BigCharts

- To launch a new entrepreneurial venture, often with the backing of the parent firm or organization;

- To assist in the evaluation of potential investments where the entrepreneur has a particular expertise; or

- To provide functional expertise to assist with an existing investment.

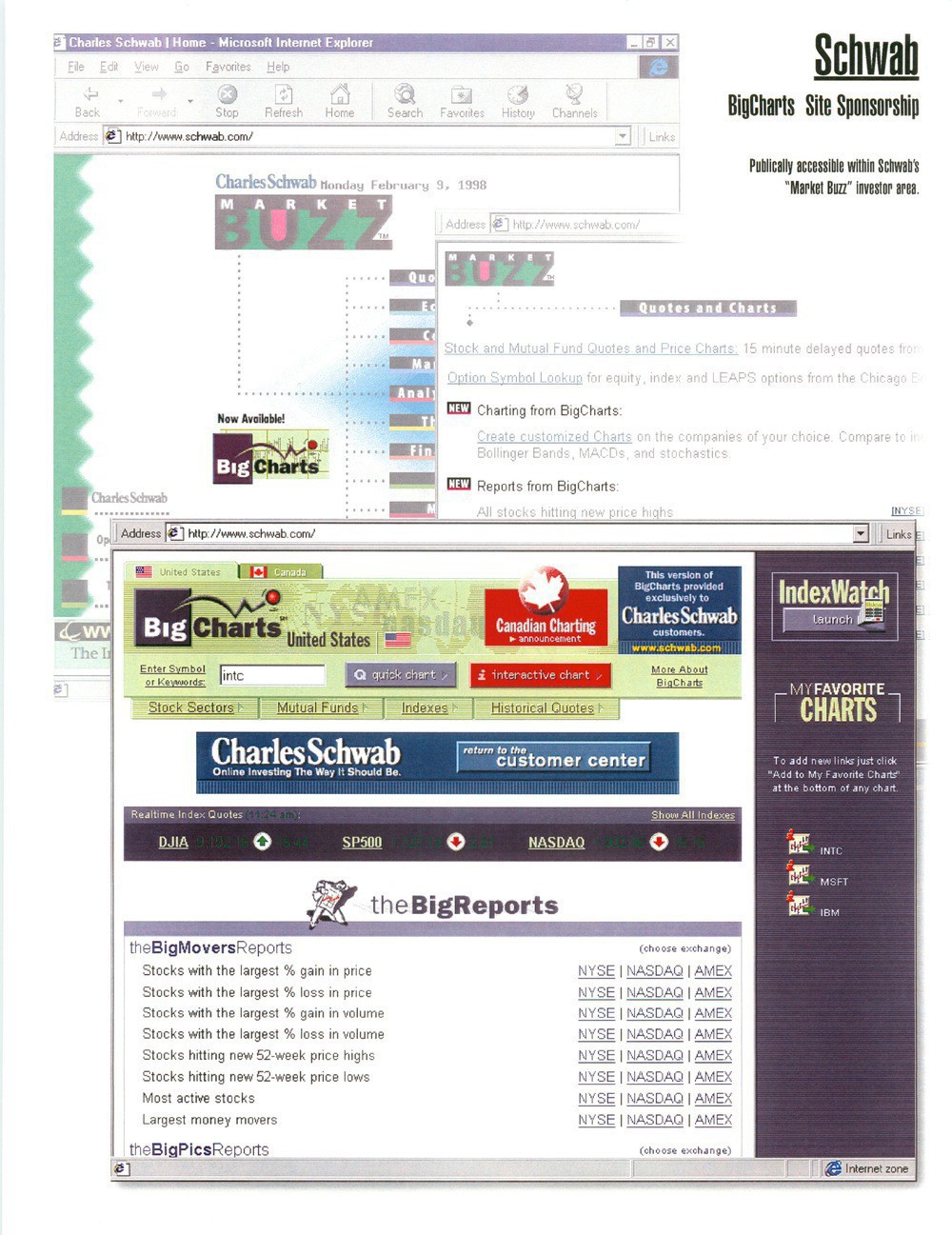

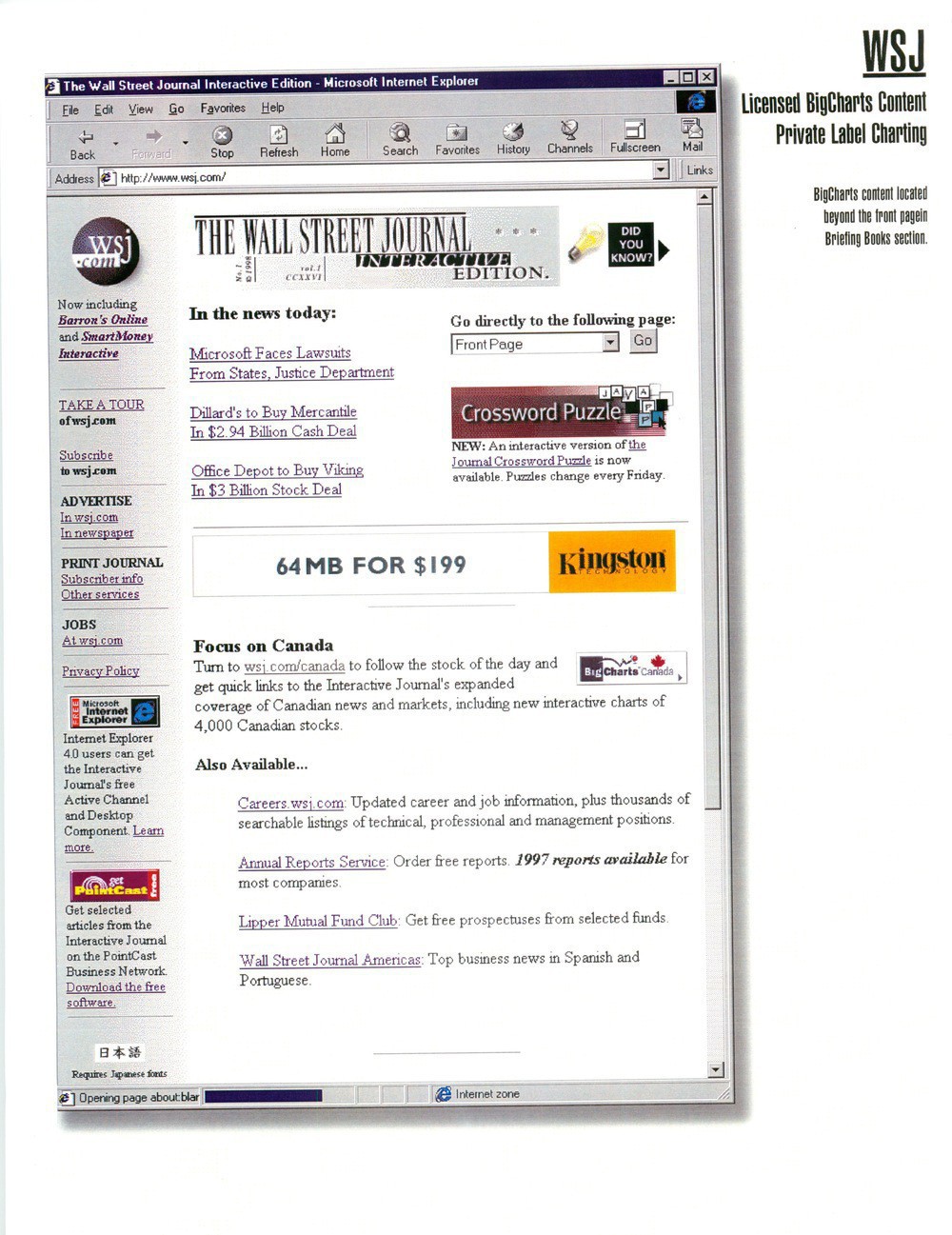

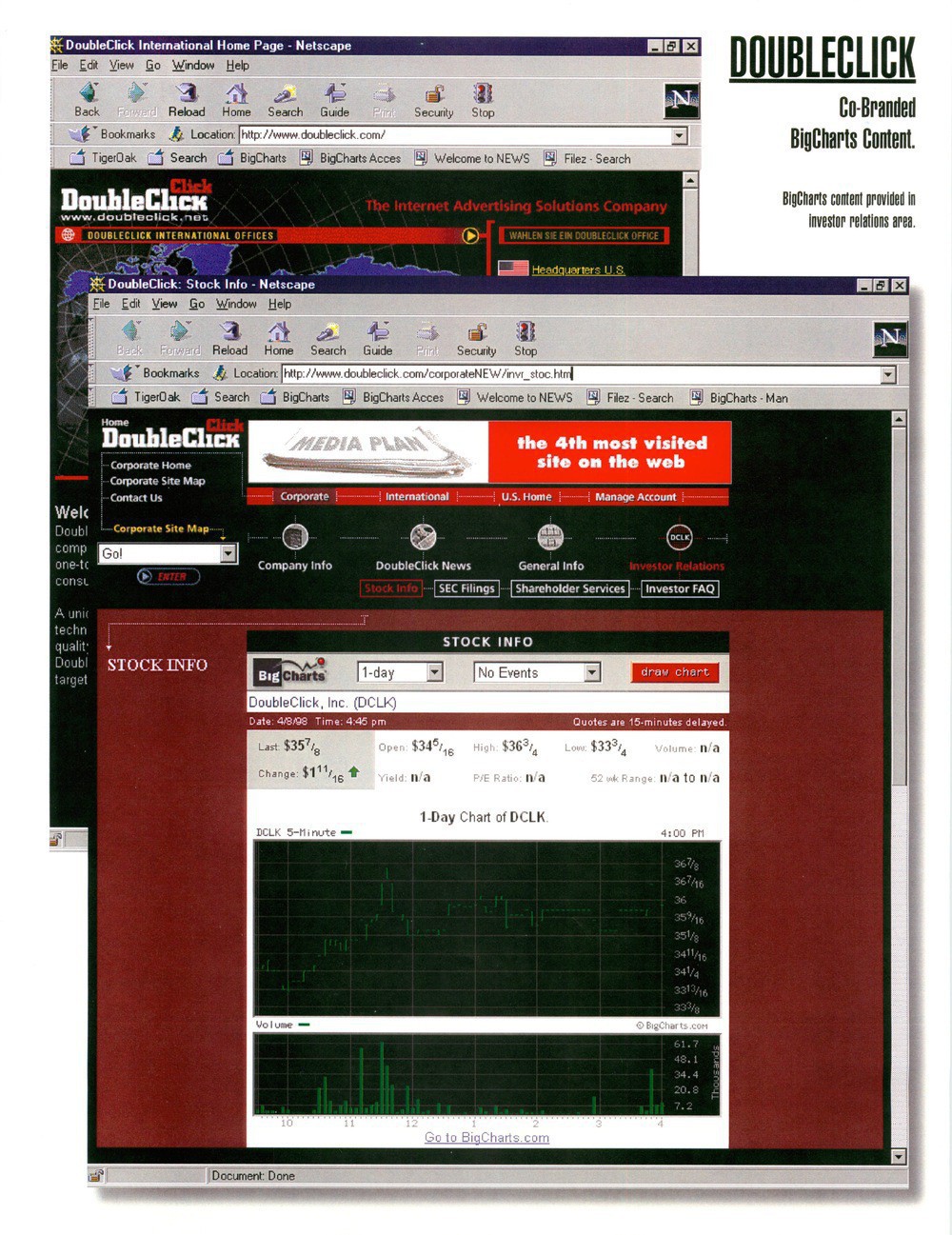

