Crypto

Forays into blockchain, NFTs and POAPs live here. I write about minting POAP tokens at family events, celebrating Ethereum’s 10‑year anniversary by creating an NFT and even using monitoring services to keep my POAP feeds up and running.

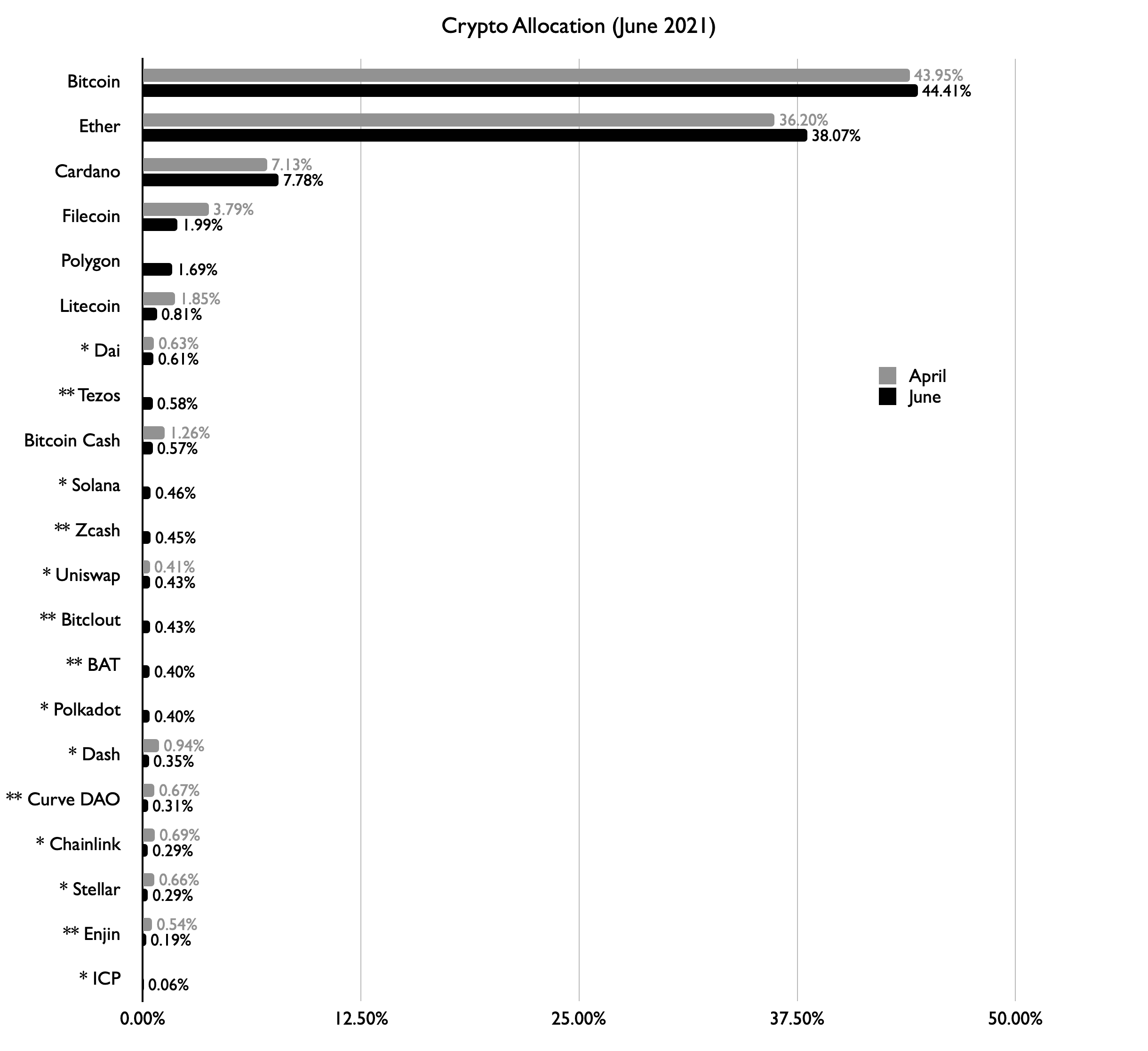

- Polygon: I got into Polygon with OpenSea’s announcement that they were adding it as an alternative blockchain to Ethereum for NFT sales. Polygon is a Level 2 chain with substantially lower costs, and has the very powerful benefit that you can transfer NFTs from Polygon’s Layer 2 chain to the Layer 1 Ethereum chain. I’m intrigued by the model of Ethereum as a core blockchain and specialized Layer 2 chains connected to it, and allowing fluid movement of tokens between them all.

