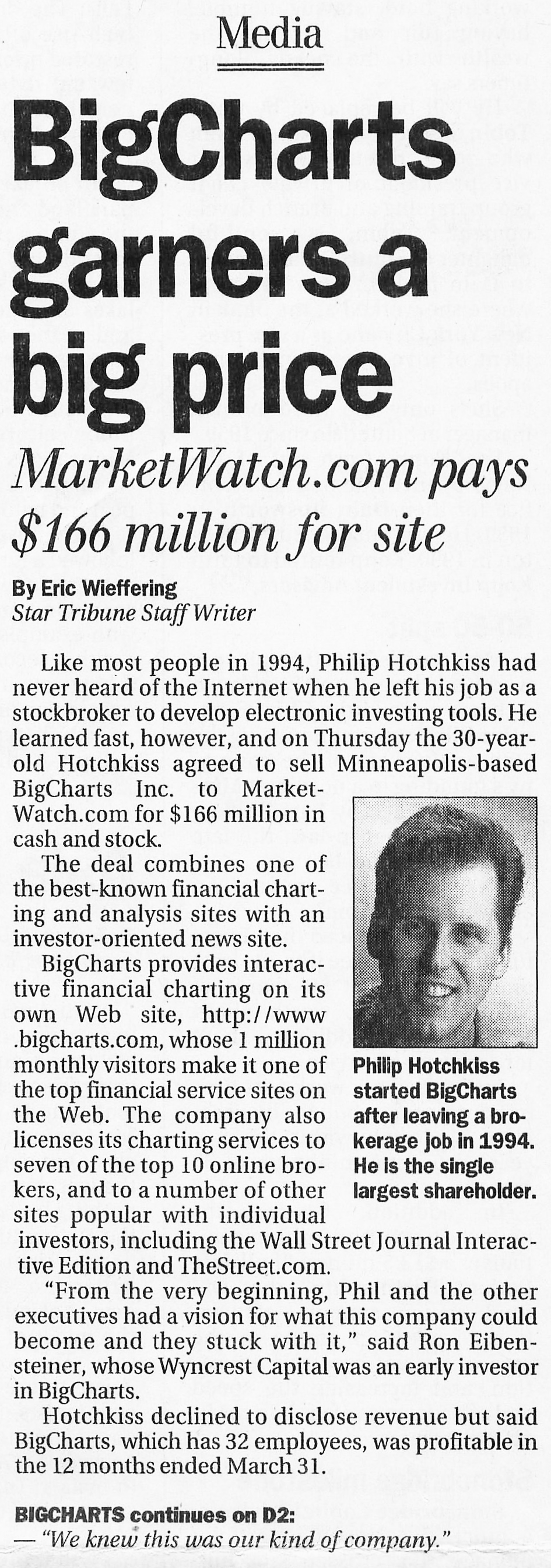

Star Tribune in April 1999 on BigCharts Acquisition

I’ve been cleaning through old files and found the copy of the April 30, 1999 issue of the Star Tribune that I had saved with the article about BigCharts being acquired by CBS MarketWatch. I couldn’t just recycle this before running it through the scanner. Phil sure had some hair back then. 😀

Funny that Phil actually did relocate to San Francisco area, just about 10 years later than this article and had nothing to do with BigCharts or MarketWatch.

Traveling old school with CBS MarketWatch duffel this trip.

One of my favorite mashups we ever did at MarketWatch put realtime news on a live timeline. Cool stuff.

Stock Charts in HTML5

HumbleFinance produces really nice looking, smooth and interactive charts in HTML5 using Canvas. Very nice. At MarketWatch we had been trying to do this several years ago but it was really hard to get the user experience we wanted. I think browser technology has finally reached the point where you can do this stuff right. (via Daring Fireball)

My Solution for Microsoft to Get Nerds Back

I was catching up on my Daring Fireball feed today and saw that John Gruber had put together a longer post on Microsoft’s earnings shortfall. It’s a worthwhile read, and I think that Gruber is correct in suggesting that Microsoft has begun a very difficult time and is going to be there for a while.

Today that is simply no longer the case. Microsoft has lost all but a sliver of this entire market. People who love computers overwhelmingly prefer to use a Mac today. Microsoft’s core problem is that they have lost the hearts of computer enthusiasts. (Emphasis mine) Regular people don’t think about their choice of computer platform in detail and with passion like nerds do because, duh, they are not nerds. But nerds are leading indicators.

Now, let me be particularly cautious here. This is combustible territory I realize. A couple of months ago I was asked by a couple of people for my opinion of what Microsoft should do to change direction. After considering it for a while I came up with a simple two step plan that would make me think that something big had happened at Microsoft.

Neither of these two steps I’m going to suggest are things that average consumers would notice, or even really care about. My point, agreeing with Gruber, is to do something that will get the nerds to take notice. However, before proceeding, let me come clean that I have been a huge Microsoft advocate. MarketWatch.com is one of the largest financial websites on the Internet, and is entirely built on Windows technology. I’ve advocated with people the benefits of Windows development environments. I’ve even been quoted in Microsoft case studies. With all that said, I can’t imagine using Windows in a new company, and I haven’t seen an early stage company using Windows for years now.

Unix Has Won

My first suggestion for Microsoft is to wave the white flag on the NT kernel. Dump it. Dump it and replace it with a Linux, BSD, Mach or other Unix-type kernel. I’m not going to get into arguments about the benefits of the NT kernel and its VMS lineage. This isn’t a point of threading models or memory management. My point is both a technical and cultural one. It seems unnecessary to continue to shoulder the burden of the NT kernel. Move to an open-source Linux kernel and stop carrying all the water yourself.

What happens with Windows? Not much for the user. Microsoft should do what Apple did when it made Mac OS X. Wholesale change the kernel but keep the user experience pretty much the same. The engine is new and different, but users don’t need to know that. Meanwhile, the nerds of the world can enjoy a native shell with the thousands of Unix executables available native on the platform.

If you’re saying to yourself “Jamie, the kernel is not Microsoft’s problem!” you are likely right. I’m not suggesting that blue screens of death are regular and that the kernel is broken. I’m suggesting that Microsoft needs to adopt a new culture, a new perspective on software. They need to force themselves onto a new path that acknowledges what has happened in the open-source world for the last 20 years. Adopting an open-source Unix style kernel would send a very clear, and very loud message that things have changed. That the future is going to be different. A new path is being broken.

Stop Fighting the Web Browsers

My second suggestion rings similar to the first, but is in a different area. I’m not going to suggest that Microsoft should abandon Internet Explorer. They can and should do what they can to make a great browser that works amazingly in Windows. Internet Explorer should be that. However, they should immediately ditch the rendering engine in IE and move to one of the open-source ones. WebKit, Gecko, anything other than Trident (or MSHTML).

The nerds of the world, the ones that build the websites that everyone uses, know intimately how bad Internet Explorer is. At this point, IE’s lack of compliance and its adoption of web standards is so poor that I would argue they are impeding the progress of the web. Ask any web developer and they will tell you how they could make amazingly better sites if only they could rely on the major browsers to behave well. By and large Firefox (Gecko), Safari (WebKit), Chrome (WebKit) all do. Even Opera (Presto). But Internet Explorer? No way. Microsoft has created a problem for everyone else, and they need to fix it.

Again, changing the rendering engine won’t be noticeable to most people (although when sites work better and load faster they will notice that). This is another move that would signal to the leading part of the technology market, that Microsoft “gets it”. That they have woken from a long slumber and are going to do it right now.

Two Steps, That’s it…

With those two moves Microsoft could wake me up, and I think a lot of other people too. They would embrace the open-source movement. They would stop positioning themselves as them against everyone else in the entire world. And, on top of it they could save money by owning the maintenance of less software, and they would have products that worked better.

Of course, I doubt these things would ever happen. But then again, I also didn’t think Macs would ever have 2-button mice or use Intel chips, and that all came true. Microsoft isn’t a bad company, and they aren’t going away. But they do need to recapture the hearts of people who are passionate about this stuff. This is my recommendation for how they can do that.

Apple’s Two Steps

Friends that have known me for a very long time know that I used to be a Mac guy for many years, and I gave up on Apple completely. I was a Mac user on System 5, System 6 and System 7. I really loved my Macs. But, I bid the platform farewell after experiencing one too many operating system failures. I never looked back and used Windows NT and it’s follow-on versions for a many, many years.

A couple of years ago I converted every computer in the house back to Macs and that is pretty much all I use now. What made me come back? Two things.

First, Apple bought NeXT computer and adopted it’s Mach-based kernel and underlying operating system. They didn’t change the user experience in a major way, but underneath it was all different. A real operating system, that didn’t crash.

The second change was to abandon the Motorola PowerPC processor. Intel was clearly the way to go, but it seemed unlikely that they ever would.

I bought my first Mac again when Mac OS X 10.3 was out. It was still on the Motorola chip, but I took a flyer. Shortly thereafter they moved to Intel chip and I’ve not looked back.

My point in telling this is to highlight how, for me at least, these two changes made all the difference in the world. Perhaps the two changes I’ve outlined above could do the same for Microsoft.

Entrepreneur in Residence at Split Rock Partners

Earlier this week Split Rock Partners did a press release regarding my entrepreneur in residence (EIR) with the firm. The first question friends of mine have asked is “What exactly is an entrepreneur in residence?” Wikipedia highlights an EIR as:

The EIR role is often designed to fill one of three primary functions:

That is a great recap of what I will be doing with Split Rock. The partners have given me a place to office and the opportunity to get and give early feedback around potential business ventures.

A couple of other items about EIR roles. There are other “in residence"programs. For example, artist in residence seems to be a fairly well established. I’ve also seen writer in residence as well as journalist in residence pop up. Lastly, just to be clear, the EIR role is a partnership. I’m not an employee at the firm, and this isn’t a “job”. It is a formal collaboration and a vehicle for us to work together.

I am excited to work with the partners at Split Rock and will make the most of such a unique opportunity!

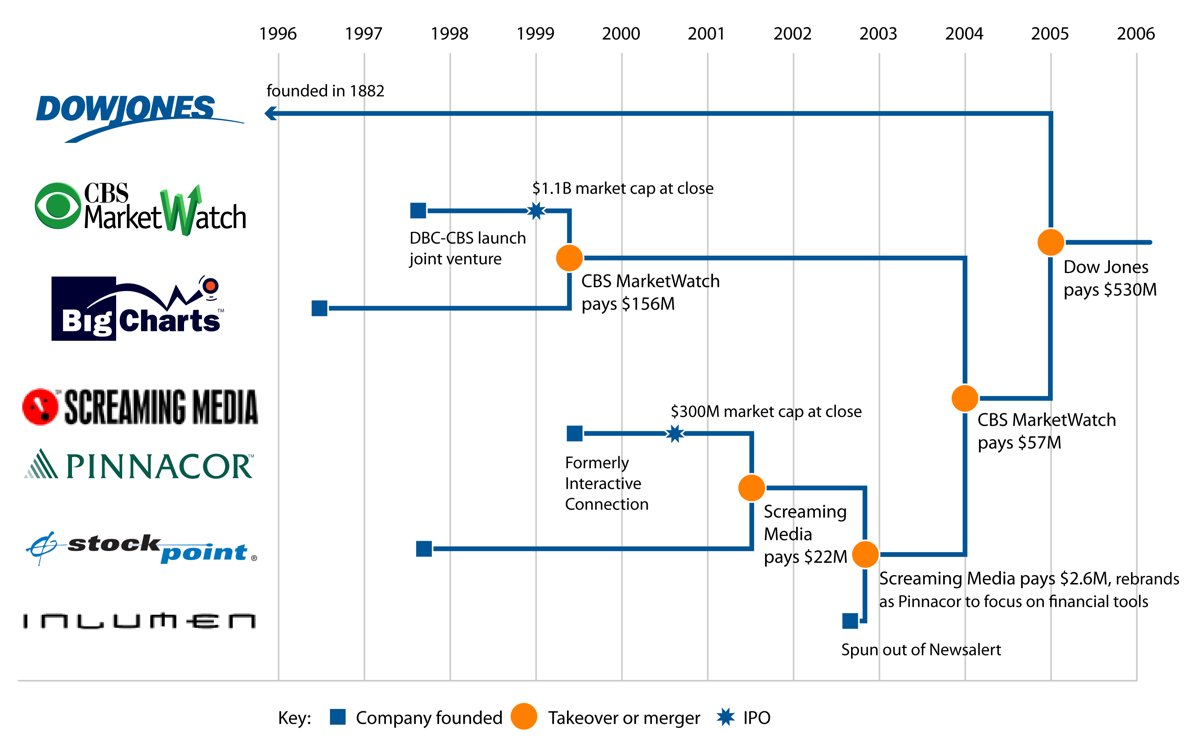

Jamie Thingelstad joins Split Rock Partners as an Entrepreneur in Residence

Former Dow Jones executive will focus on emerging opportunities in digital media

Minneapolis, MN, July 27 – Split Rock Partners, a venture capital firm focused on emerging software and internet services companies, is pleased to announce that Jamie Thingelstad, former Vice President, Chief Technology Officer of the Wall Street Journal Digital Network, the consumer division of Dow Jones & Company and Chief Technology Officer of MarketWatch, Inc., is affiliated with the firm as an Entrepreneur in Residence (“EIR”).