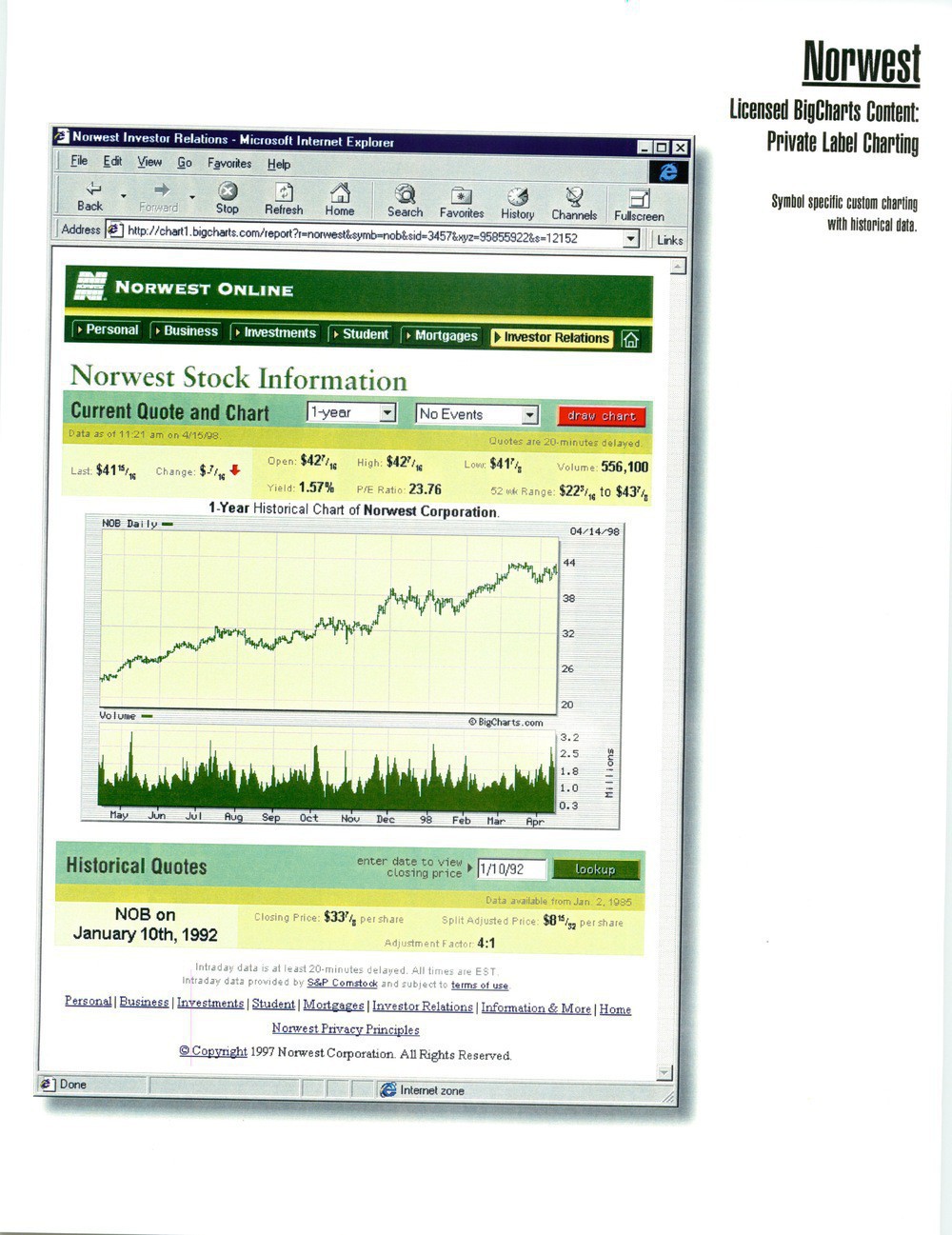

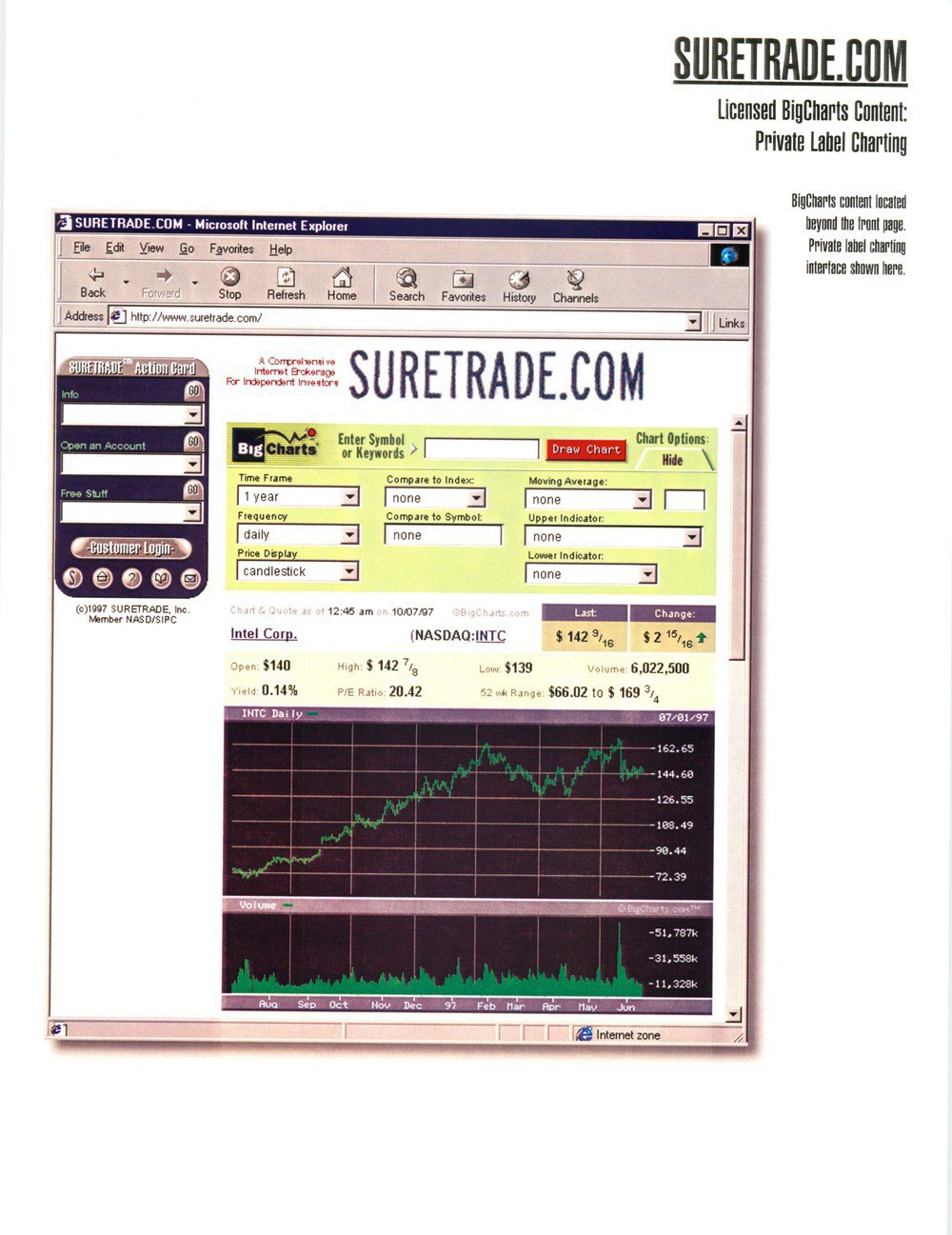

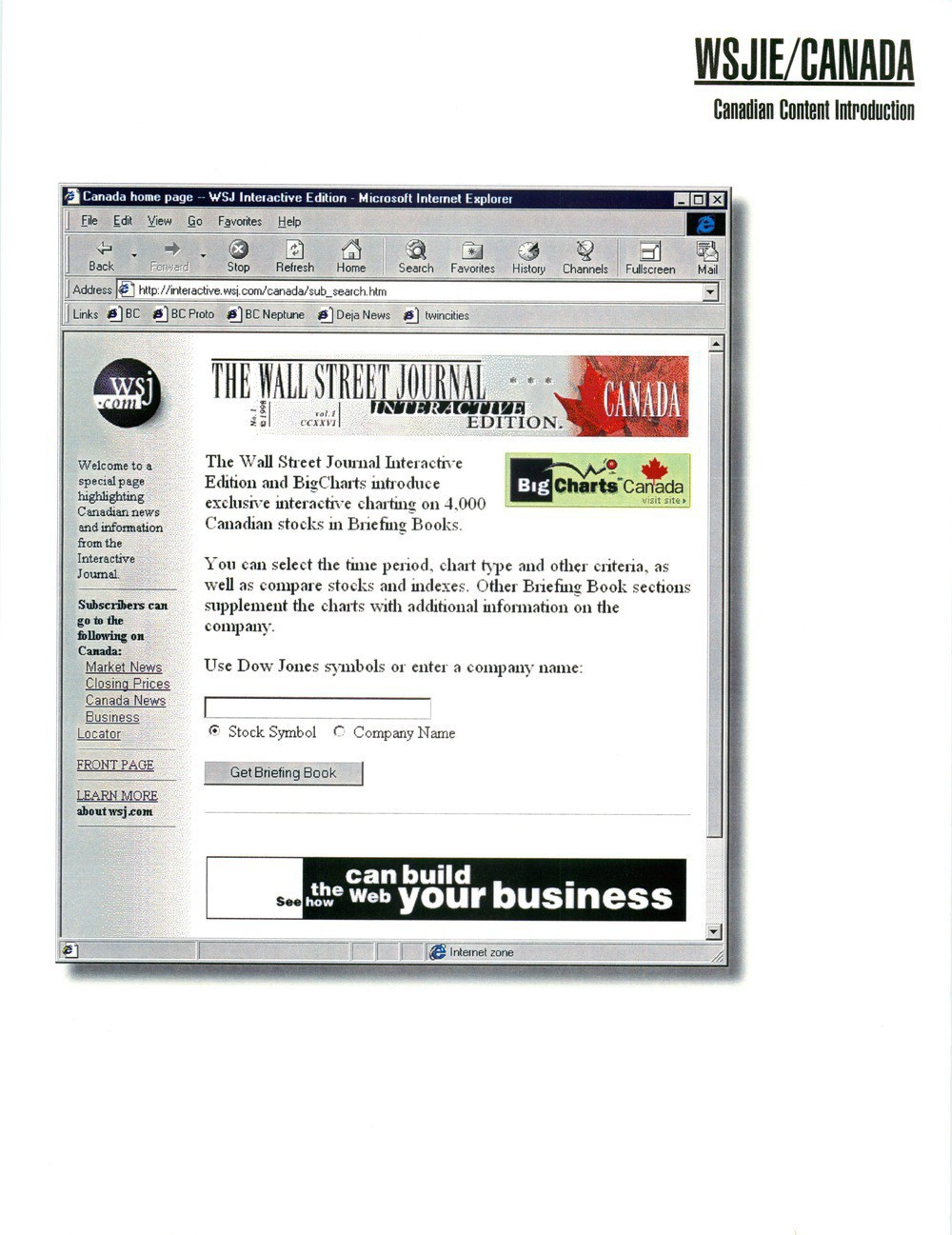

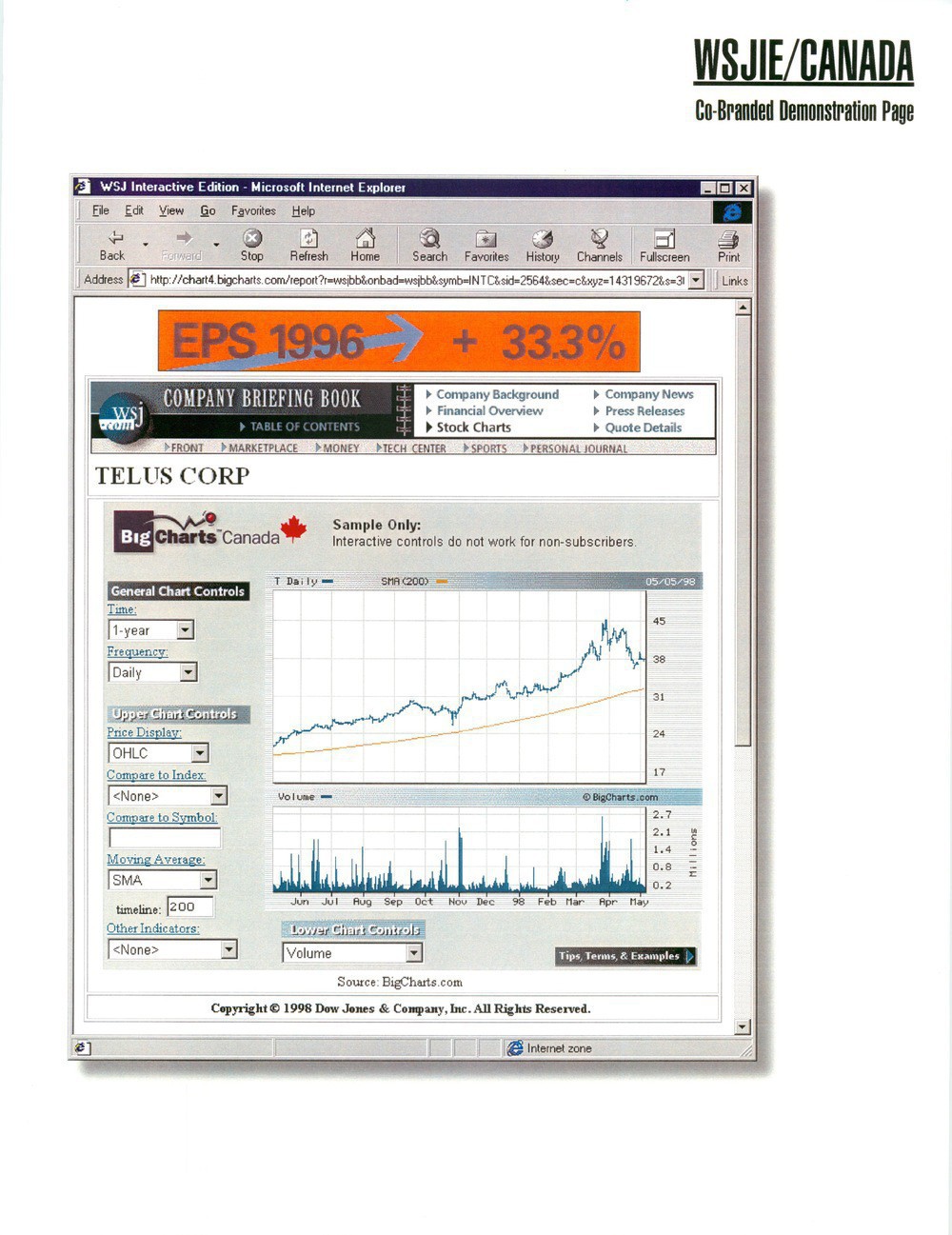

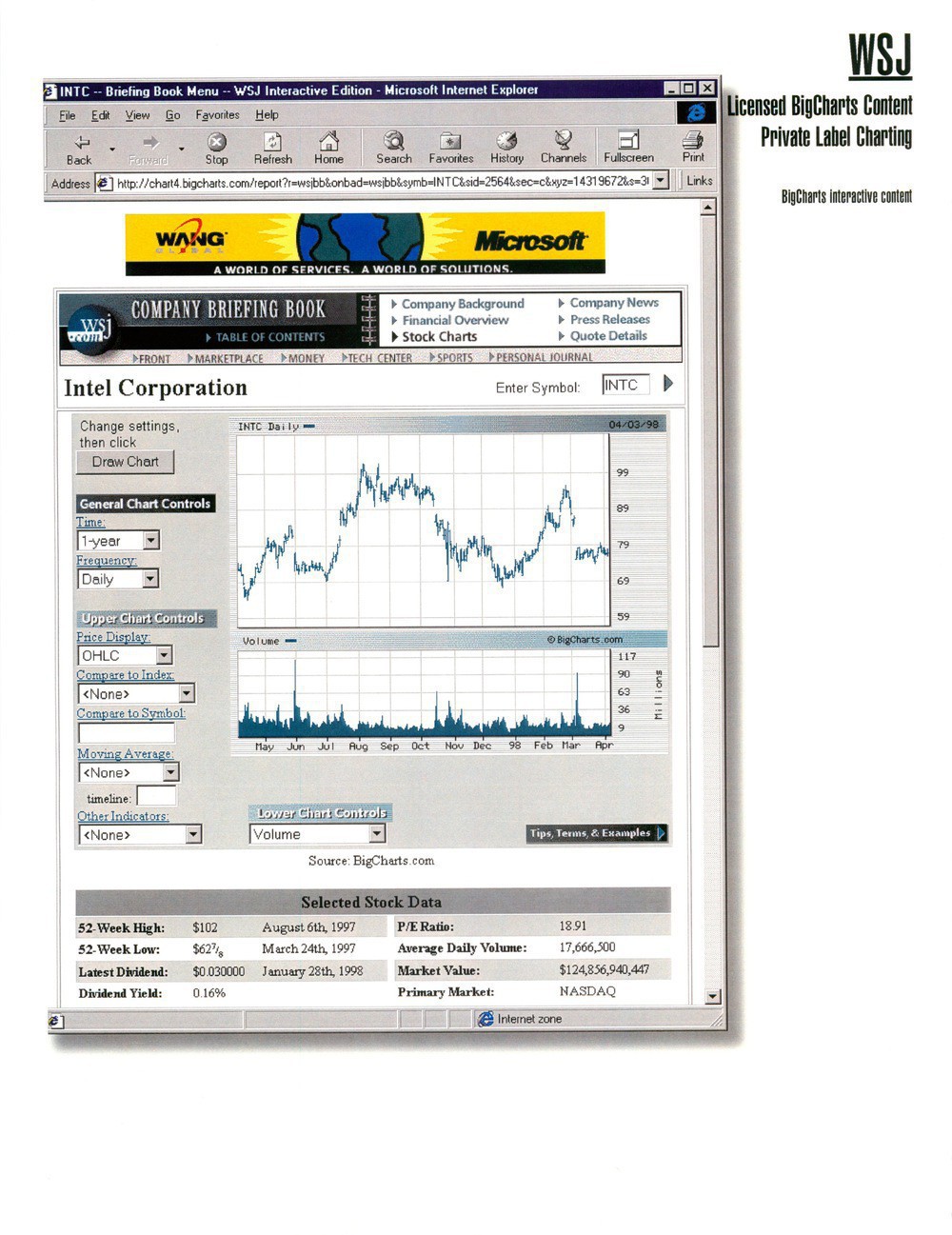

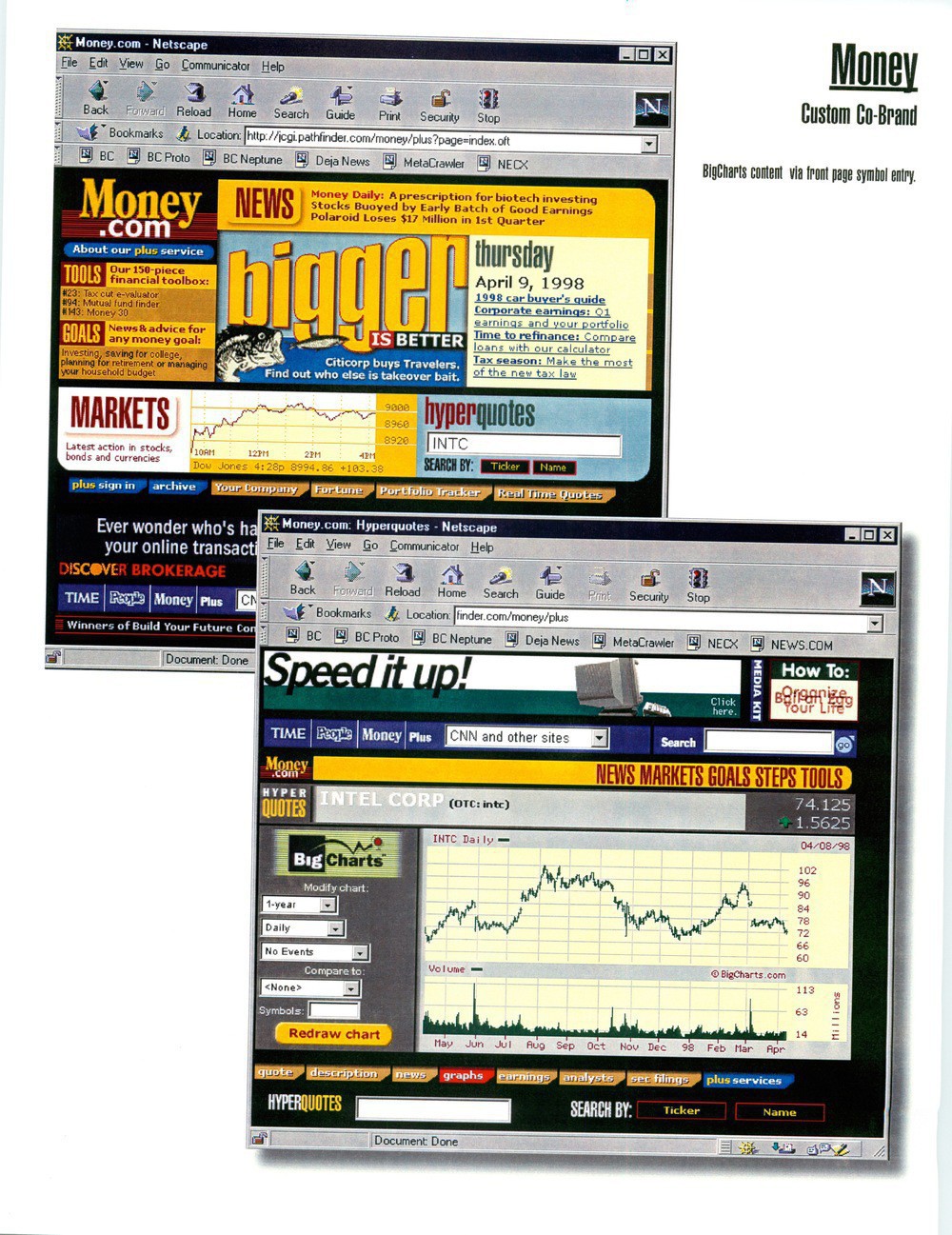