- Solana: Solana is an incredibly performant blockchain built on Rust. It support smart contracts and you can even write them in Rust. Solana does not meet my market cap requirement however I bought my minimum to get early exposure to it and to get my wallet setup and play with it.

- Uniswap: Powerful solution to swap any token for any other token. Seems like a core component of the DeFi solution space. Meets the $10B market cap threshold.

- Polkadot: Newly listed on Coinbase and meets the $10B market cap threshold. Facilitates cross blockchain movement of tokens and data.

- ICP: Newly listed on Coinbase and met $10B threshold so added to basket. Promises to offer an amazingly performant blockchain with very good features. Worse performing token I’ve had now dropping 90%.

- Zcash: Zcash is super interesting to me because it supports multiple types of addresses including a shielded address that is more private. Zcash is one of the few that overs private transfers on its blockchain. Zcash does not meet the $10B market cap requirement.

- Tezos: I purchased Tezos just so I could buy some NFT at the REM5 for Good event.

- Bitclout: I’ve setup a profile on Bitclout, and all profiles on Bitclout hold CLOUT tokens. I also have one for the Weekly Thing. The whole ecosystem of creator coins and “diamonding” posts is pretty interesting. Bitclout can be purchased with Bitcoin, and you can sell Bitclout back to Bitcoin. The Bitclout blockchain is merge mined with Bitcoin. This does not meet the $10B market cap requirement, and it is also not traded on Coinbase.

- Basic Attention Token: BAT is the token that the Brave browser uses, and I’m intrigued by Brave and what they are doing to I added it to my basket. This does not meet the $10B market cap requirement.

- Mastering Bitcoin 2nd Edition - Programming the Open Blockchain

- Mastering Ethereum

- Resources from a16z for Understanding Crypto

- Crypto Startup School

- Crypto Reading

- Learn to Code Blockchain DApps By Building Simple Games

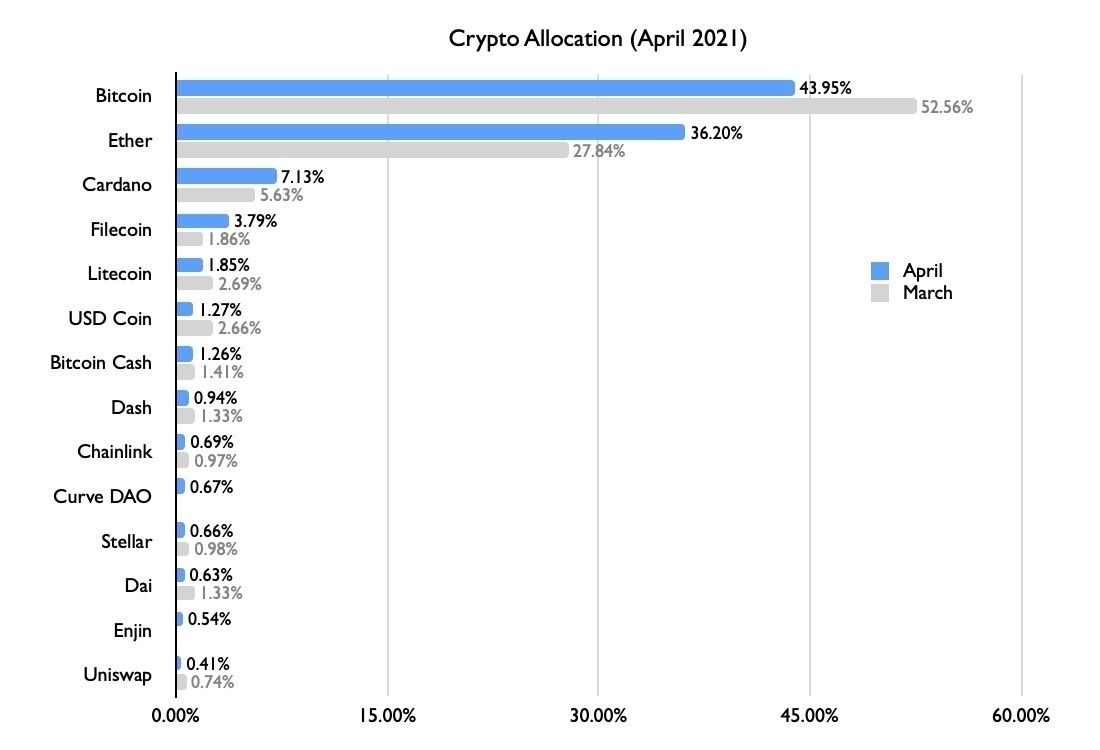

- I’ve been increasing Ethereum to get closer to Bitcoin.