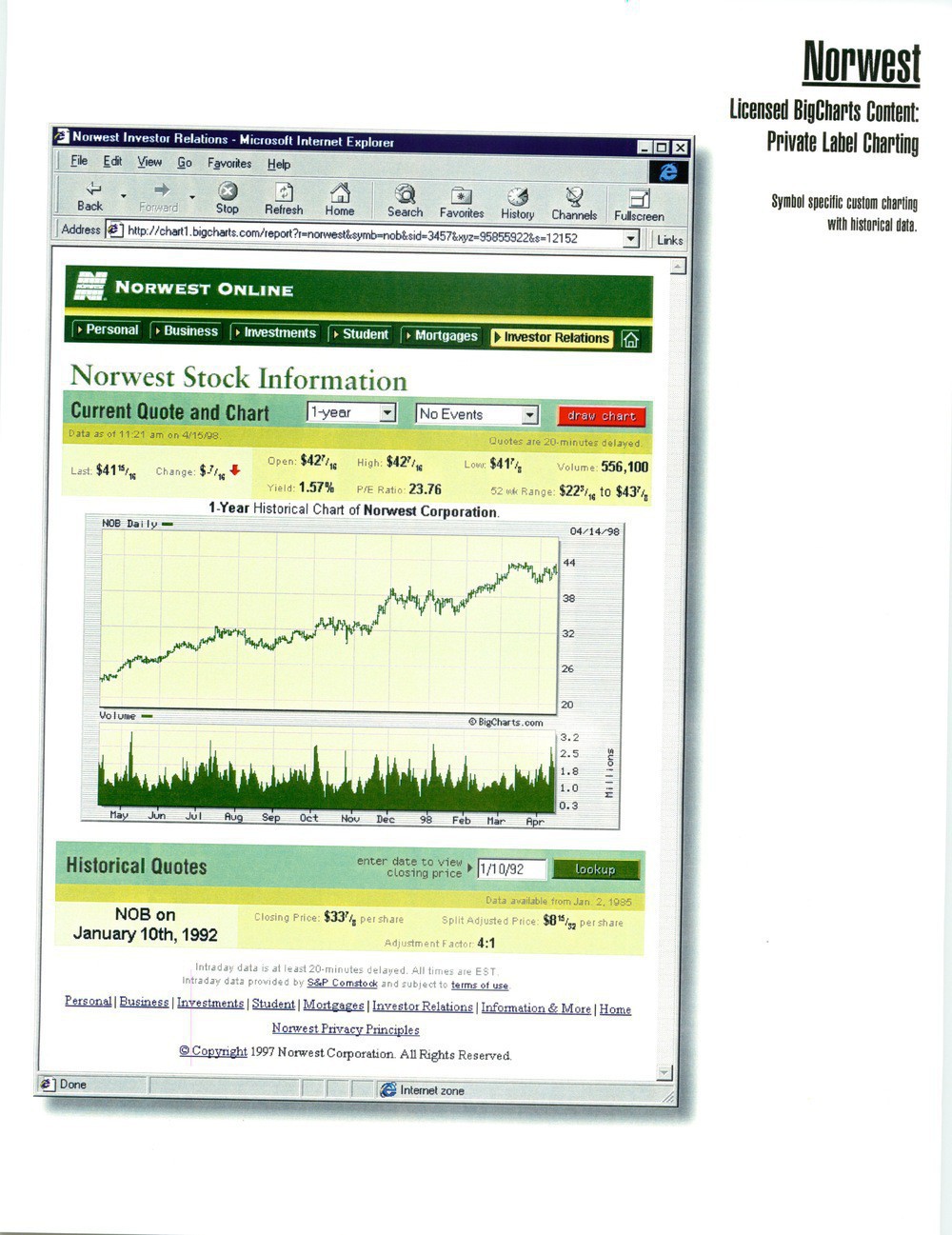

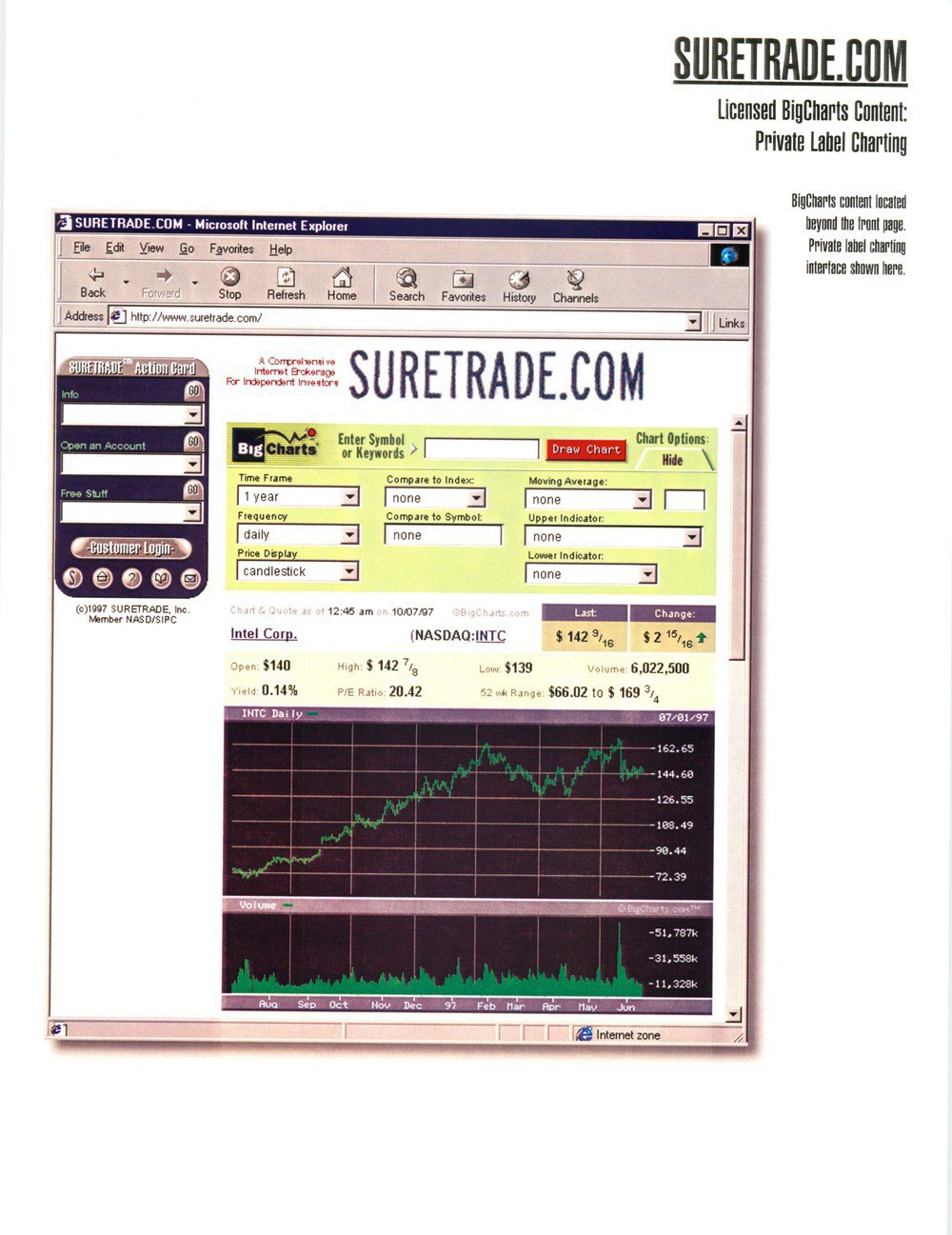

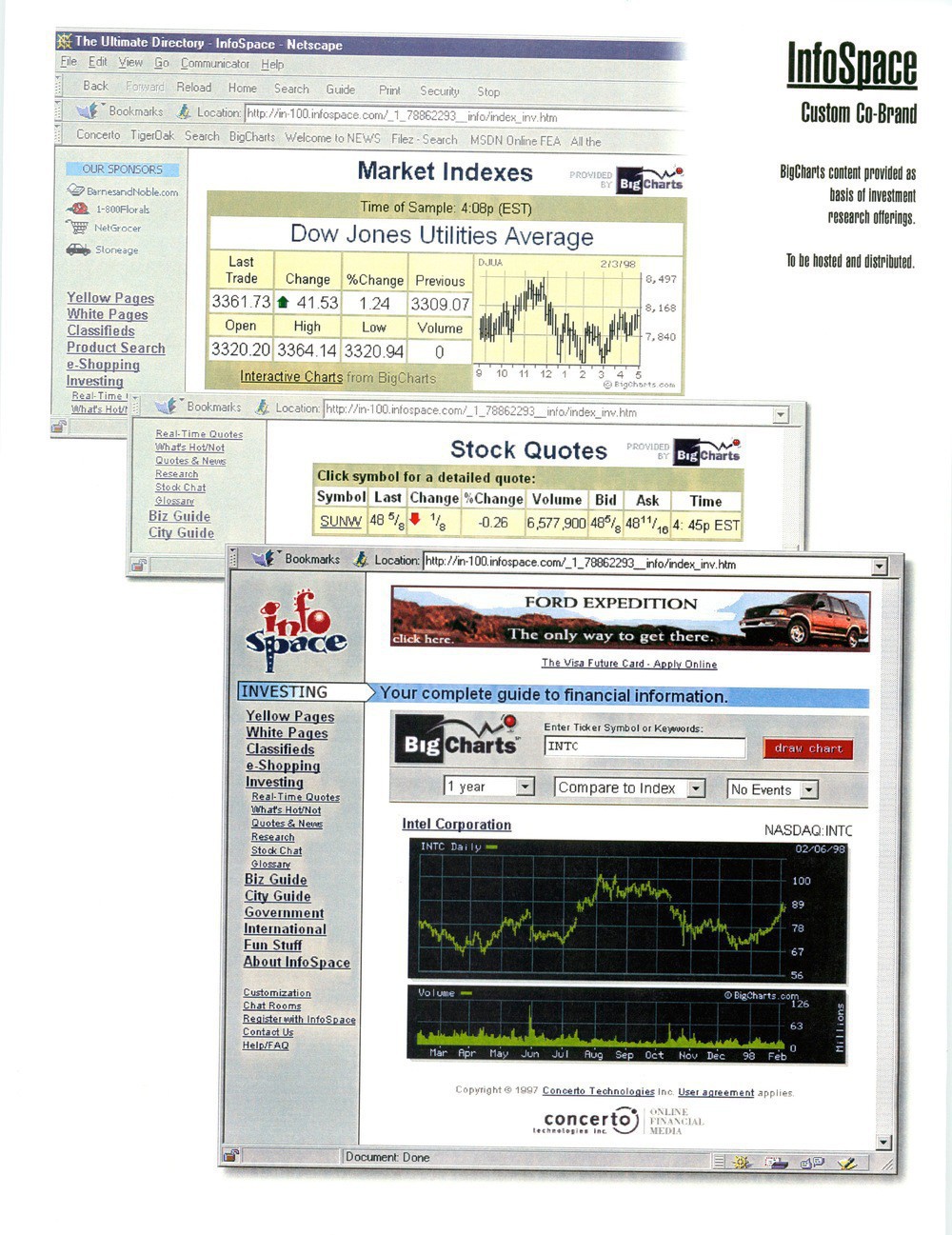

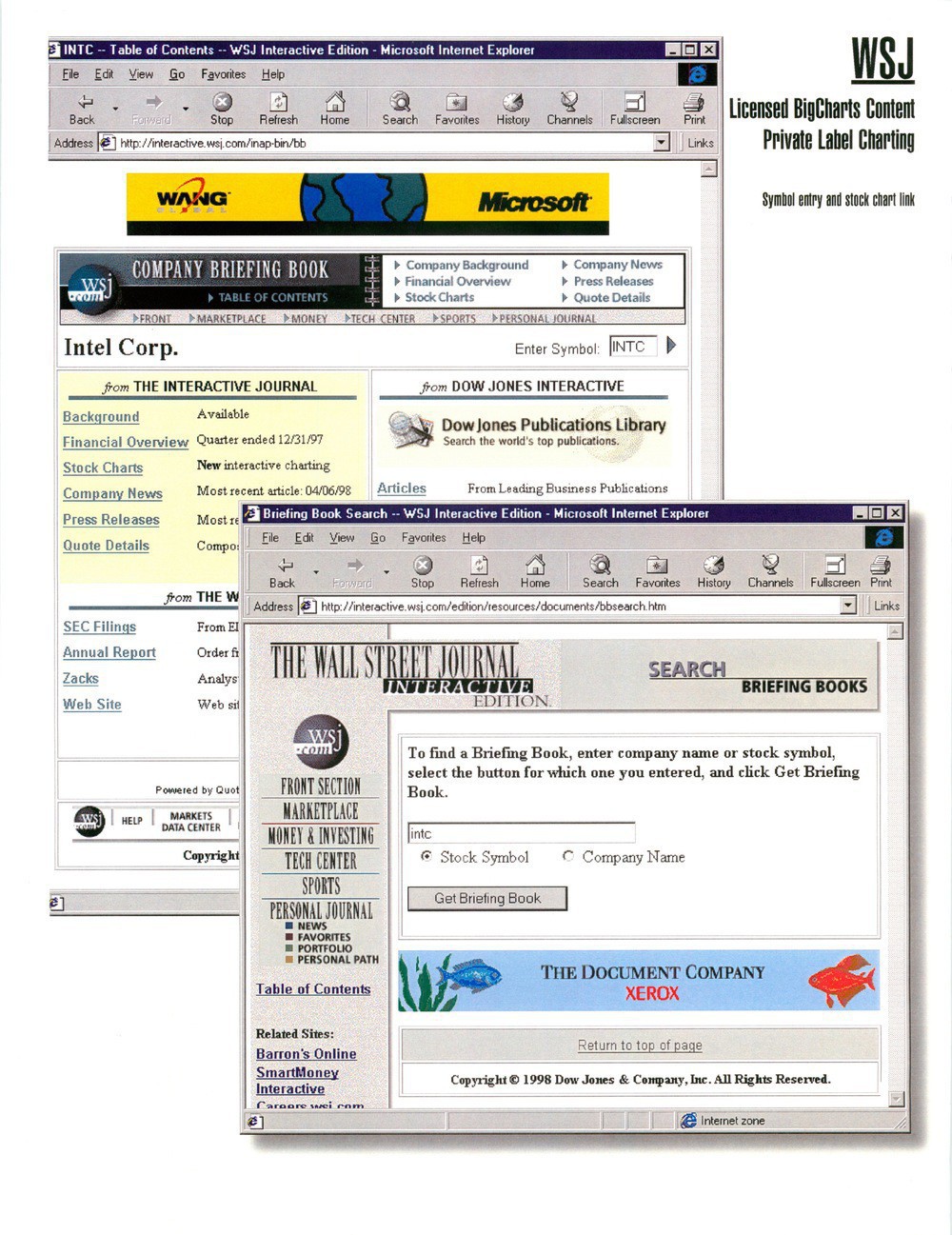

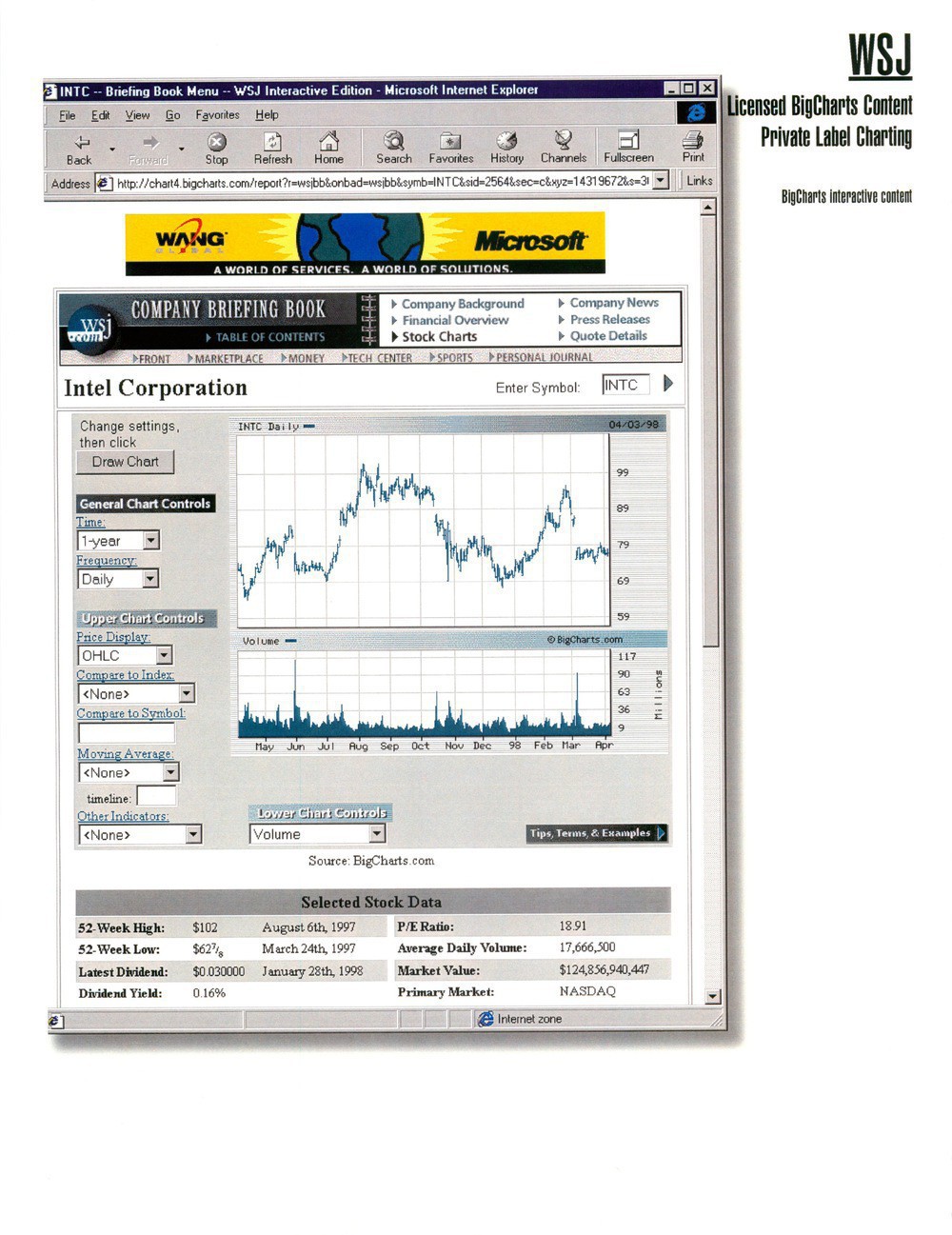

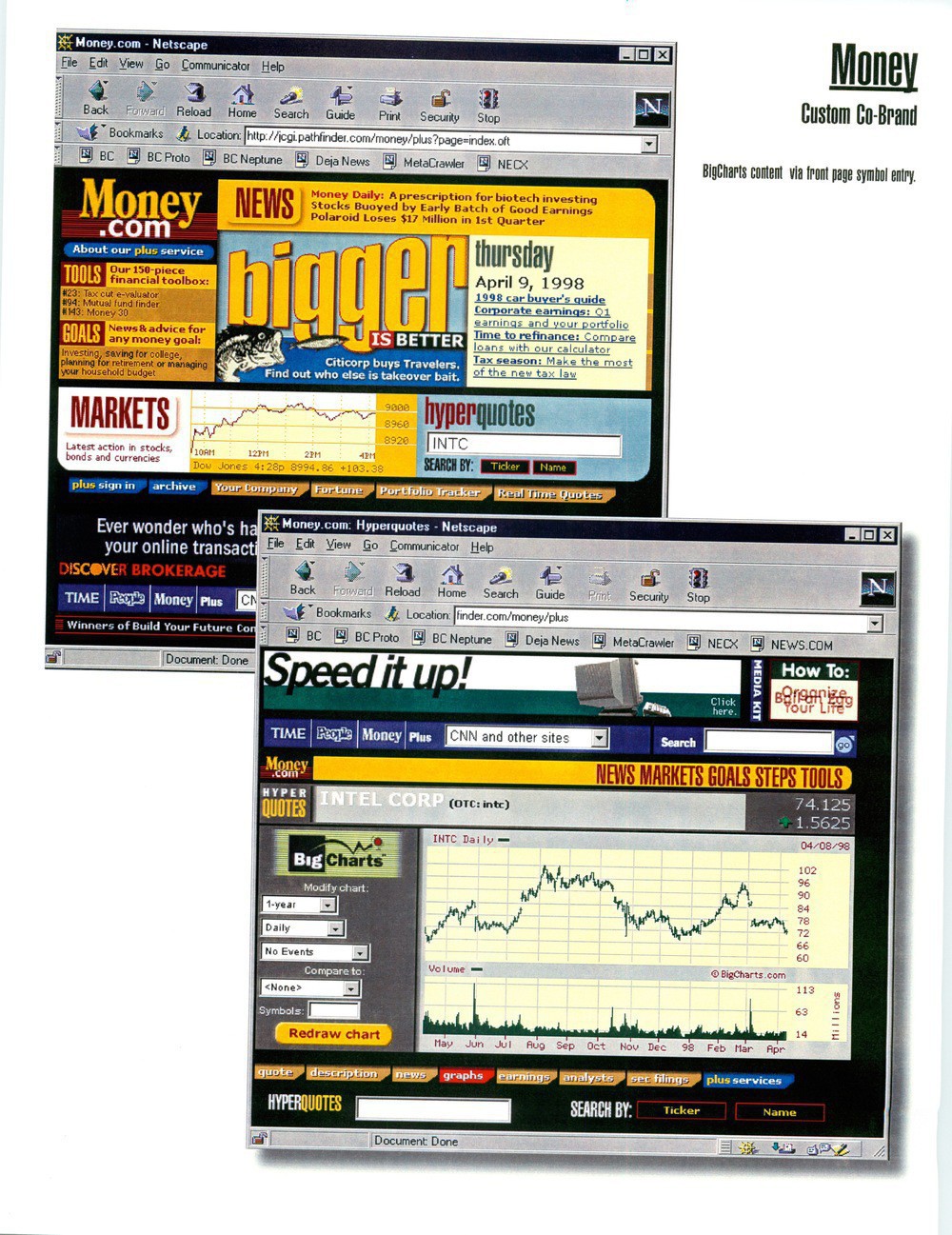

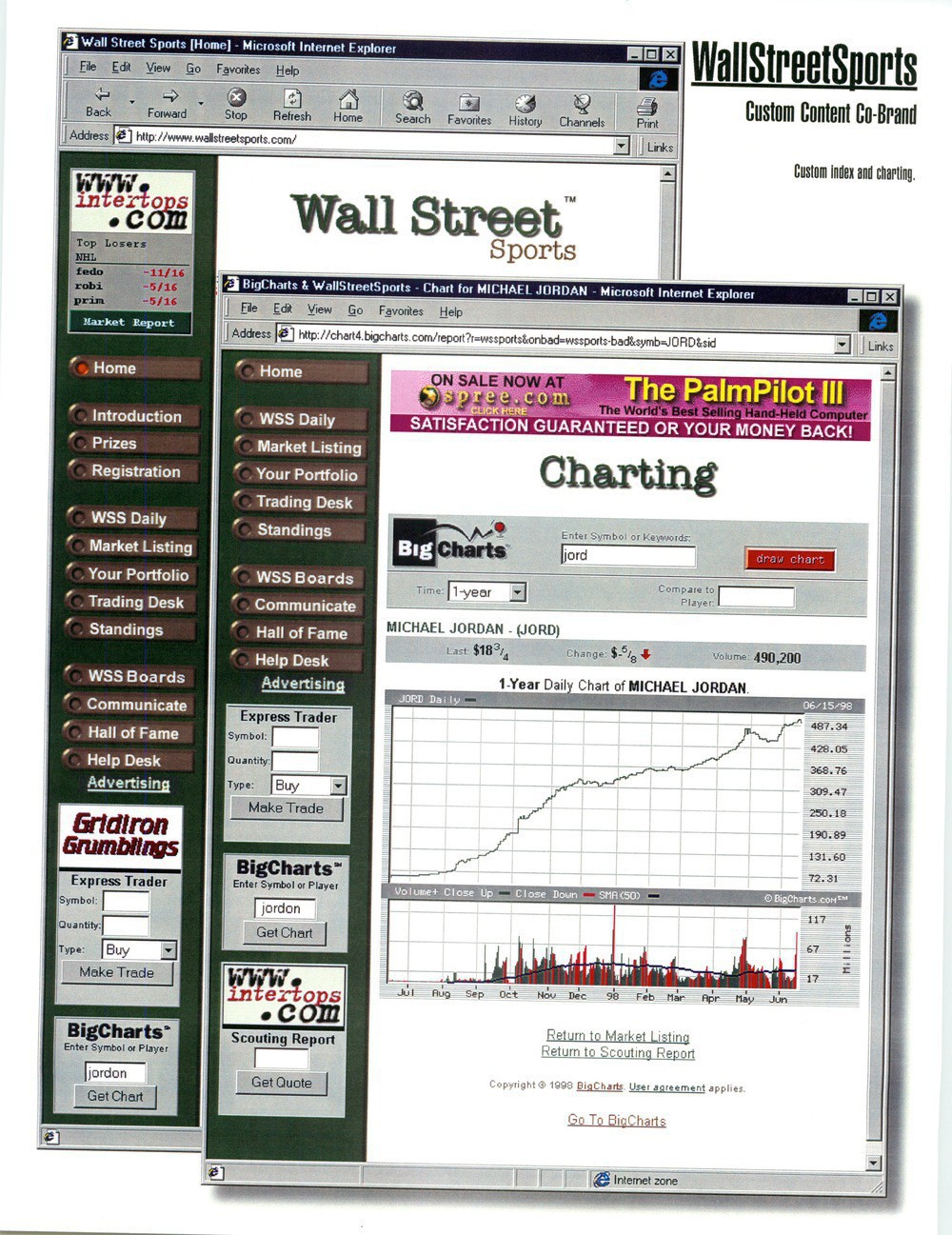

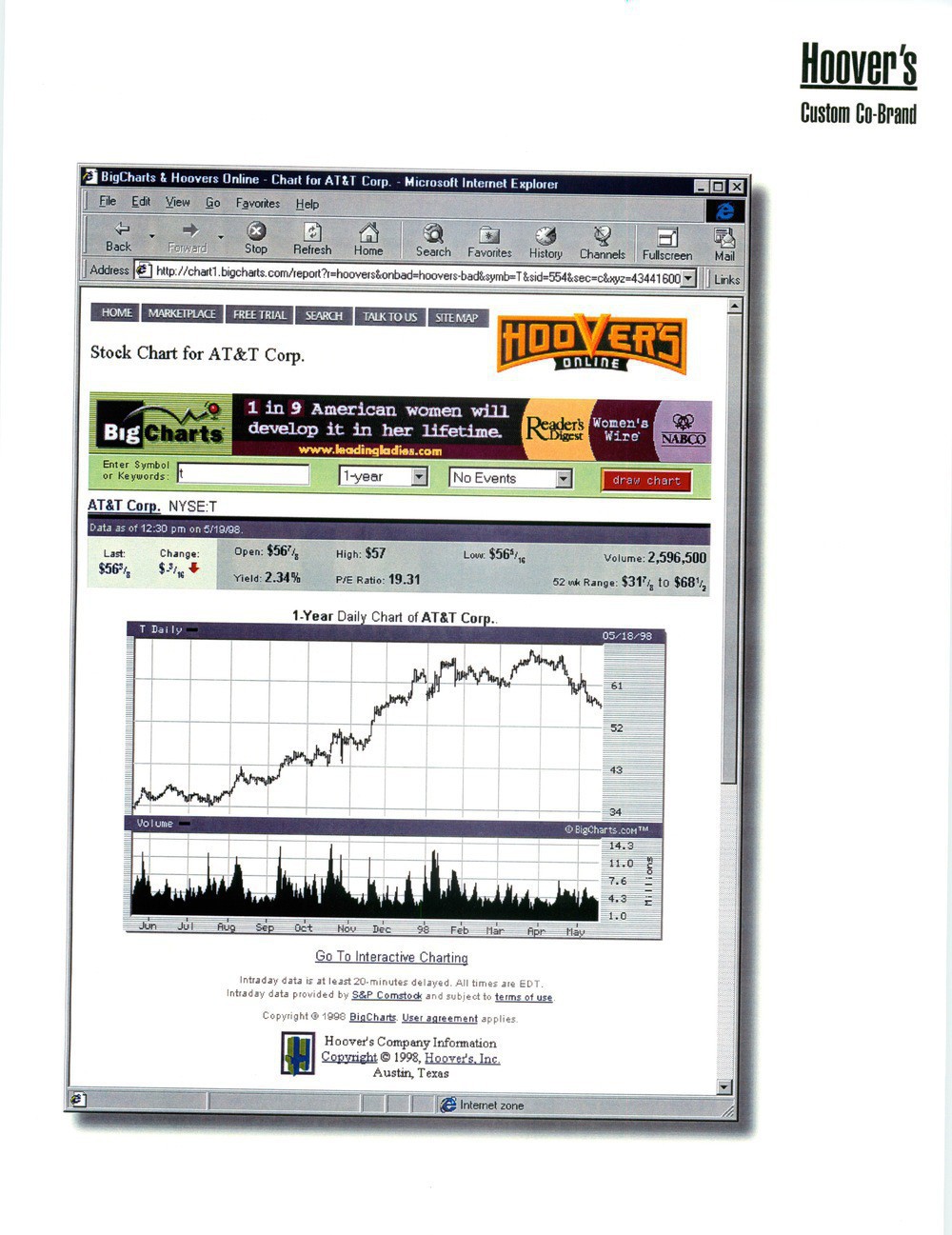

Mr. Thingelstad was founding Chief Technology Officer of BigCharts, Inc. through its acquisition by MarketWatch in 1999. BigCharts was a pioneer in delivering real-time financial information via the web, and provided financial tools offered by the majority of top financial services firms at the time of the acquisition.

MarketWatch was subsequently acquired by Dow Jones, and Mr. Thingelstad continued to take on progressively larger responsibilities within the Dow Jones organization. In his last role, he served as Chief Technology Officer of the Wall Street Journal Digital Network, a leading provider of financial and investment news through sites sites such as the Wall Street Journal, MarketWatch and Barrons. During his tenure, the network properties grew substantially in audience, and introduced several new product offerings. Prior to that Mr. Thingelstad was Chief Technology