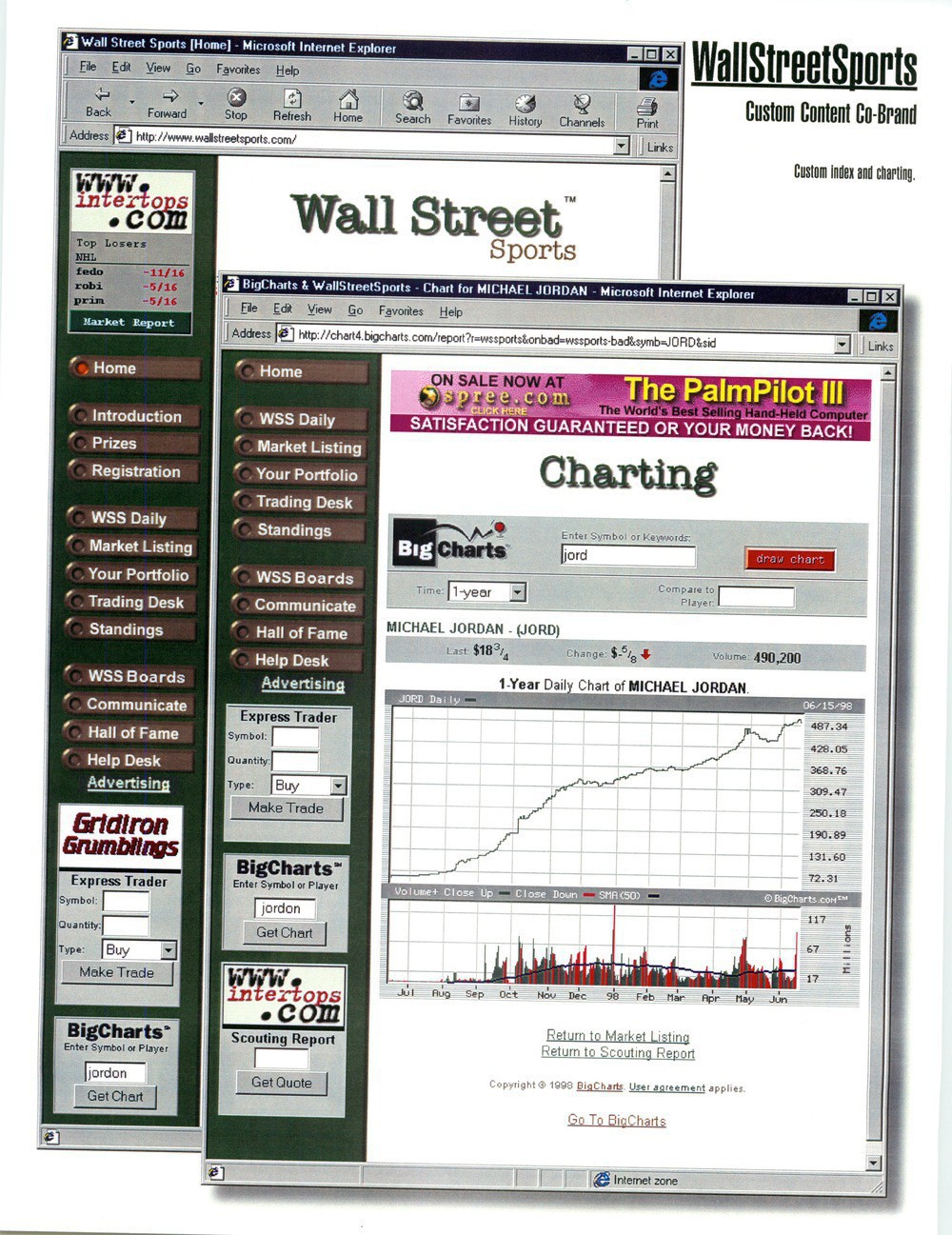

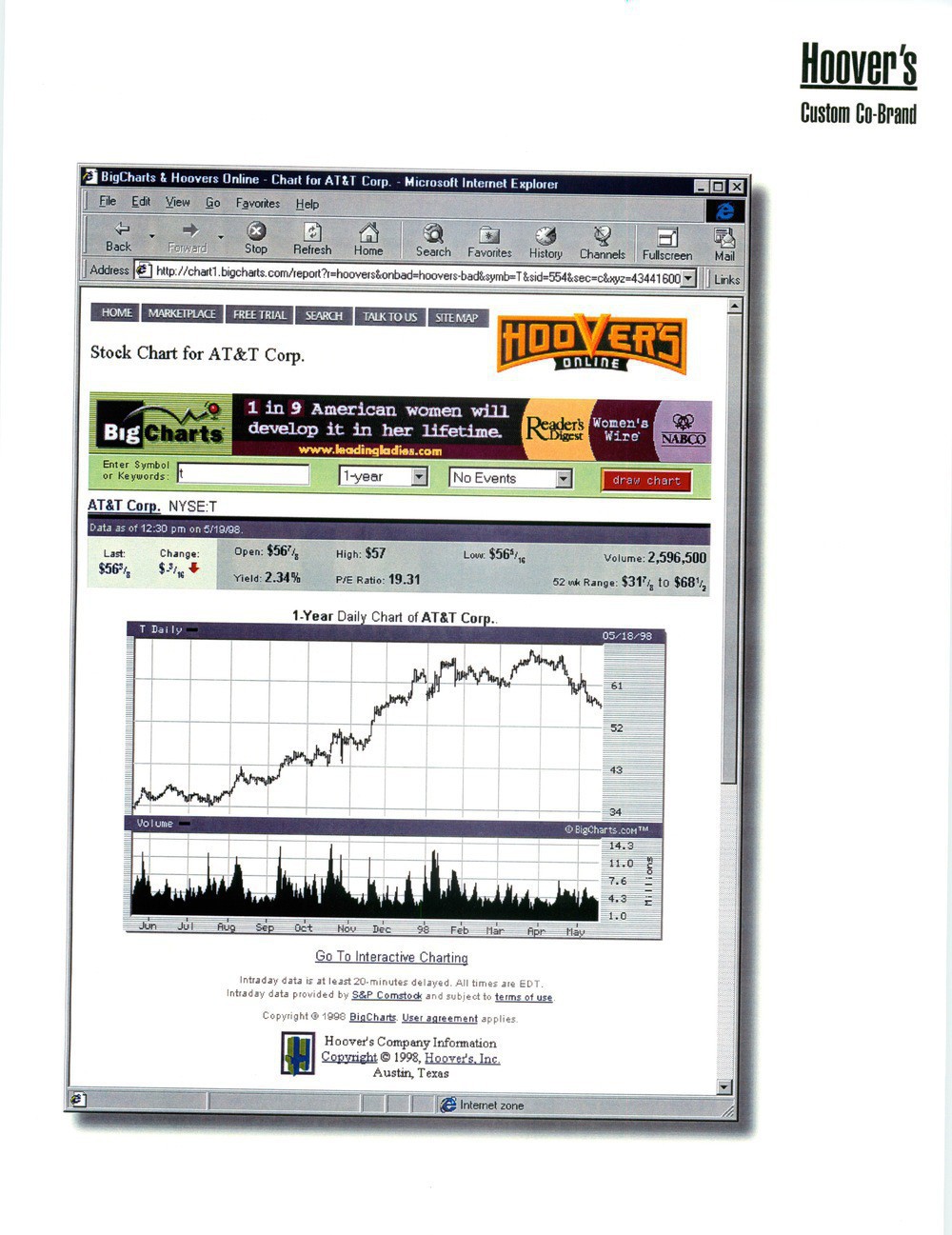

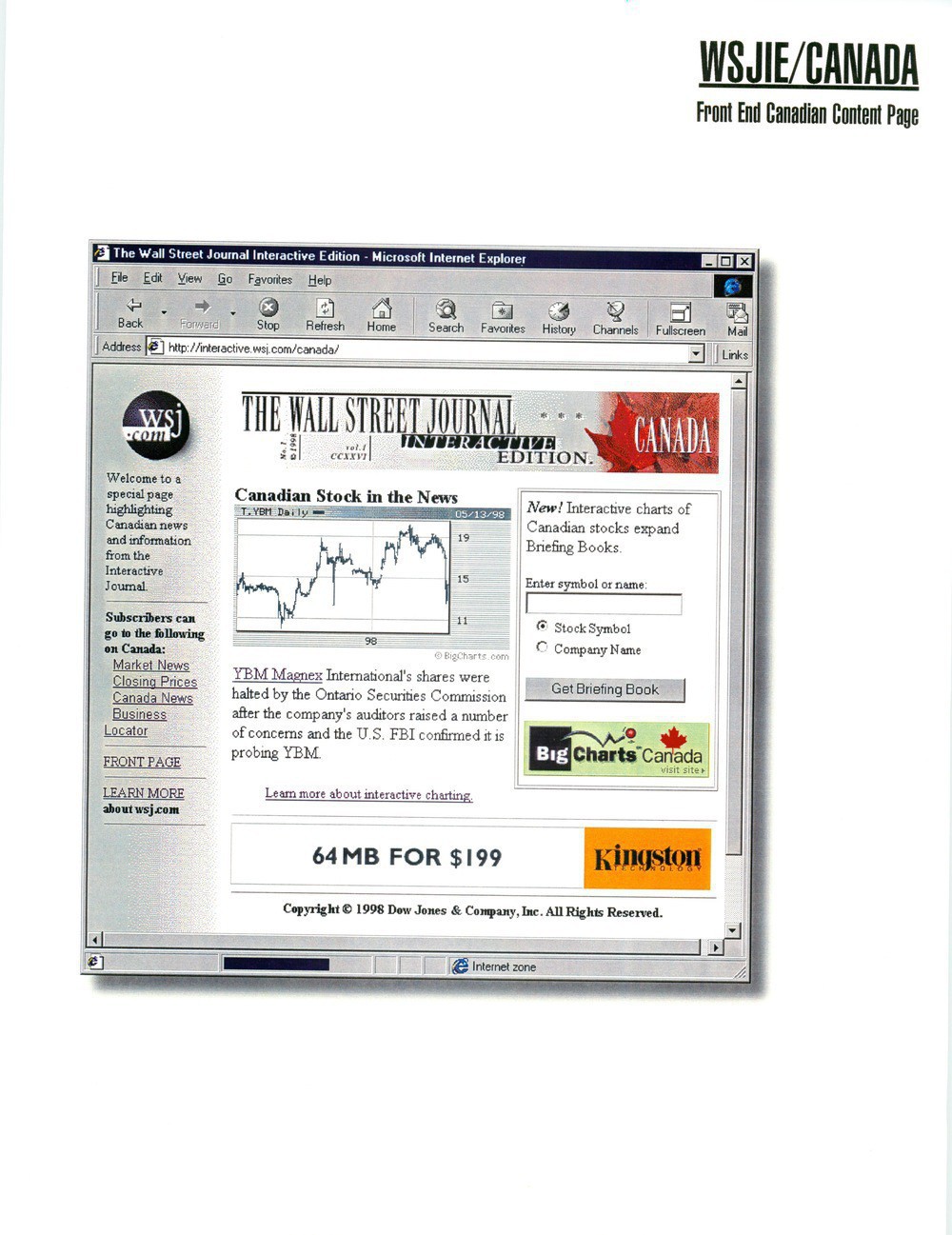

- All the screenshots are so narrow. We all had little, tiny monitors.