- Bitcoin and Ethereum together are 80%.

- Increased the amount of Cardano as an additional Ethereum-like blockchain.

- Doubled Filecoin, which builds a permanence layer on IPFS.

- Added Curve DAO because of the focus on cost-efficient swapping between stablecoins.

- Added Enjin because of the focus on NFTs.

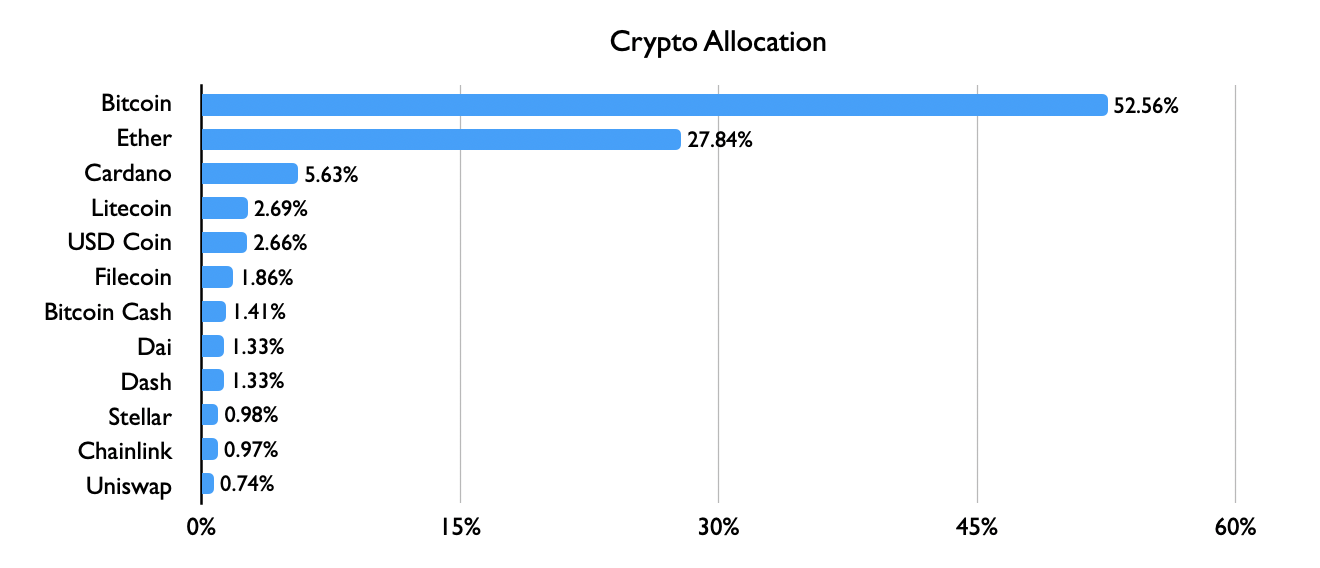

Crypto Allocation (June 2021)

Time for another Crypto Allocation update. The last two months have seen a huge draw down in all crypto markets. Here is NYDIG Market Update on June 23, 2021 to put it into context.

The current market drawdown, the peak to trough decline, currently ranks as one of bitcoin’s toughest periods. The current decline of 55.6% is the fifth most severe, following big rallies and subsequent drawdowns in 2011, 2013 (which had two), and 2017.

So needless to say all crypto assets are down substantially in that period. Here is how my allocation looks as of today, with notes below. I’ve added some footnotes. Tokens that have no notes are ones that I have made an active decision to hold some invested amount in. Others are either included in my basket, or are tokens I hold for some utility.

* Indicates tokens that Coinbase makes a market in with a $10B market cap.

** Indicates a token that does not meet one of my criteria, meaning it is either less than $10B in market cap or is not traded on Coinbase, however I have purchased it for some other purpose.

Notes:

Also see April 2021 and March 2021 allocations, and my approach to crypto.

REM5 for Good: Simulacra Two

REM5 for Good ran a digital art event, Simulacra Two, and in addition to other options they offered NFTs of a number of items.

I missed the real event but found out about it before it was all done and picked up four NFTs.

They used Tezos for this and minted and sold the NFTs on H=N. I wasn’t setup for that at all so I bought some XTZ on Coinbase, setup a walled on Kukai, and was then able to grab these.

Crypto Links

Balaji Srinivasan shared these links in a tweet. I’m putting them here for reference, with a couple of my own added.