Officer for the Enterprise Media Group of Dow Jones where he oversaw the development efforts for Dow Jones Newswires, Dow Jones Indexes and other business services offered by the company.

“Jamie is an accomplished entrepreneur and brings great insight into the intersection of the internet, new media, and the implications for next-generation business models,” said Michael Gorman, a Managing Director at Split Rock Partners. “As a pioneer in digital media, he is intimately familiar with the unique challenges and opportunities presented by the convergence of new technologies, consumer behavior, advertiser objectives and industry economics. We look forward to applying his insights to the process of identifying the most promising opportunities taking advantage of these dynamic trends.”

As an EIR with Split Rock Partners, Mr. Thingelstad will be evaluating opportunities defining the next generation of digital media, the increasing opportunities in social applications on the web as well as the continuous evolution of the web as a platform.

“I am excited to explore how new technologies can build upon the foundation of traditional media, while creating new opportunities to meet the needs of consumers and businesses in unanticipated ways,” said Mr. Thingelstad. “We are still at an early stage in the transformation of digital content production, delivery and consumption, and in that transformation lies opportunity. I am pleased to partner with the Split Rock team given their track record of partnering with entrepreneurs to translate the potential of breakthrough ideas into leading companies.”

About Split Rock PartnersSplit Rock Partners, with offices in Minneapolis and Menlo Park, seeks emerging opportunities in healthcare, software, and Internet services primarily in the Upper Midwest and West Coast. Split Rock was formed in June 2004 by the teams responsible for healthcare, software and Internet services investments for St. Paul Venture Capital (SPVC) and continues to manage SPVC’s portfolio in those sectors. Split Rock closed a $275 million inaugural fund in April of 2005, and a $300 million second fund in May, 2008. Representative companies backed by Split Rock’s team include Atritech, Disc Dynamics, EBR, eBureau, Entellus, Evalve, Gearworks, Internet Broadcasting, HireRight, LowerMyBills.com, MyNewPlace, QuinStreet, and Tornier. Additional information about the firm can be found at www.splitrock.com.