- BigCharts Canada, FTW!

- Virtual Stock Exchange ended up being bought by MarketWatch, who bought BigCharts.

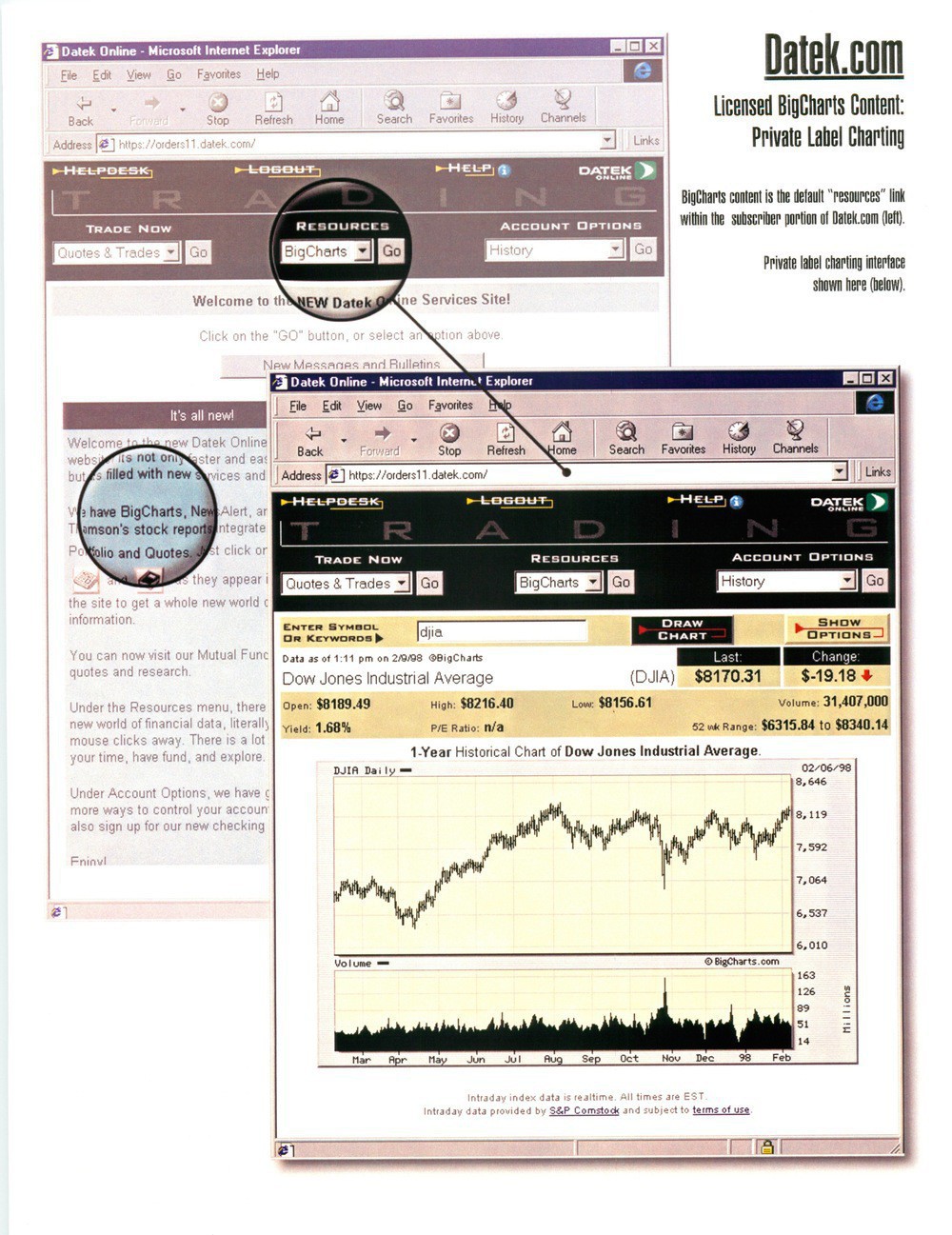

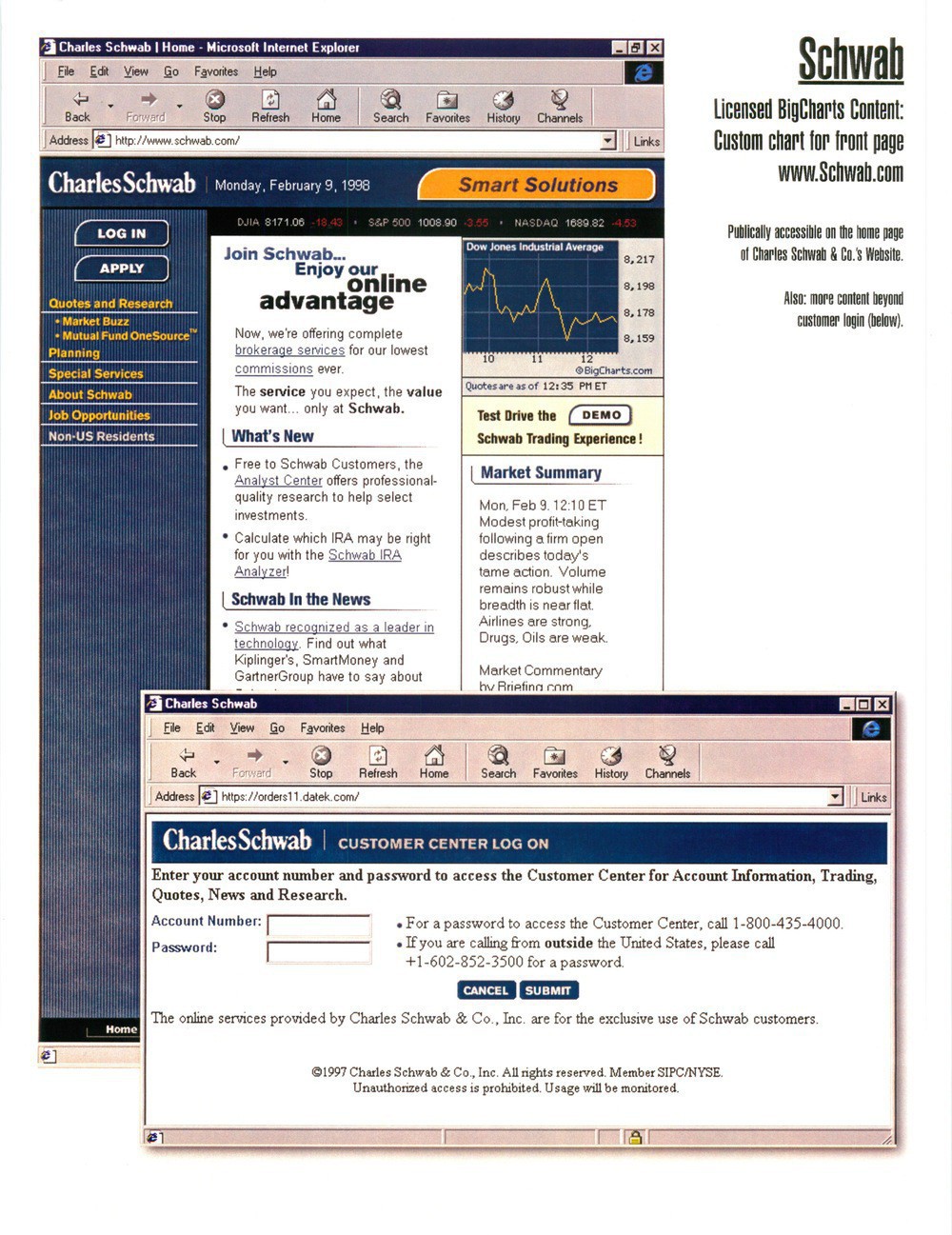

- Note the error on the Schwab image (page 10) where the URL is “datek.com”. 🙂

This chart of SPSC performance since IPO is amazing. Compared to the high growth tech giants — outperforms AMZN, MSFT, GOOG, AAPL. 🤩

Remembering Matthew Dornquast

I first met Matthew when he was CTO at Fallon. It must have been 1997. I don’t remember how we got introduced to each other. We both went to the University of Minnesota in Computer Science but Matthew was a few years ahead of me and we didn’t overlap there. I do remember meeting Matthew though. We were building BigCharts and Matthew and I immediately connected on our shared passion for technology and specifically the Internet and the rapidly evolving web. Matthew was very smart, passionate, focused. I remember him talking about moving on and doing something new, the thing that eventually became Code42. Not before I tried to persuade him to join our ragtag band at BigCharts. But it was very clear that he wanted to pursue something on his own.

We stayed in touch over the years and would regularly meetup to chat technology, the Internet, startups, etc. He returned my favor of gently trying to bring him into BigCharts when we had lunch downtown and he gauged my interest in joining them as they started to build out CrashPlan. I was an early user of the peer-to-peer version of CrashPlan and used it to for a neighbor and I to be each others offsite backup. As always, Matthew was passionate, excited, driven and always focused on the technology.

Matthew and I would regularly connect around our shared passions and joint focus on doing everything we could to make the Twin Cities technology community stronger. Matthew was always a dedicated supporter of Minnebar and Minnedemo. He cared deeply about the technology community around him, and always showed up to support and grow the talent around him. I will forever miss that about him.

Matthew and I never did get to do a project together. I have an incredible amount of respect for what he built. Through the consulting business of Code42 they bootstrapped a product that became the largest Series A investment in Minnesota history. In the middle Matthew made several bets in early stage companies by building the technology in return for some equity.

Unfortunately it has been a few years since we connected. After Matthew moved on from Code42 and moved to New York we didn’t have those serendipitous moments to connect. But by his tweets you can see that his passion for technology was present through all of his life. It is sad to see a mind as bright as his go so early in life.

Thank you Matthew for all you did for the technology community, and for building so many things that continue to provide value today. You will be missed.

Related

Happy 23rd Birthday BigCharts!

On this day, 23 years ago, we launched BigCharts.com. The time before and after that was fun, stressful, and filled with unknowns. It was a great ride. One of the defining experiences of my life. I love that the site is still around, serving charts for all that want! I’m sure code I wrote is still running on it. 😬

I bet that it is one of the very few sites that can show a graph of the Dow Jones Industrial Average back to 1970. I know because I was the one that backloaded that data into the database!

I love that the size of chart bigger than Large is still called Big! I remember the laughter when we came up with that obvious label.

It still is one of the few sites that will give you a historical quote, with the price info for a given day in the past, backing out splits.

I remember the up2.aspx page that we used for the load balancers to make sure servers were healthy.

Here is a team photo from June 9, 1999. It was a tech team dinner at Buca. What a great team!

I hope the site enjoys its 20s and is around for decades to come!

I also shared this on LinkedIn and hopefully we’ll get some old school BigCharts folks commenting.