Main List

Extended

My adds

Crypto Markets and Kids Soccer

On Wednesday May 12 at 5:06pm CT Elon Musk tweeted that Tesla would no longer accept Bitcoin to buy cars. The company also has $1.5B of Bitcoin on their balance sheet, reported $300M of which they’ve sold. Musks message is about the carbon footprint of Bitcoin. Odd since this isn’t new information.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

Anyway, my commentary is not about Musk’s position but the market reaction. Immediately, as one would expect, Bitcoin dropped 10%.

BTC

Now lets talk about kids soccer. Any parent that has watched their kids play soccer knows what it looks like. There is a big group of kids chasing the ball around with no tactics or strategy. Ball is over there, run and get it.

The crypto market was all kids soccer with this. Filecoin, which has nothing in common with the Bitcoin news dropped nearly the same, with a slight time lag.

FIL

Then Cardano drops the same too. Cardano however is a massively more efficient blockchain. The fundamental argument doesn’t apply. They even told that story.

ADA

The point here is that these markets and investors are still treating all of these assets as a single thing. Only Ethereum in recent months has broken out and moves materially on its own. I put this in my approach, but I think it is really important. You need some mental model of the utility for each of these assets. That utility should drive how you value them, and how you differently value them.

I love the #TeamSPS Cyberweek 2020 Shirt, and for the first time a paired challenge coin! 🪙 The challenge coin was also minted as an NFT. We also included the themed deck of playing cards. ♠️ Thank you to Kat Alberts for the great design.

Ethereum is up 32% in the last week, over 11% in just the last 24 hours! Hard to say what is driving it up, but it has definitely diverged significantly from Bitcoin.

On 4/30 at 11:29am I got an email from OpenSea officially announcing that they are adding support for Polygon (MATIC). Polygon is a network built on top of Ethereum. Interoperability to move NFTs in and out of Polygon into the main blockchain is a key feature for OpenSea.

Support for other blockchains (Polygon (formerly Matic) trading coming soon!)

Look at the trading activity for Polygon (MATIC). it is pretty obvious when the news leaked to the market. 😏

Used the relatively low Ether gas prices today to register weeklything.eth on the Ethereum Name Service, including reverse. I already have thingelstad.eth and reverse. This still falls in the category of playing and learning. 🤔

Trying to get one of my ICANN domain names, thingelstad.xyz, registered on Ethereum Name Service but stumped on DNSSEC error message from ENS, but DNSSEC tests out fine. 🤷♂️

Crypto Allocation (April 2021)

I’ve been building out my approach to crypto. I shared my allocation in March and updated it this weekend.

Notes:

I’m sharing this as my own notes for any value they may have to others.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the content as such. This website does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your own due diligence and consult your financial advisor before making any investment decisions.

Registered thingelstad.eth on ENS

In my continuing exploration and learning about Ethereum I decided to setup what would be my usual entry on the Ethereum Name Service (ENS). The same way the Domain Name Service (DNS) converts names like thingelstad.com into something computers can use, ENS can convert thingelstad.eth into the wallet address I prefer for Ethereum, and other crypto as well.

ENS is a companion to DNS. Mostly it holds addresses for crypto destinations. It also can hold additional metadata like pointers to your Twitter and Github profiles, as well as your website, email address, and profile image. ENS is completely decentralized like all things on Ethereum. It is operated and governed via a series of smart contracts.

The process is super easy, as one might expect. You simply connect to your wallet. I use Rainbow for all my Ethereum dapps connections. To buy the domain name you execute a series of two transactions on the blockchain. In fact, all changes to your ENS entries are changes on the blockchain. Some of them have fees, and all of them cost Ethereum gas. After registering the domain, you have to set your resolver. The resolver is saying which contract should requesters ask for information from. Think of this as your DNS host records. You can then add any number of crypto addresses to your entry. I setup Ethereum (of course), Bitcoin, Litecoin, Cardano, and Filecoin. It is unclear to me that there is any benefit in setting up all of them, but that was the list I thought may get used.

The last step is to create a reverse entry for your wallet. That is just like your Reverse DNS entry. Doing that allows dapps to show your friendly thingelstad.eth entry instead of the address. This is another transaction.

You can see the records for thingelstad.eth, it is all setup. I also have the reverse record set. To test, Etherscan Name Lookup for thingelstad.eth works as does the reverse lookup. Nice! 🙌

It was fun to do this and another opportunity to get familiar with dapps and Ethereum. Unfortunately this type of experimentation is extremely expensive right now due to gas prices being so high. The actual costs of doing all of the above are very low, but the gas prices to execute the transactions were more than 10x the cost of the thing itself. Right now this is like buying a $10 item on eBay and spending $100 to have it shipped to you.