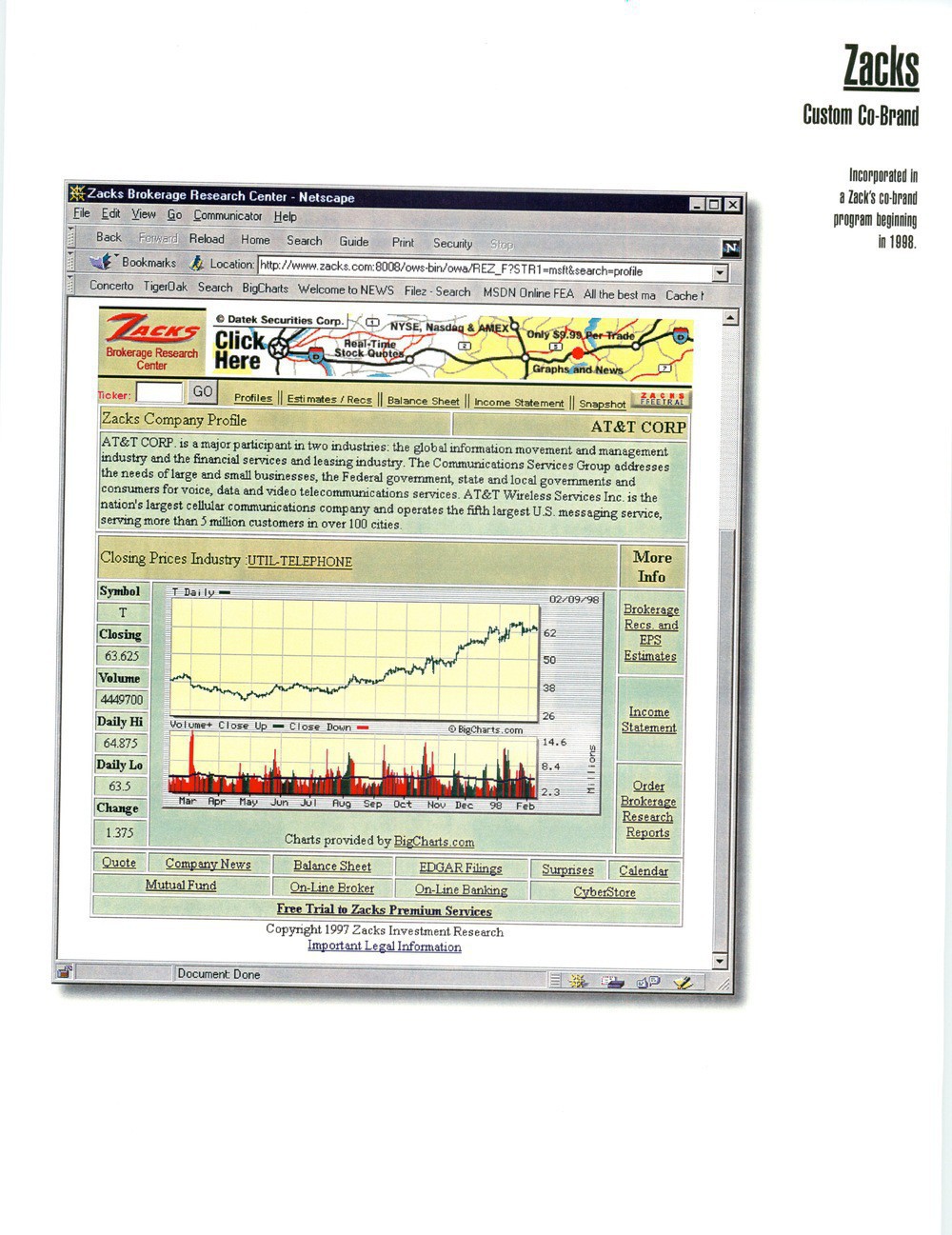

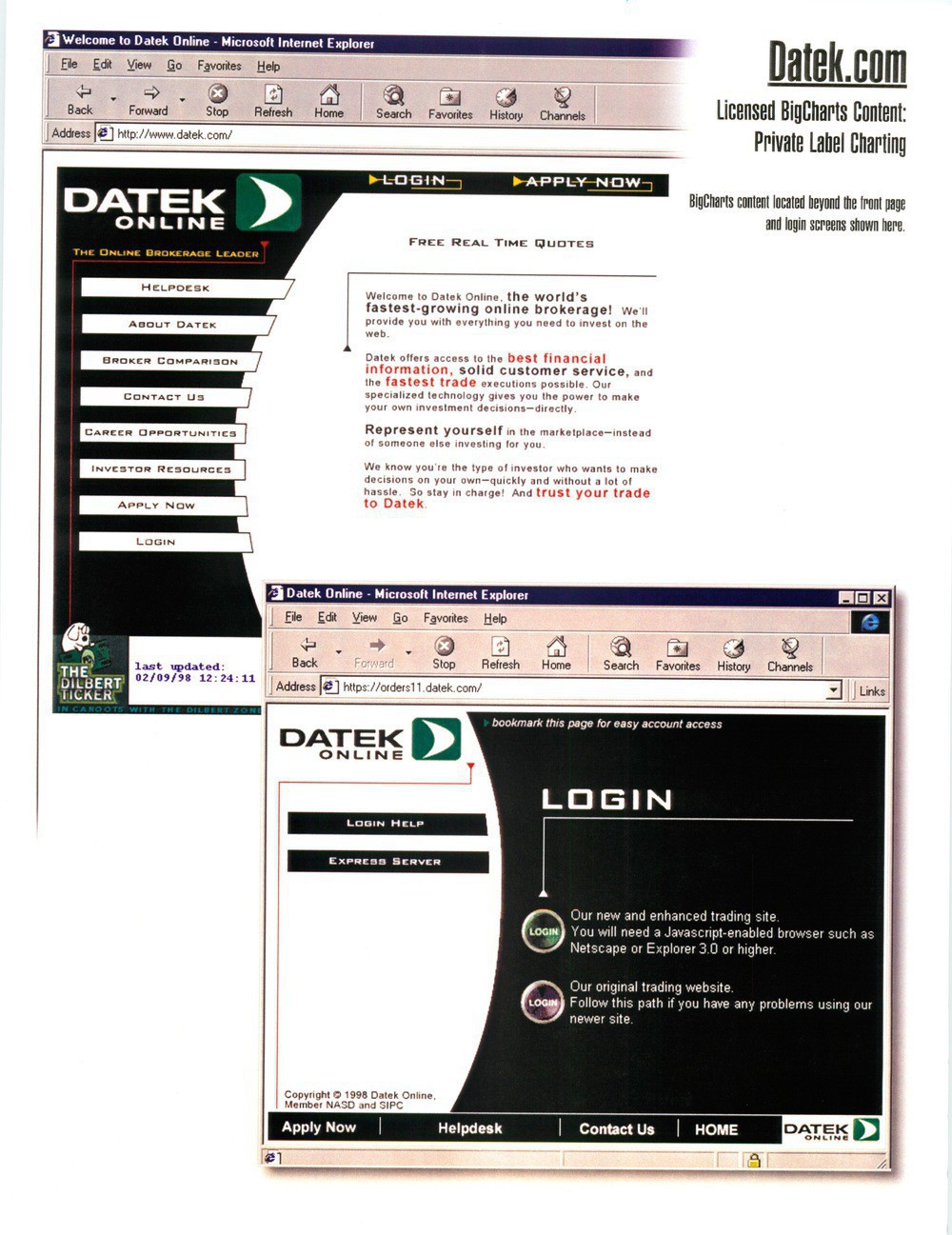

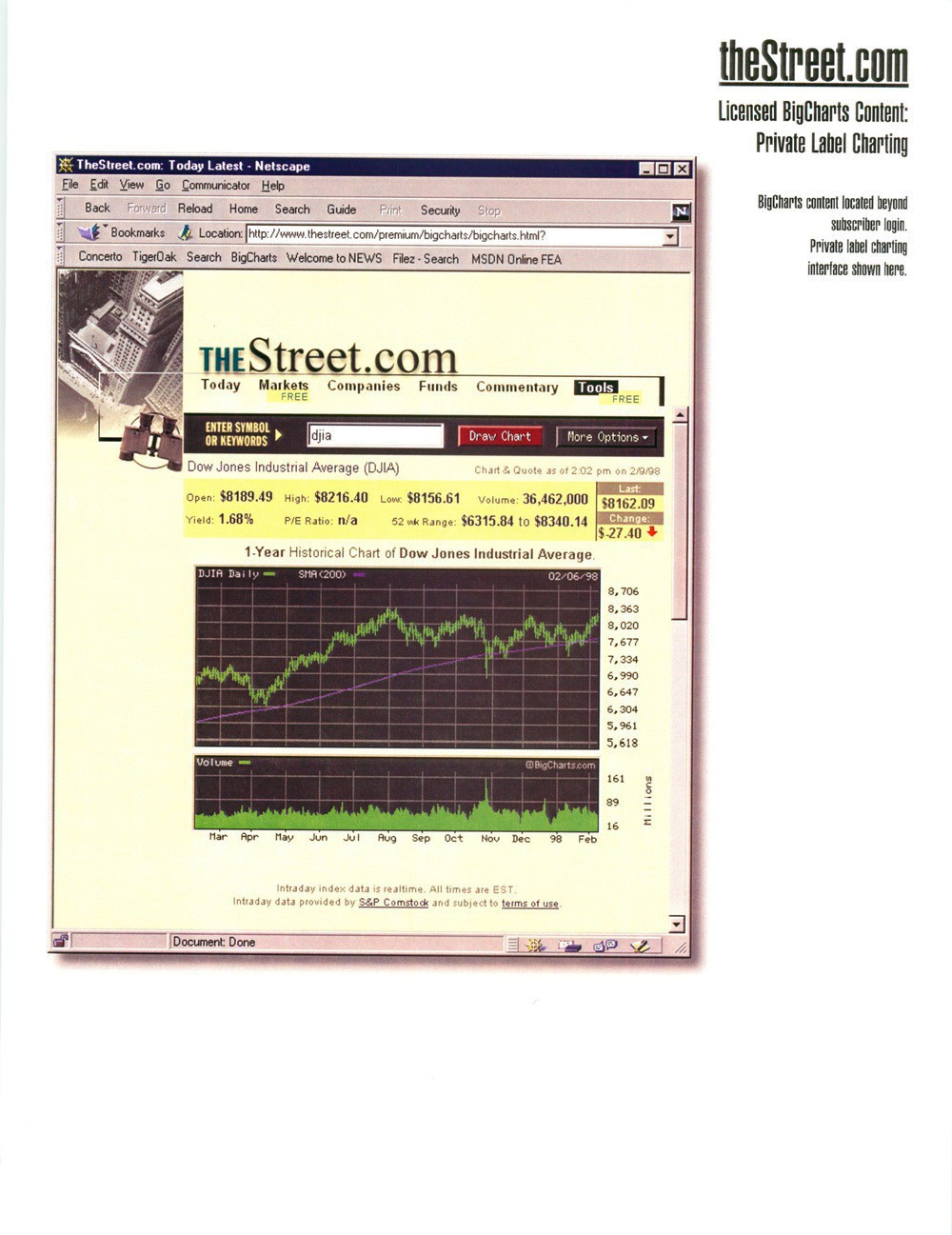

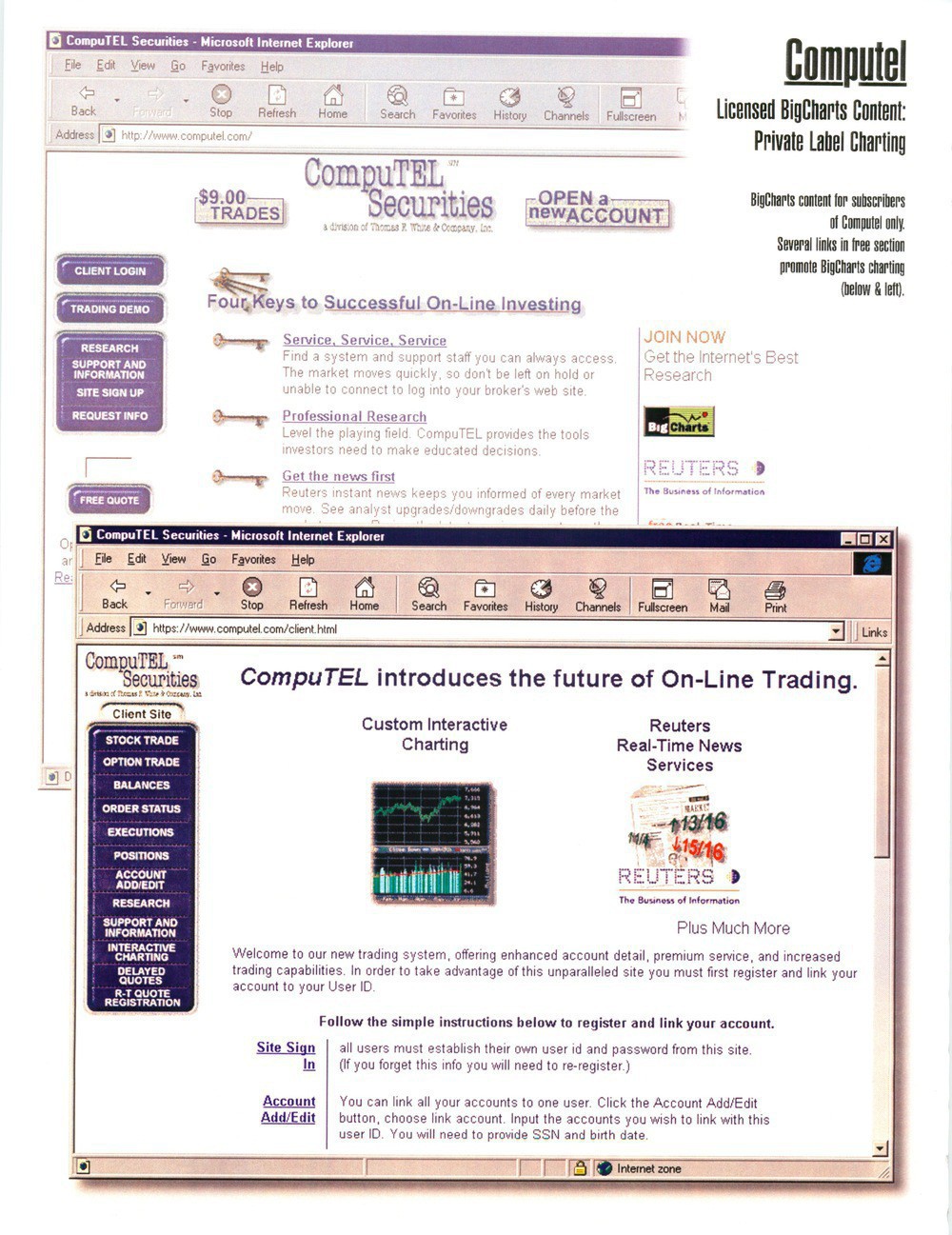

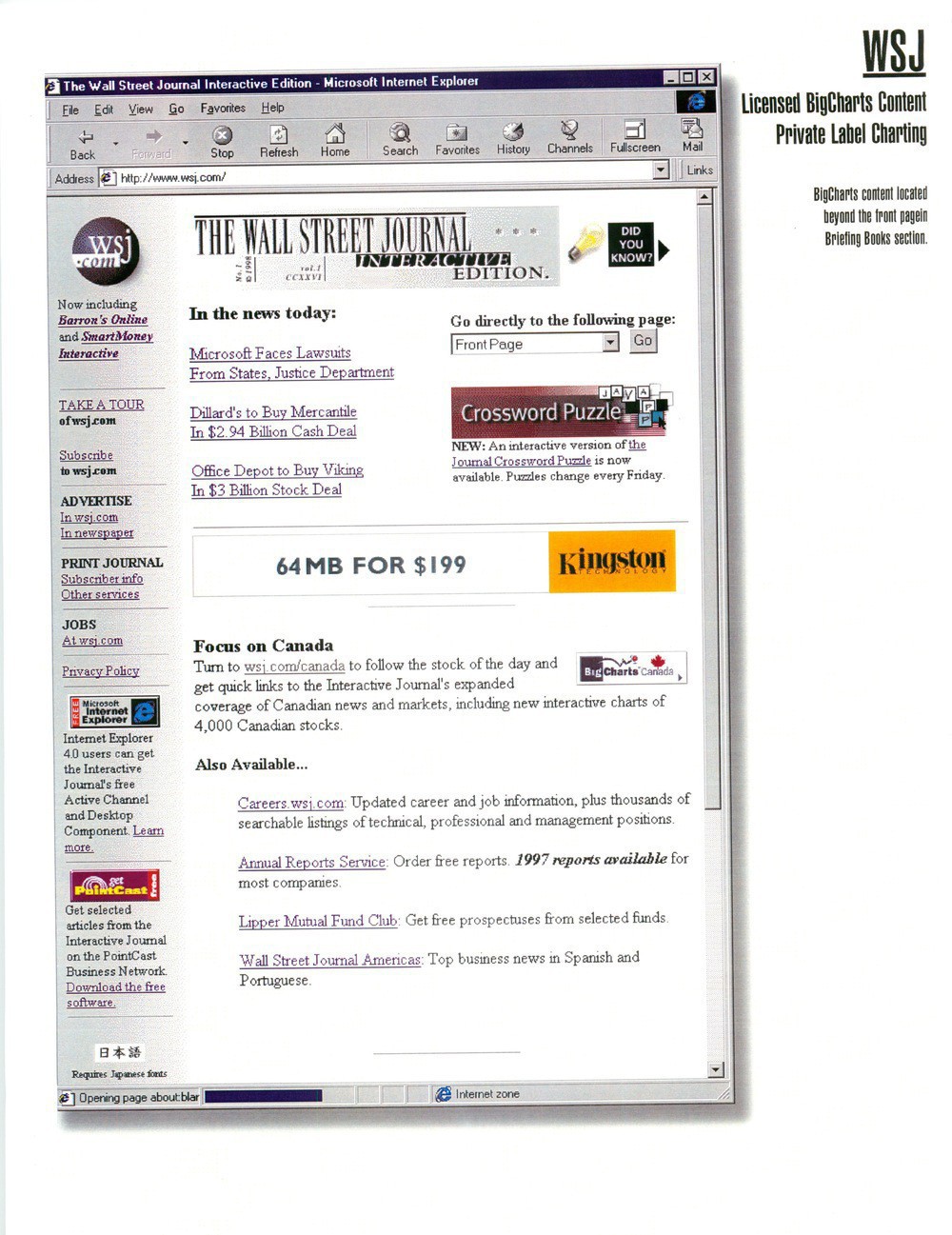

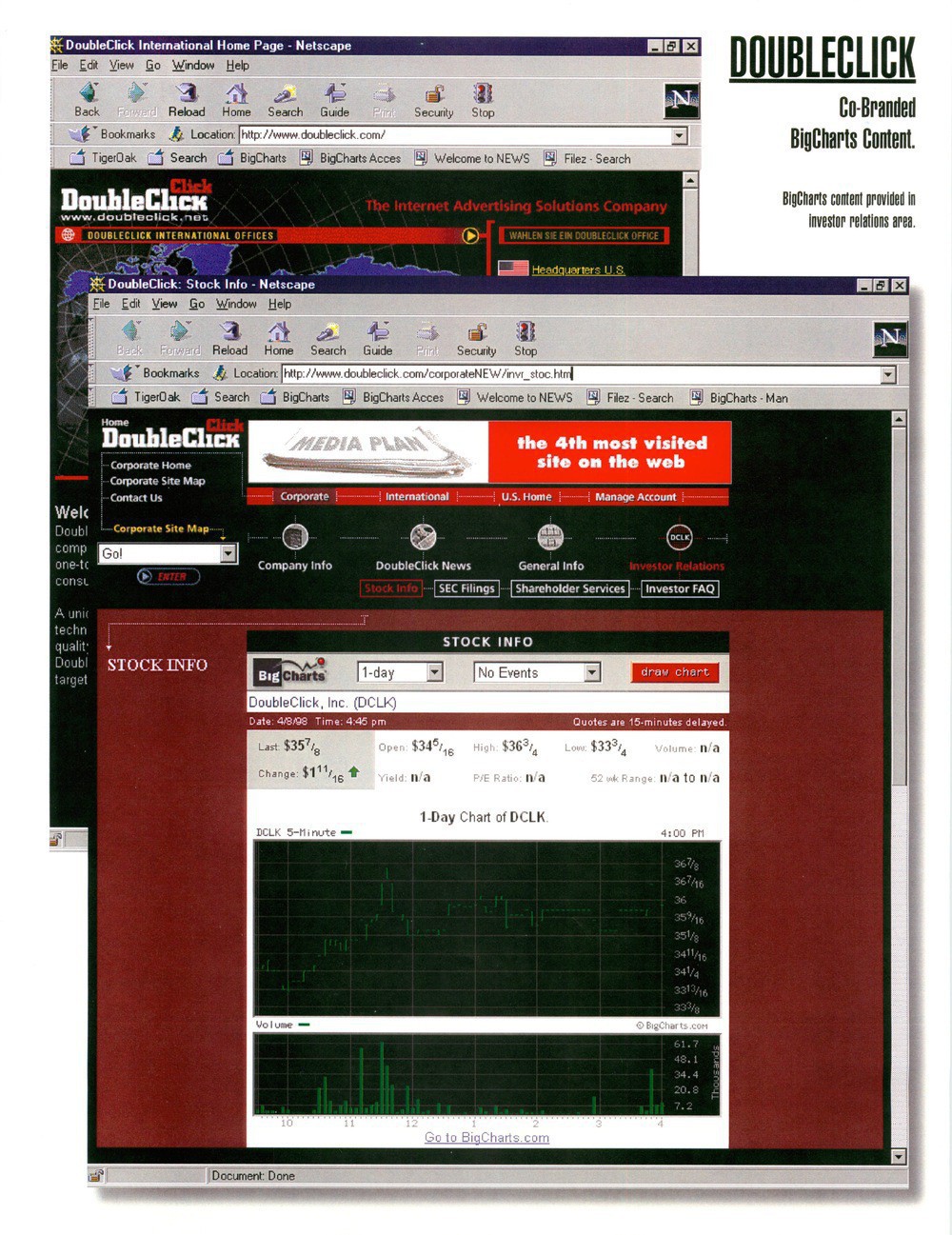

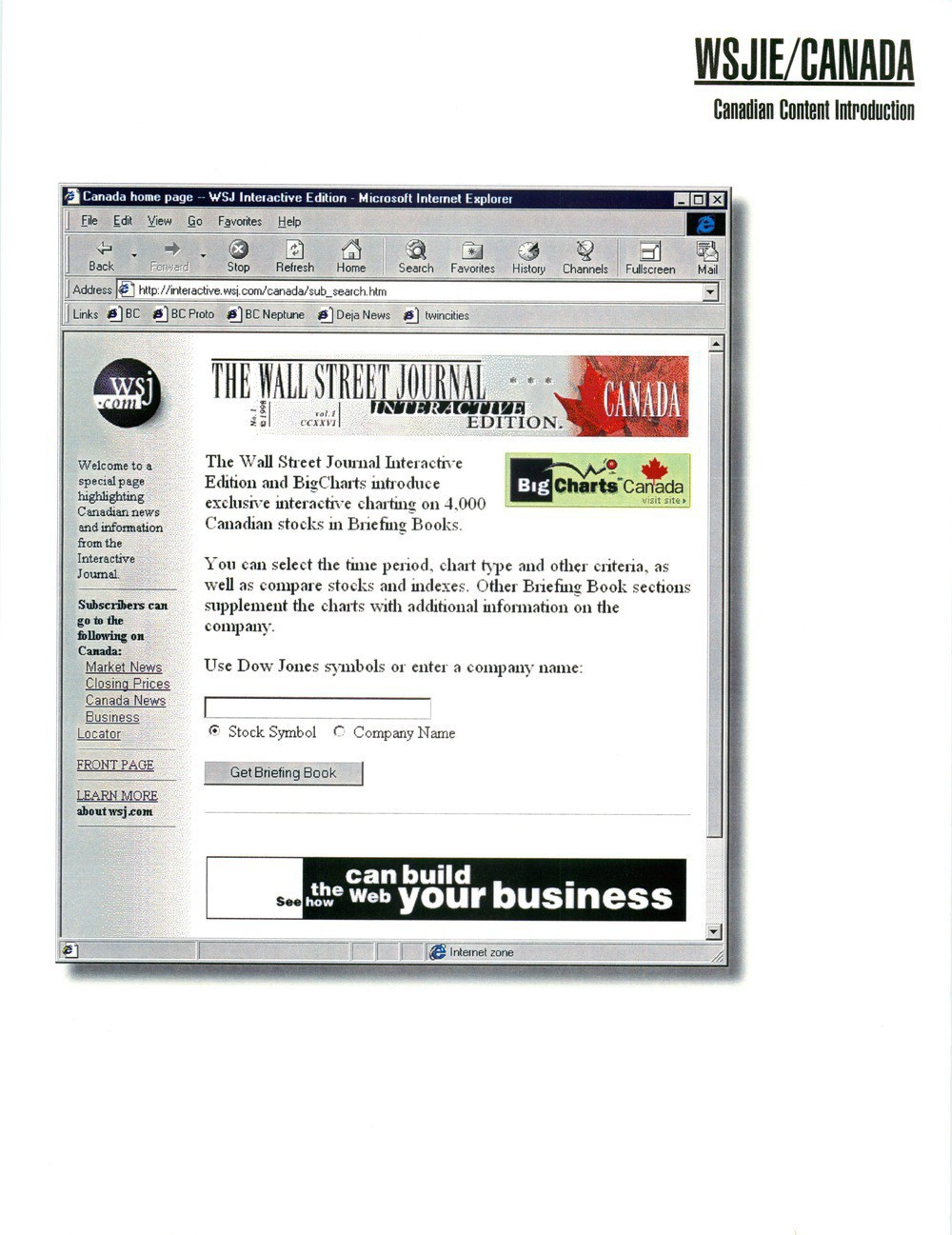

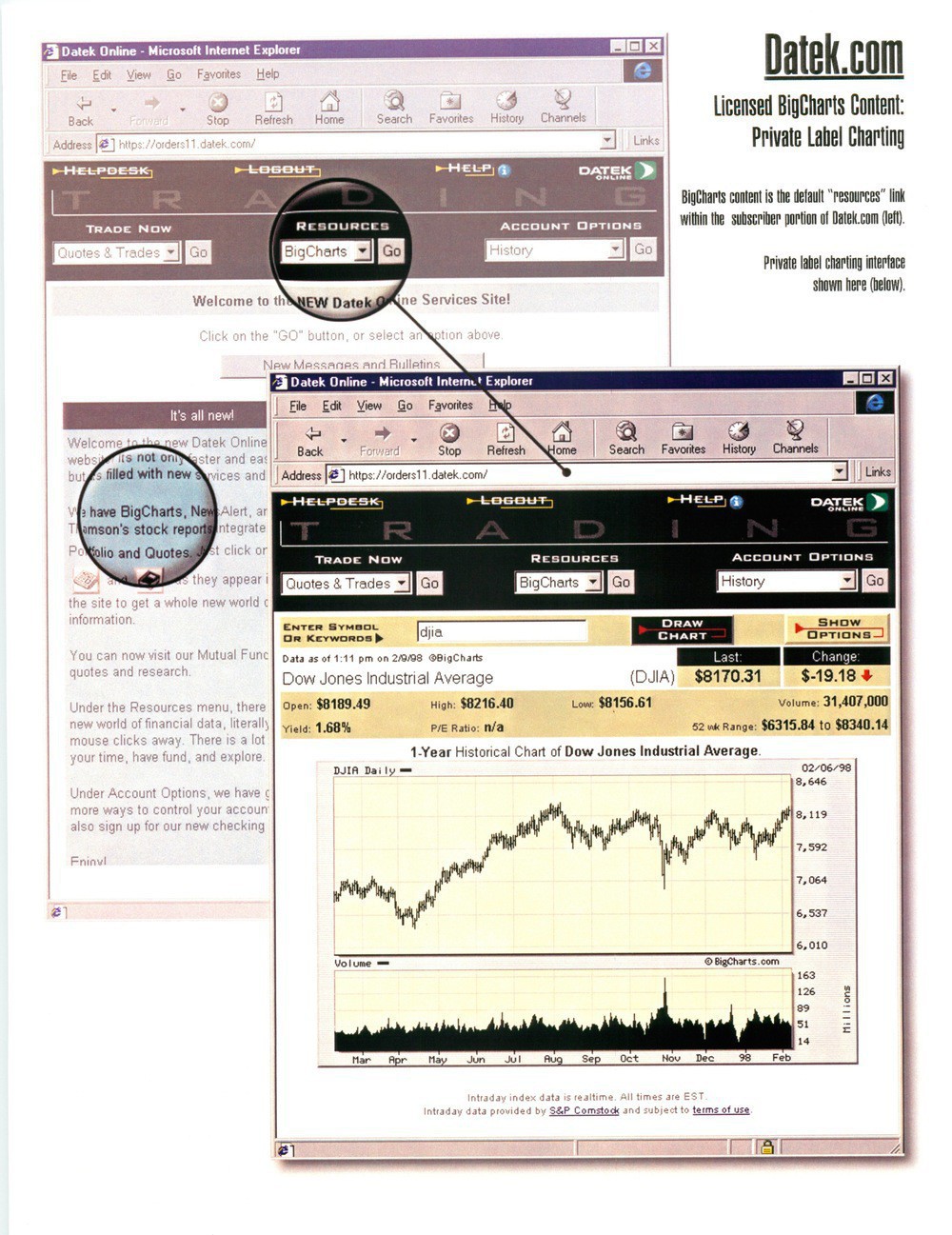

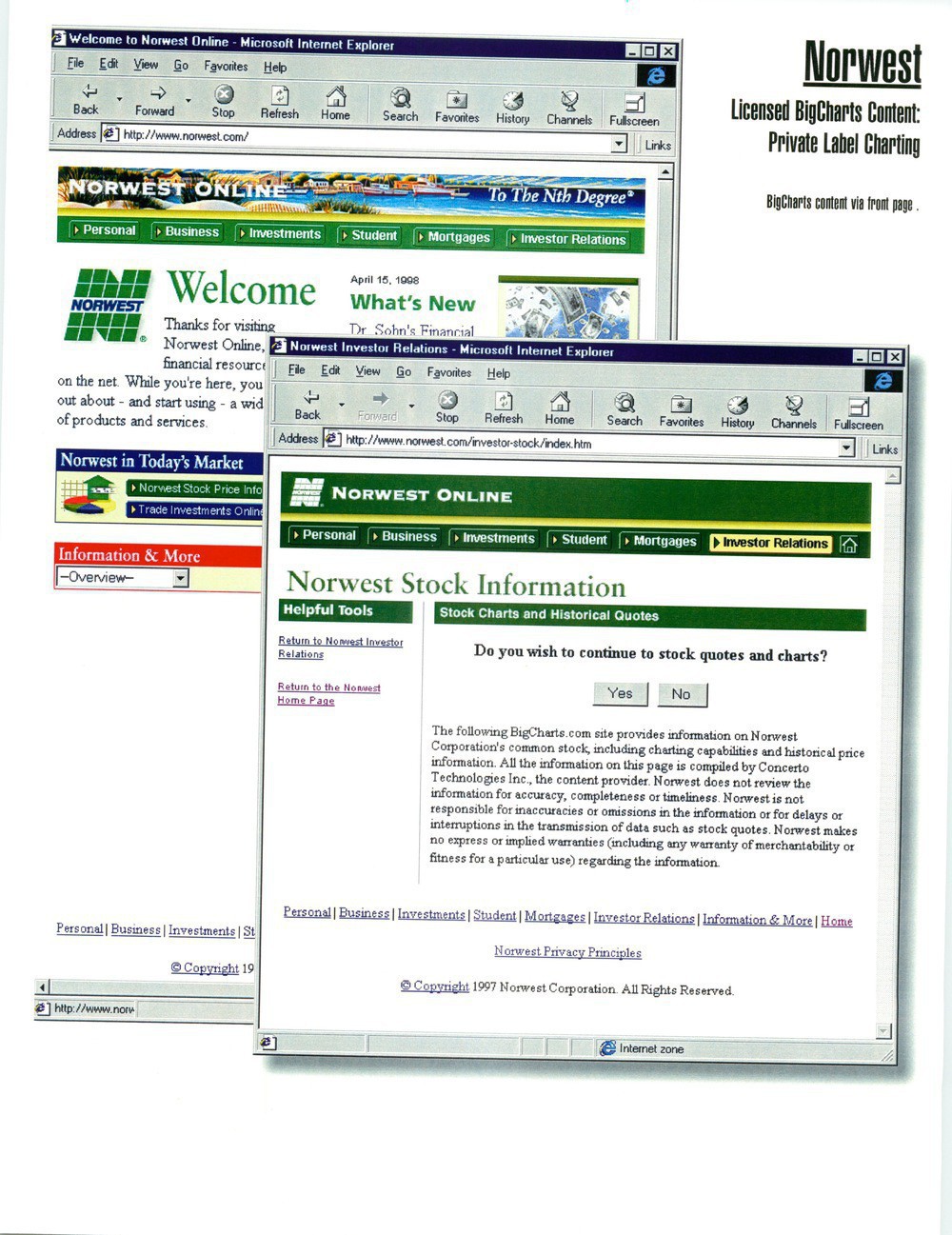

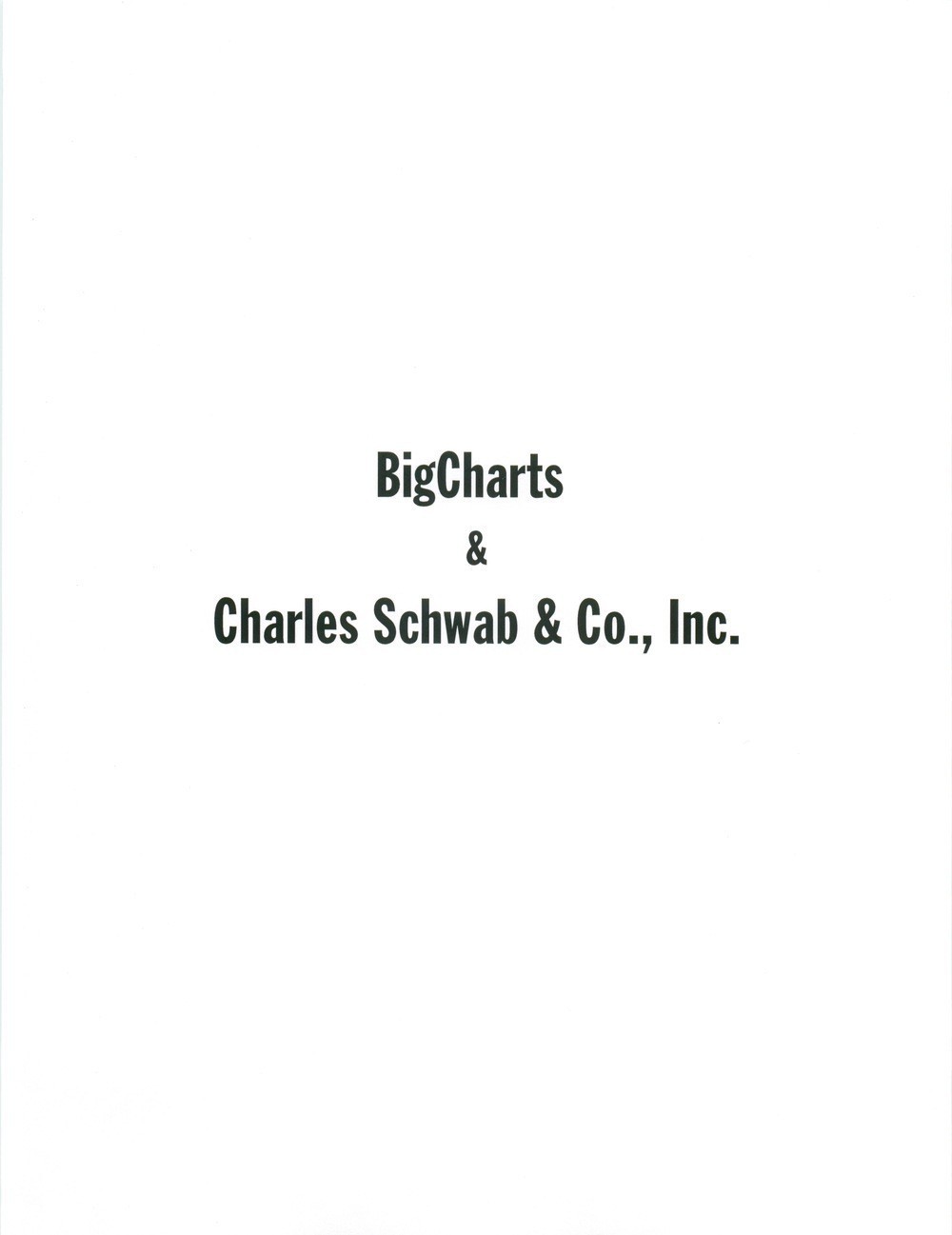

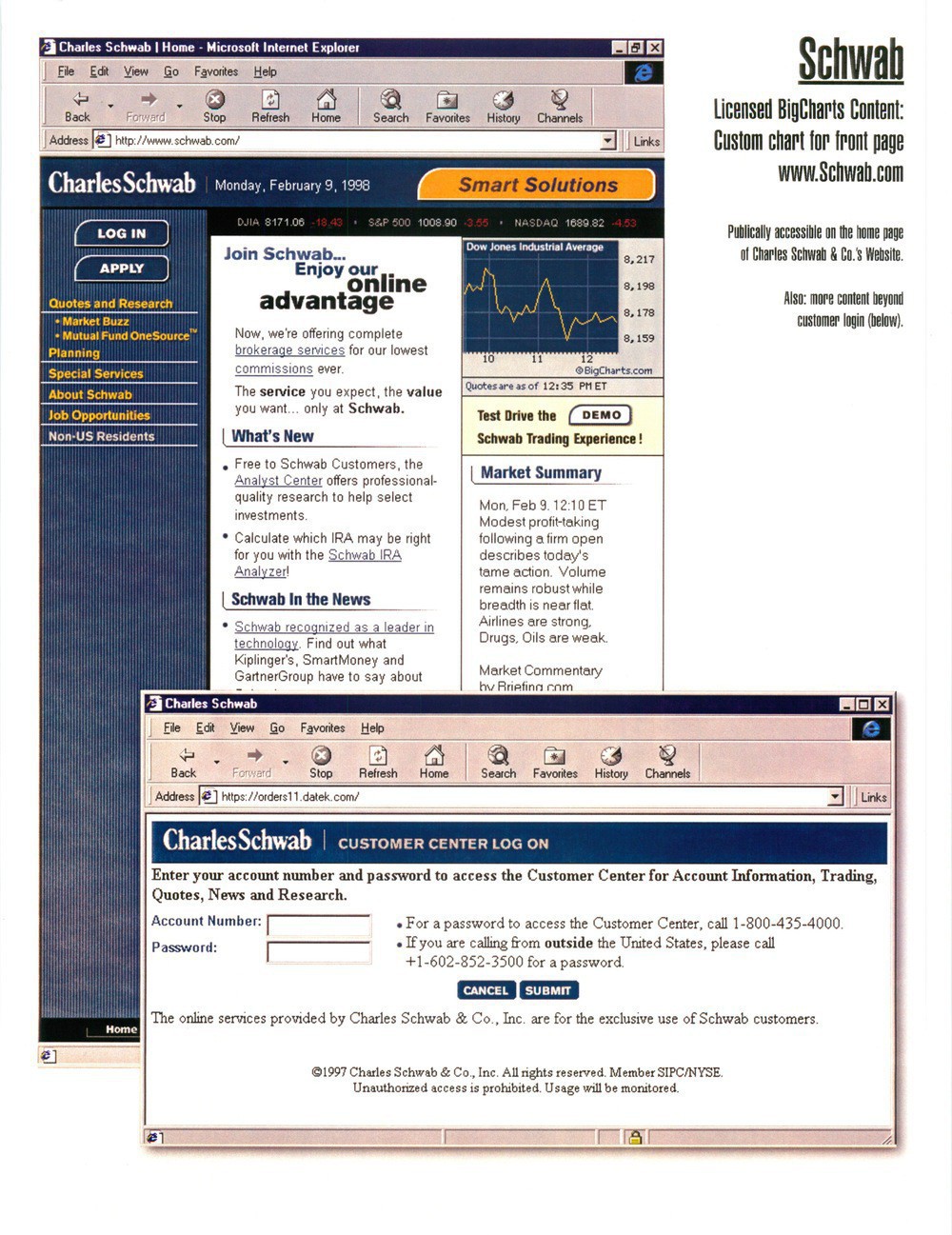

Flashback: BigCharts Partnership Portfolio from 1997

We recently converted my home office to hardwood flooring from carpet. Doing this required that the room be emptied, including a big filing cabinet. I decided it was time to do a filter through that filing cabinet and found some fun things from a many years ago. One of those items was the BigCharts Partnership Portfolio from 1997-1998. This was a printed, high-gloss, portfolio item that we shared with clients so they could see how people were using the products. It’s pretty fun to see all these screen shots of sites (many of which are long gone now) from a decade ago. I scanned a copy so others could enjoy.

Some highlights that gave me a chuckle:

Markets are recovering by websites are not. Much of the web just not working…

NYTimes.com, WSJ.com, Marketwatch.com, Economist.com – all are loading very slowly or not at all.

Just got whiplash from the market.

Happy Fathers Day 2008!

This year marks something that will not happen again until 2014, when Mazie turns 9. Father’s Day is the day right after Mazie’s birthday! Father’s Day is always the 3rd Sunday in June. After 2014 it won’t happen again until 2025, on Mazie’s 20th birthday. Now, I know what you are all wondering. When will Mazie’s birthday be on Father’s day? Never. It gets to the day before, and then flips back away because Father’s Day moves back due the third Sunday thing.