Raspberry Pi vs SPARCstation 20: Fight! ← 20 or so years ago we launched BigCharts on a SPARCstation 20! 😀

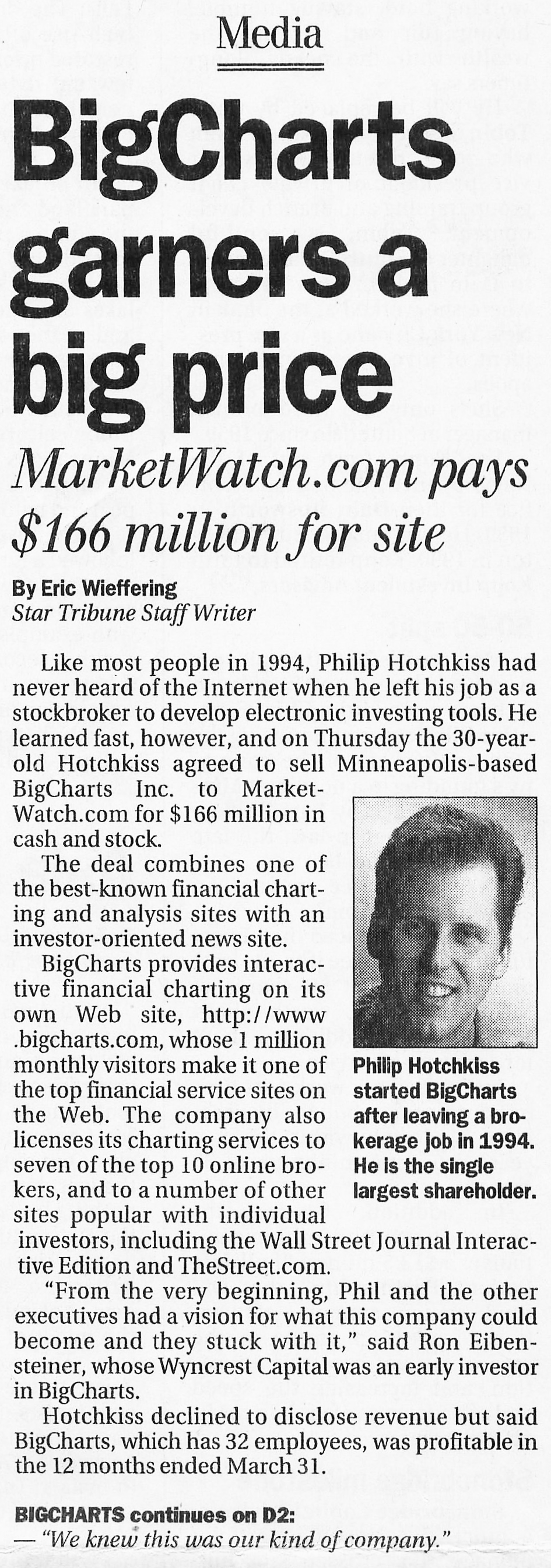

Star Tribune in April 1999 on BigCharts Acquisition

I’ve been cleaning through old files and found the copy of the April 30, 1999 issue of the Star Tribune that I had saved with the article about BigCharts being acquired by CBS MarketWatch. I couldn’t just recycle this before running it through the scanner. Phil sure had some hair back then. 😀

Funny that Phil actually did relocate to San Francisco area, just about 10 years later than this article and had nothing to do with BigCharts or MarketWatch.

Just hung this BigCharts.com memory in my new office.

Very impressed with TradingView. If I were to build BigCharts.com again today, I would like to think it would be what they did.

Today is the anniversary of BigCharts.com I still remember watching those first chart requests scroll by.

On this day in 1997 Philip Hotchkiss, me and a team of 6 launched BigCharts.com. Great memories!

Entrepreneur in Residence at Split Rock Partners

Earlier this week Split Rock Partners did a press release regarding my entrepreneur in residence (EIR) with the firm. The first question friends of mine have asked is “What exactly is an entrepreneur in residence?” Wikipedia highlights an EIR as:

The EIR role is often designed to fill one of three primary functions:

That is a great recap of what I will be doing with Split Rock. The partners have given me a place to office and the opportunity to get and give early feedback around potential business ventures.

A couple of other items about EIR roles. There are other “in residence"programs. For example, artist in residence seems to be a fairly well established. I’ve also seen writer in residence as well as journalist in residence pop up. Lastly, just to be clear, the EIR role is a partnership. I’m not an employee at the firm, and this isn’t a “job”. It is a formal collaboration and a vehicle for us to work together.

I am excited to work with the partners at Split Rock and will make the most of such a unique opportunity!

Jamie Thingelstad joins Split Rock Partners as an Entrepreneur in Residence

Former Dow Jones executive will focus on emerging opportunities in digital media

Minneapolis, MN, July 27 – Split Rock Partners, a venture capital firm focused on emerging software and internet services companies, is pleased to announce that Jamie Thingelstad, former Vice President, Chief Technology Officer of the Wall Street Journal Digital Network, the consumer division of Dow Jones & Company and Chief Technology Officer of MarketWatch, Inc., is affiliated with the firm as an Entrepreneur in Residence (“EIR”).

Mr. Thingelstad was founding Chief Technology Officer of BigCharts, Inc. through its acquisition by MarketWatch in 1999. BigCharts was a pioneer in delivering real-time financial information via the web, and provided financial tools offered by the majority of top financial services firms at the time of the acquisition.

MarketWatch was subsequently acquired by Dow Jones, and Mr. Thingelstad continued to take on progressively larger responsibilities within the Dow Jones organization. In his last role, he served as Chief Technology Officer of the Wall Street Journal Digital Network, a leading provider of financial and investment news through sites sites such as the Wall Street Journal, MarketWatch and Barrons. During his tenure, the network properties grew substantially in audience, and introduced several new product offerings. Prior to that Mr. Thingelstad was Chief Technology Officer for the Enterprise Media Group of Dow Jones where he oversaw the development efforts for Dow Jones Newswires, Dow Jones Indexes and other business services offered by the company.

“Jamie is an accomplished entrepreneur and brings great insight into the intersection of the internet, new media, and the implications for next-generation business models,” said Michael Gorman, a Managing Director at Split Rock Partners. “As a pioneer in digital media, he is intimately familiar with the unique challenges and opportunities presented by the convergence of new technologies, consumer behavior, advertiser objectives and industry economics. We look forward to applying his insights to the process of identifying the most promising opportunities taking advantage of these dynamic trends.”

As an EIR with Split Rock Partners, Mr. Thingelstad will be evaluating opportunities defining the next generation of digital media, the increasing opportunities in social applications on the web as well as the continuous evolution of the web as a platform.

“I am excited to explore how new technologies can build upon the foundation of traditional media, while creating new opportunities to meet the needs of consumers and businesses in unanticipated ways,” said Mr. Thingelstad. “We are still at an early stage in the transformation of digital content production, delivery and consumption, and in that transformation lies opportunity. I am pleased to partner with the Split Rock team given their track record of partnering with entrepreneurs to translate the potential of breakthrough ideas into leading companies.”

About Split Rock PartnersSplit Rock Partners, with offices in Minneapolis and Menlo Park, seeks emerging opportunities in healthcare, software, and Internet services primarily in the Upper Midwest and West Coast. Split Rock was formed in June 2004 by the teams responsible for healthcare, software and Internet services investments for St. Paul Venture Capital (SPVC) and continues to manage SPVC’s portfolio in those sectors. Split Rock closed a $275 million inaugural fund in April of 2005, and a $300 million second fund in May, 2008. Representative companies backed by Split Rock’s team include Atritech, Disc Dynamics, EBR, eBureau, Entellus, Evalve, Gearworks, Internet Broadcasting, HireRight, LowerMyBills.com, MyNewPlace, QuinStreet, and Tornier. Additional information about the firm can be found at www.splitrock.com.

