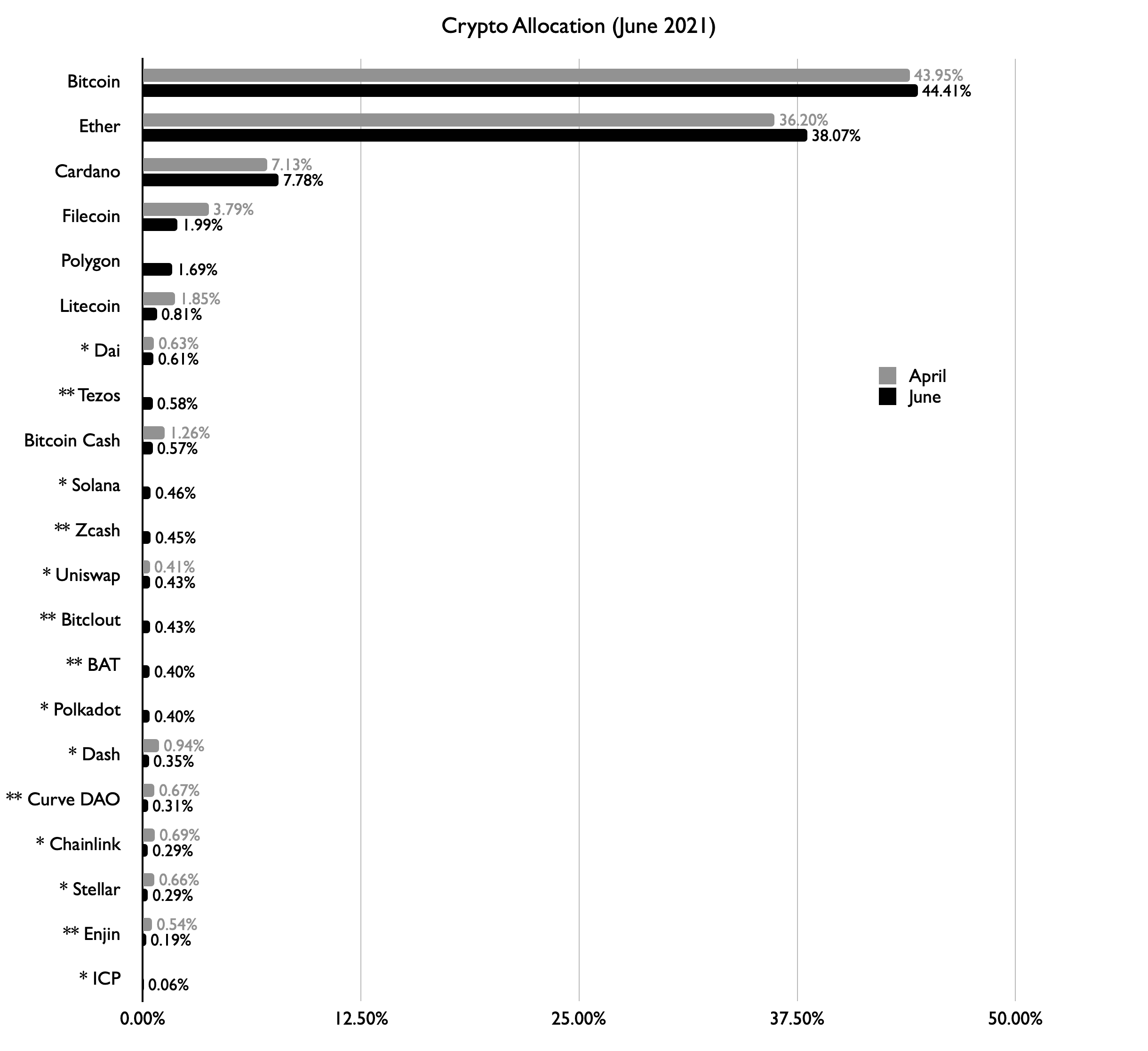

Crypto Allocation (June 2021)

Time for another Crypto Allocation update. The last two months have seen a huge draw down in all crypto markets. Here is NYDIG Market Update on June 23, 2021 to put it into context.

The current market drawdown, the peak to trough decline, currently ranks as one of bitcoin’s toughest periods. The current decline of 55.6% is the fifth most severe, following big rallies and subsequent drawdowns in 2011, 2013 (which had two), and 2017.

So needless to say all crypto assets are down substantially in that period. Here is how my allocation looks as of today, with notes below. I’ve added some footnotes. Tokens that have no notes are ones that I have made an active decision to hold some invested amount in. Others are either included in my basket, or are tokens I hold for some utility.

* Indicates tokens that Coinbase makes a market in with a $10B market cap.

** Indicates a token that does not meet one of my criteria, meaning it is either less than $10B in market cap or is not traded on Coinbase, however I have purchased it for some other purpose.

Notes:

- Polygon: I got into Polygon with OpenSea’s announcement that they were adding it as an alternative blockchain to Ethereum for NFT sales. Polygon is a Level 2 chain with substantially lower costs, and has the very powerful benefit that you can transfer NFTs from Polygon’s Layer 2 chain to the Layer 1 Ethereum chain. I’m intrigued by the model of Ethereum as a core blockchain and specialized Layer 2 chains connected to it, and allowing fluid movement of tokens between them all.

- Solana: Solana is an incredibly performant blockchain built on Rust. It support smart contracts and you can even write them in Rust. Solana does not meet my market cap requirement however I bought my minimum to get early exposure to it and to get my wallet setup and play with it.

- Uniswap: Powerful solution to swap any token for any other token. Seems like a core component of the DeFi solution space. Meets the $10B market cap threshold.

- Polkadot: Newly listed on Coinbase and meets the $10B market cap threshold. Facilitates cross blockchain movement of tokens and data.

- ICP: Newly listed on Coinbase and met $10B threshold so added to basket. Promises to offer an amazingly performant blockchain with very good features. Worse performing token I’ve had now dropping 90%.

- Zcash: Zcash is super interesting to me because it supports multiple types of addresses including a shielded address that is more private. Zcash is one of the few that overs private transfers on its blockchain. Zcash does not meet the $10B market cap requirement.

- Tezos: I purchased Tezos just so I could buy some NFT at the REM5 for Good event.

- Bitclout: I’ve setup a profile on Bitclout, and all profiles on Bitclout hold CLOUT tokens. I also have one for the Weekly Thing. The whole ecosystem of creator coins and “diamonding” posts is pretty interesting. Bitclout can be purchased with Bitcoin, and you can sell Bitclout back to Bitcoin. The Bitclout blockchain is merge mined with Bitcoin. This does not meet the $10B market cap requirement, and it is also not traded on Coinbase.

- Basic Attention Token: BAT is the token that the Brave browser uses, and I’m intrigued by Brave and what they are doing to I added it to my basket. This does not meet the $10B market cap requirement.

Also see April 2021 and March 2021 allocations, and my approach to crypto.