I love being a Dad and as the years pass I realize more and more that it’s the most important thing in my life. Your job changes, your hobbies come and go. Your family is always your family. Your kids are forever your kids. Taking this summer off has provided a luxury that I’m so lucky to have. To be able to spend all my time with my family. Completely unrelated, I was reading The Soul of a New Machine today and this passage seemed so fitting for the day (p. 279).

During that summer, West suddenly remembered bike rides he’d taken with his father on Sunday evenings, and he found time to reassert that tradition with his oldest daughter. Suddenly, it seemed, he realized that his children were growing, and apparently he intended now to guide them on their way. He said one evening: “That’s the bear trap, the greatest vice. Your job. You can justify about any behavior with it. Maybe that’s why you do it, so you don’t have to deal with all those other problems.”

I like to think that I’ve kept my priorities in order, but I think the “bear trap” reference is appropriate. Its good to remind myself what is important and where priorities lie. I’m grateful to have this summer for that, and to have Father’s Day every year to reflect on it.

See also: Father’s Day 2006

MarketWatch Farewell Video

Last night was my absolutely amazing farewell party at the Bernard’s house. The gang put together this awesome going away video for me. It’s just great. Thank you so much everyone. Who would have ever thought reading “twitters” could be so funny! There is an amazing, completely unexpected and inexplicable cameo at the end. But don’t skip to it! Sit back and enjoy…

That is just great. I’m speechless. 🤩

Links to most messages read:

MarketWatch, Dow Jones Chapter Closing

Today I’m closing a very long chapter in my career. This is my last day at Dow Jones/MarketWatch. This transition has been in the works for a while. It was announced in January and over the course of the following months I’ve been able to wrap-up some projects, transition others and most importantly work to get my replacement hired and up-to-speed. I’m