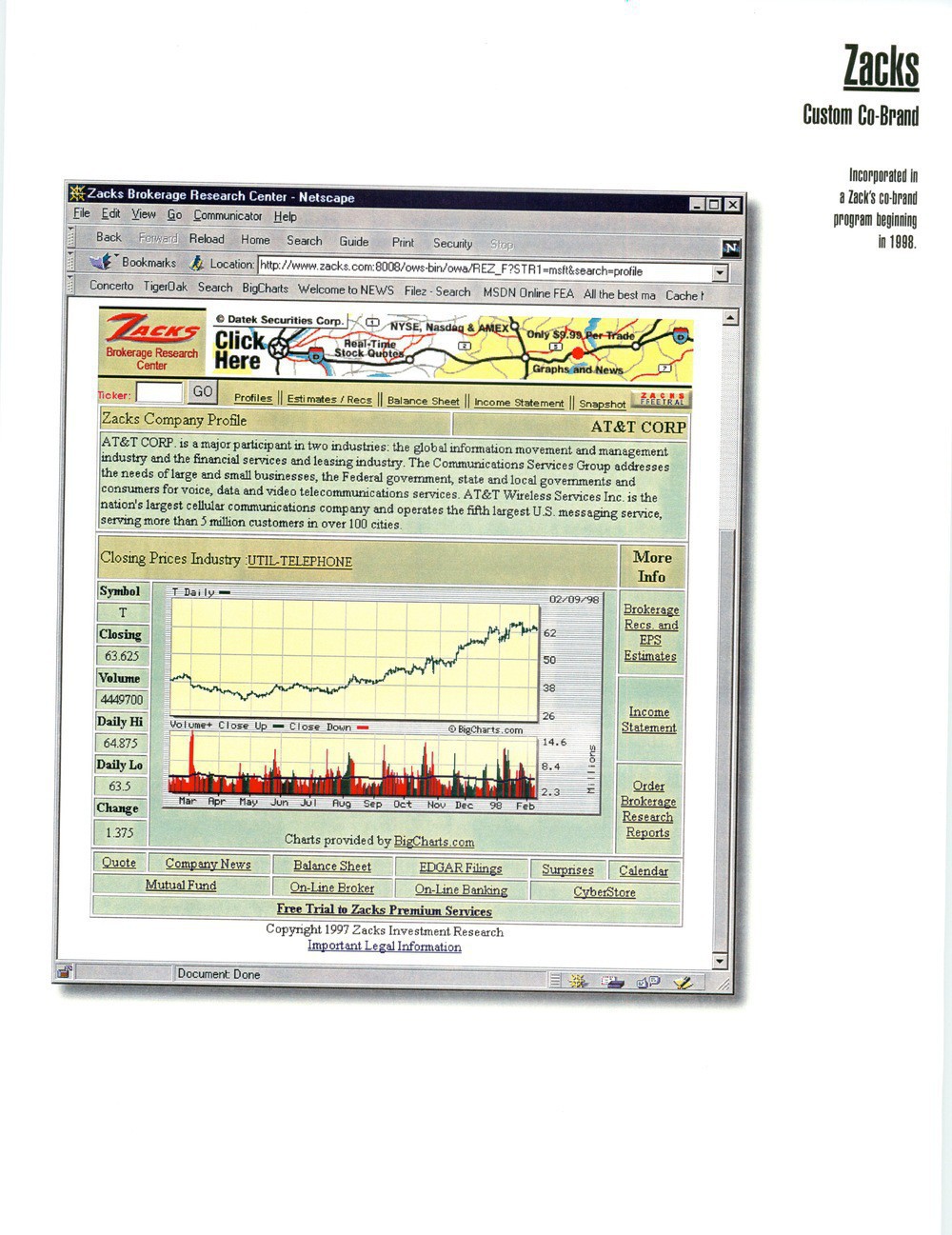

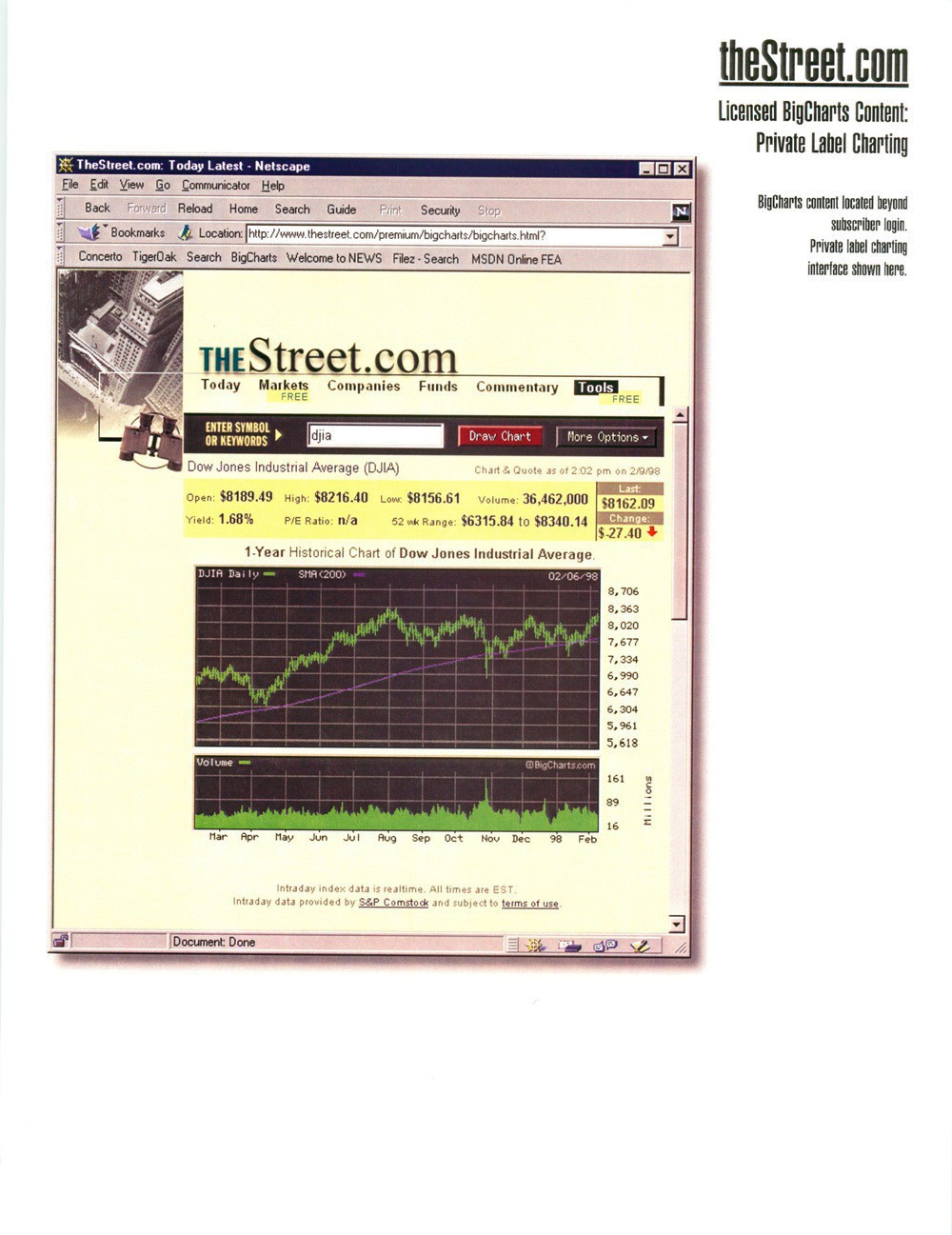

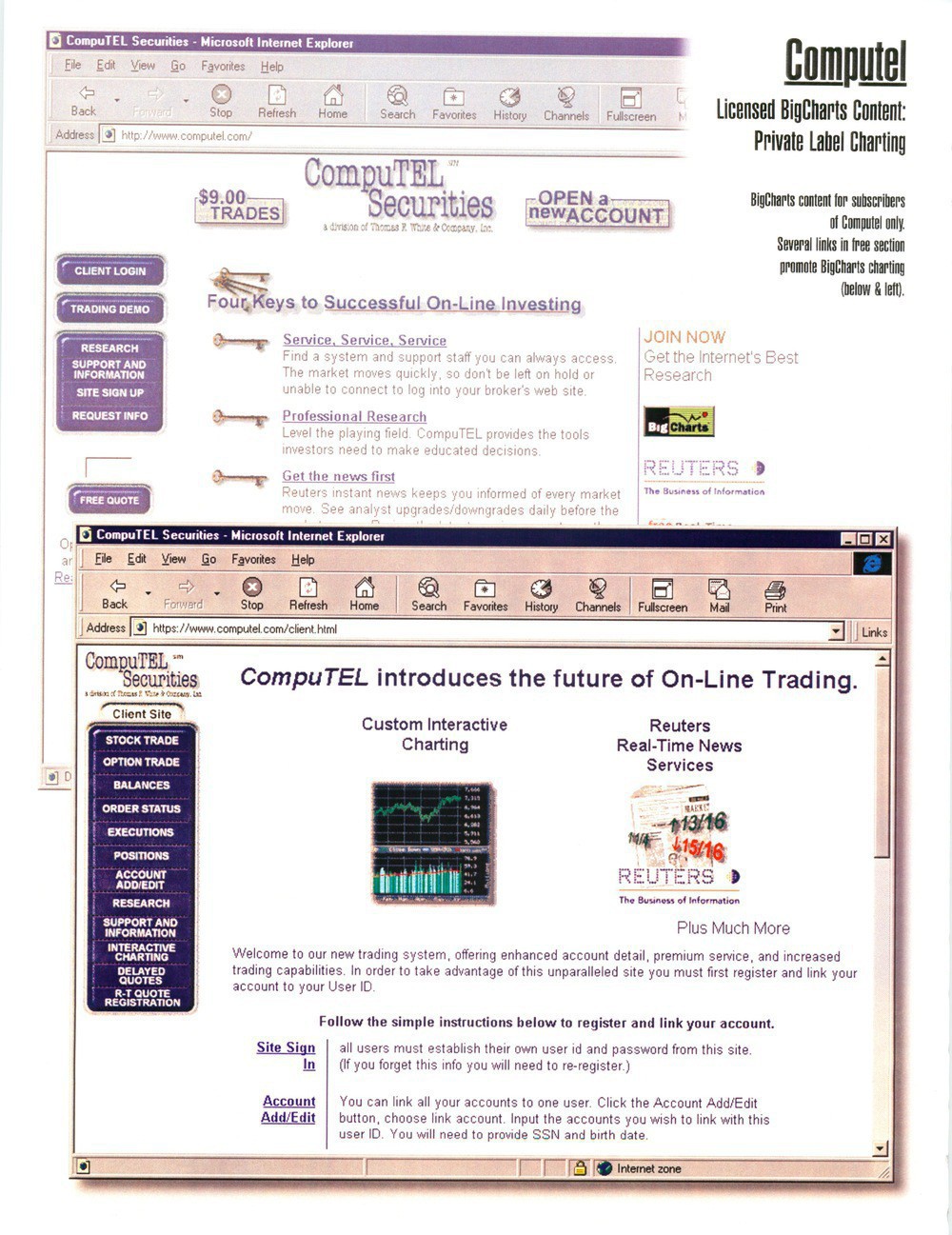