Lastly, the ENS service operates as a token. My address, thingelstad.eth, is a token that only I own. It is kind of neat that it now shows up in my wallet as well!

Sharing my current allocation of crypto investments. Skin in the game.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the content as such. This website does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your own due diligence and consult your financial advisor before making any investment decisions.

From today’s Economist Espresso:

Coinbase, America’s largest cryptocurrency exchange, was valued at $68bn ahead of its planned stockmarket listing. Its previous round of fundraising in 2018 put a value of $8bn on the company. It has surged thanks to this year’s bitcoin rally. A successful public listing would be an important moment for the cryptocurrency sector, which regulators have viewed with scepticism.

$60 billion in market value in 3 years. An IPO for Coinbase would be a huge additional validator for the crypto markets.

I’m trying to mint an NFT on Zora.co and am shocked by the variability in the network fee. I’ve checked multiple times and the price has ranged 500% in one day. The gwei price moves a lot each day, but closer to 200% difference.

Approaching Crypto

I’ve recently clarified my thinking on Bitcoin and related crypto. To be transparent, I’ve followed this for years and had plenty of opportunities to buy BTC for a few hundred dollars. It’s now over $50,000 a coin. So, based on that, you may want to stop reading now. 😊

Focusing on 3+ year horizon / Investing

First, I’m not looking to become an active trader. That isn’t my game. So I’m going to look at all crypto investments with a 3+ year horizon. I have a long view that crypto is real and will be a component of corporate and personal balance sheets over the next decade. How large of an element? More than it is now!

Only $10B instruments / Limit Risk

I’m only considering crypto that has a total market cap over $10B for at least 30 days. I’m also only considering crypto I can trade on Coinbase. Setting a value threshold limits the noise and distraction. I am sure there is positive activity below $10B, but I’m choosing to ignore that for now. Based on that limit Bitcoin (BTC) at $1.1T, Ethereum (ETH) at $233B, Litecoin (LTC) at $16.2B, Chainlink (LINK) at $15B, Bitcoin Cash (BCH) at $13.8B, and Stellar Lumens (XLM) at $11.8B are the only things I’m watching. (Market caps as of Feb 20 2021 7:00 AM CT.)

Any crypto over $10B in value is worth a nominal investment and puts it on the radar to consider more broadly.

The one exception I am making to that limit is stablecoin. I don’t know what to think of stablecoin, and I am tracking USD Coin (USDC) to learn more.

Develop a Model / Diversify

Crypto are very different, with different objectives. You can treat them as a basket for broad crypto investment and a bet on decentralized financial systems. But that is where it ends. I think you should develop a model for each one and why it is applicable for investment. My current thinking is:

| Crypto | Value |

|---|---|

| BTC | Stored value. I think of it as gold. |

| ETH | A bet on a different compute model. |

| LINK | A bet on smart contracts. |

| LTC | Money in your wallet. You might buy a coffee with LTC. |

| BCH | Bitcoin version of LTC. Same thesis. |

| XLM | Financial backend and potentially an alternative to systems like SWIFT. |

| USDC | Question mark for me right now. |

Overall Allocation / Portfolio

Crypto is super volatile and risky. I like Ray Dalio’s comment.

Bitcoin looks like a long-duration option on a highly unknown future that I could put an amount of money in that I wouldn’t mind losing about 80% of.

So with that in mind, this shouldn’t be your retirement fund!

I’ve watched this for too long from the sidelines and have not participated other than some small dollars for fun. My brother-in-law Hector made a comment that resonated with me. With a handful of public companies now holding BTC on their balance sheet, others will follow suit. I’ve also had many people approach me about using BTC as a hedge on inflation.

The net of all this is that crypto has moved from experimental to maturing and I expect we will see a multi-year increase in demand.

I haven’t talked about the technology behind it all. I’m entirely confident in that component, and I use Coinbase to manage my wallet for me.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the content as such. This website does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your own due diligence and consult your financial advisor before making any investment decisions.

Bitcoin has gone crazy this year. That is more than a 10x price change in the last year, most of it in the last month! Doesn’t seem correlated to anything of measurable value. 🤷♂️💸

Bitcoin went up 21% in the last week! 🤭

I don’t get 1000%+ price increase in Bitcoin. 🤷♂️

Bitcoin price for last month. Bananas. 🍌🤷♂️