happy to leave on a Friday, and have a new CTO start on Monday to take the organization forward. My replacement will be in New York which I think will be immensely helpful. I’ve been able to do a lot from Minneapolis, but moving to New York isn’t in the cards and it was time for me to do something different.

The past 10+ years have been amazing. This chart is a great representation of all the twists and turns that have occurred over that period.

This is a tough day. It’s filled with a lot of emotion. I’ve found myself reflecting a lot over this week. Remembering a lot of past colleagues, all the great projects and even some of the bombs. It’s been amazing to see an organization grow and change through so many events. I’m incredibly proud of everything that has been accomplished by such this great team.

I’ll be taking a respite this summer and enjoying a great number of trips with my family. Stay tuned right here for news on those travels!

Flashback: MarketWatch in Windows 2000 Launch

There are a few points in the history of BigCharts and MarketWatch that I’m especially proud of. Perhaps one of the most prominent ones, and most public, is the inclusion of the BigCharts BigArchitecture (the name we retroactively gave the COM-infrastructure behind MarketWatch and BigCharts) in the scalability demo at the Windows 2000 launch event. The video is a fun watch.

Prelude

We had been working with Microsoft pretty extensively at this point in part because we were trying to run our stuff on Windows NT 4.0 and it was horrible. We were having immense problems. We decided to throw a “Hail Mary” and upgrade to the unreleased beta of Windows 2000 Server. It worked! Our problems, which I can’t even remember now (anyone?) went away, and our sites stabilized.

Microsoft knew about the success we had had and was looking for the scalability demo for the launch. They called us about 10 days before the launch event to see if we could do it. We sent one of our systems team out that night. When he got there, Kristian Meier called me on my mobile saying “Dude! Do you know what they want me to do?! This is awesome!” We really hadn’t had time to brief him before his flight.

They made images, installed 500 clients, a bunch of servers, some databases and loaded it all up on trucks to drive from Redmond to San Francisco.

Event

Microsoft only gave us two seats on the floor for the event. Chris Tersteeg and I attended. The screen that they had MarketWatch on in the auditorium was immense. To this day I don’t think I’ve ever seen a screen projected bigger. They brought MarketWatch up live during the talk and at one point the page refresh kicked in. The whole screen went blank and Chris and I sat there with our heartbeat stopped waiting for the page to redraw. I don’t think there has ever been a more anxious page view to the site.

There is a funny editorial aside here. The newsroom was of course covering the launch of Windows 2000 and the theme of the coverage was that it was generally a non-event. We had a headline, above the fold that morning, called “Windoze 2000 Launch” and there was a picture of a guy sleeping next to it, if I remember right. Microsoft of course called me with panic since this wouldn’t exactly be the kind of headline you would want on the screen during the launch event. I called our editor to see what we could do. He appropriately suggested that we hope something new happens to take the headline off the site, otherwise, pound sand. Luckily some new news broke!

The demo was awesome in person. Seeing 500 client machines drive huge traffic to your code base was great. After the launch event we called it a day, rented a convertible and drove around the valley for the afternoon. We also made a stop at Fry’s to pick up some toys.

What a great event. Thanks to everyone who made it a reality!

I sent this tweet four hours ago. Your getting it now, in the future, from me in the past.

One of the tweets highlighted in my MarketWatch Farewell Video.