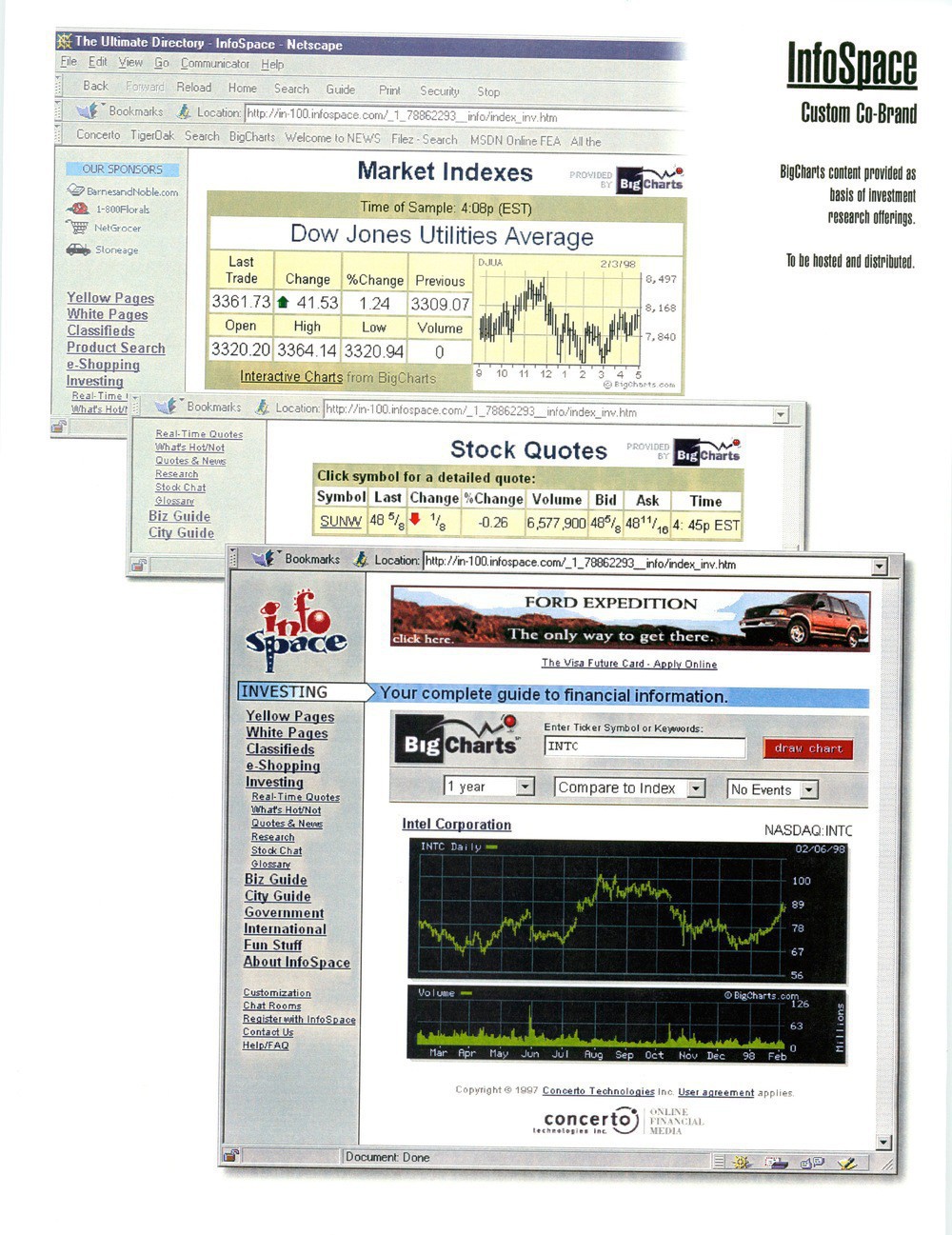

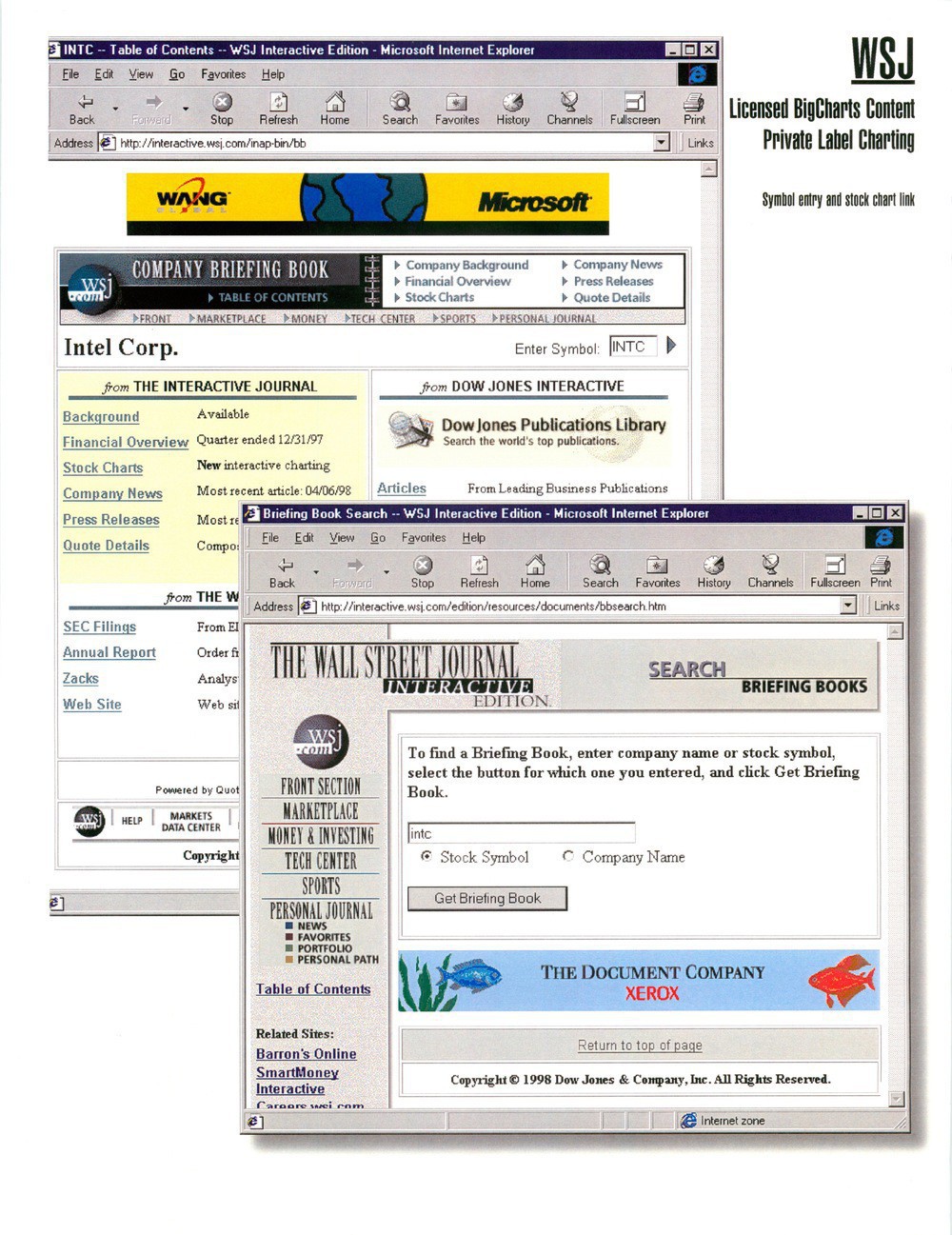

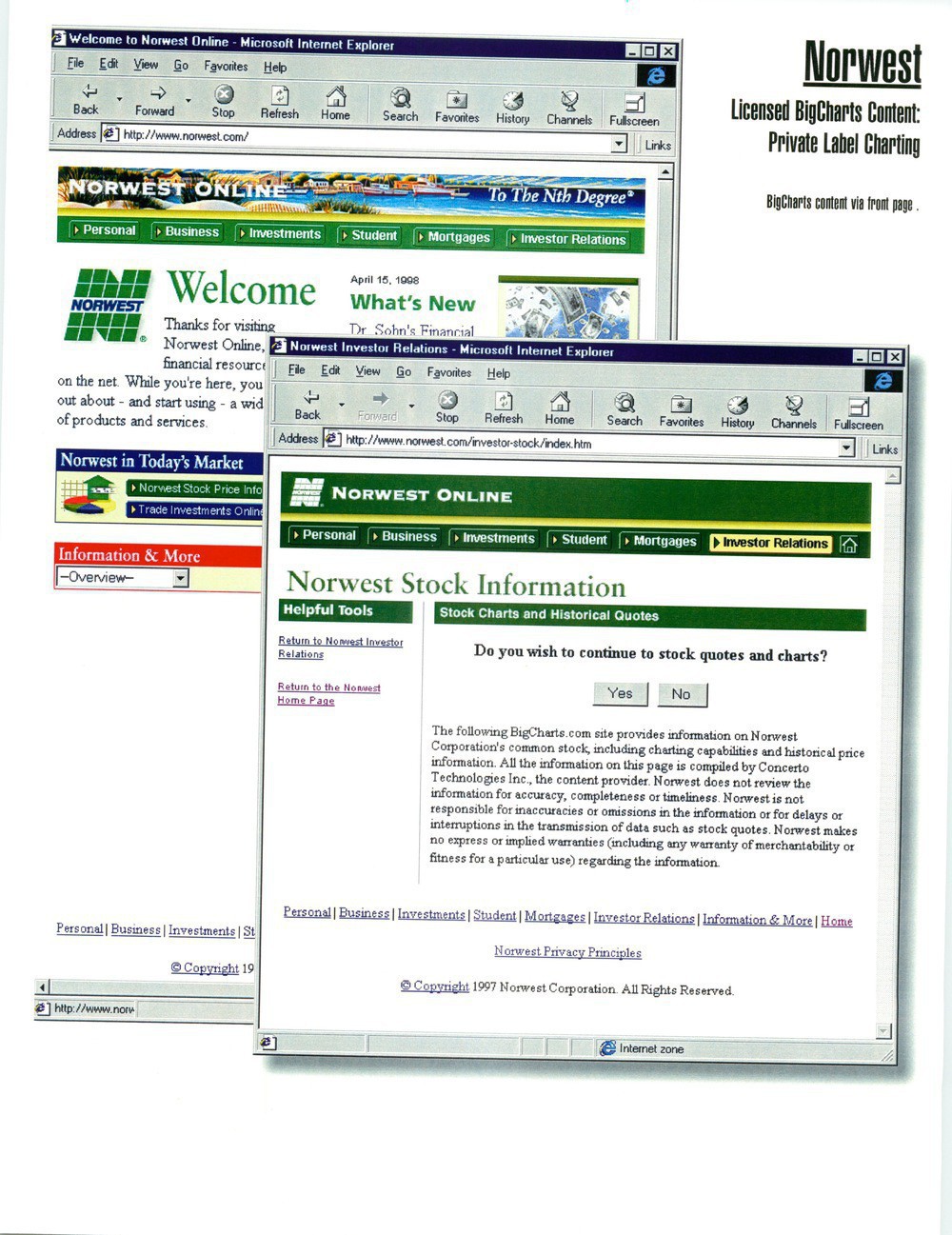

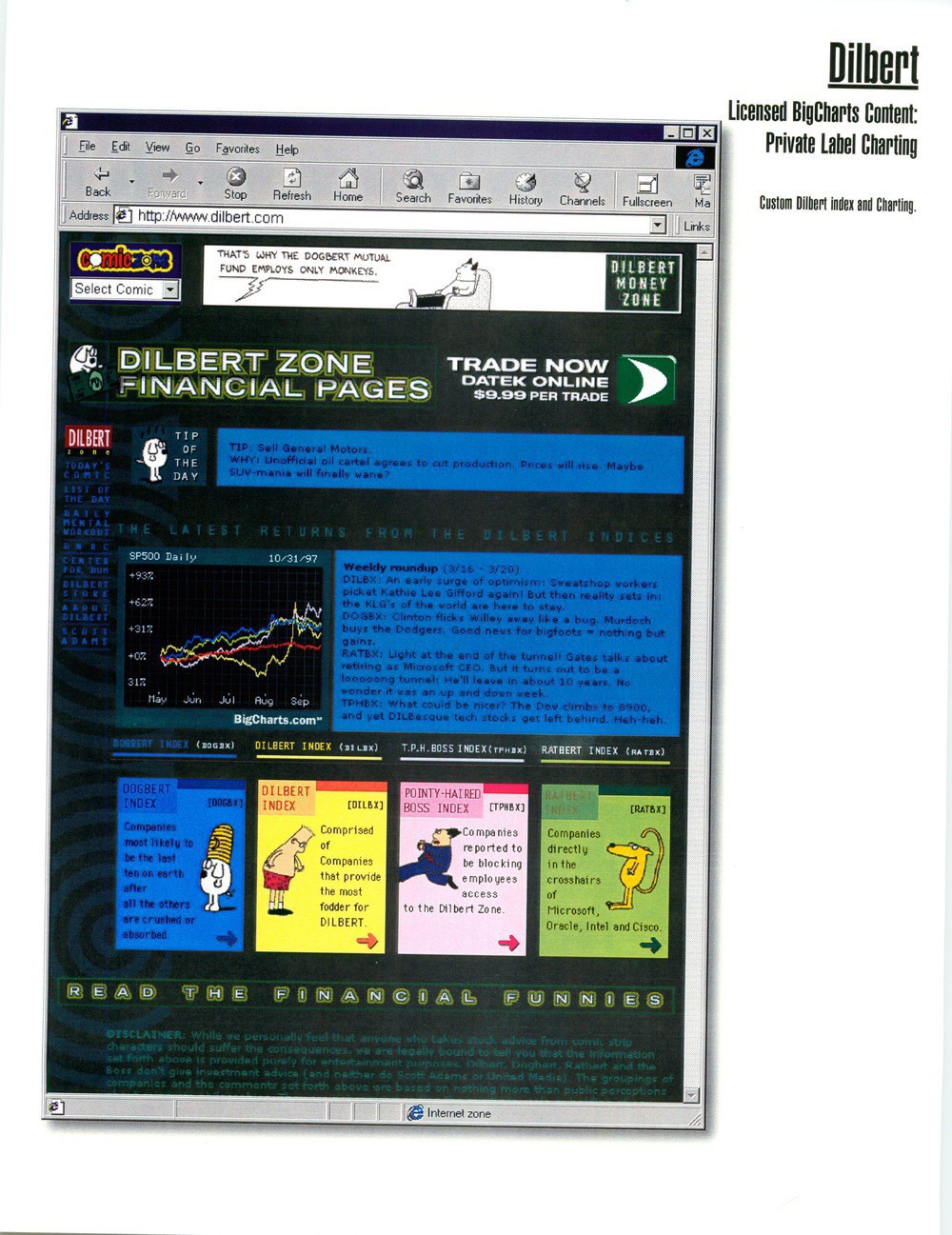

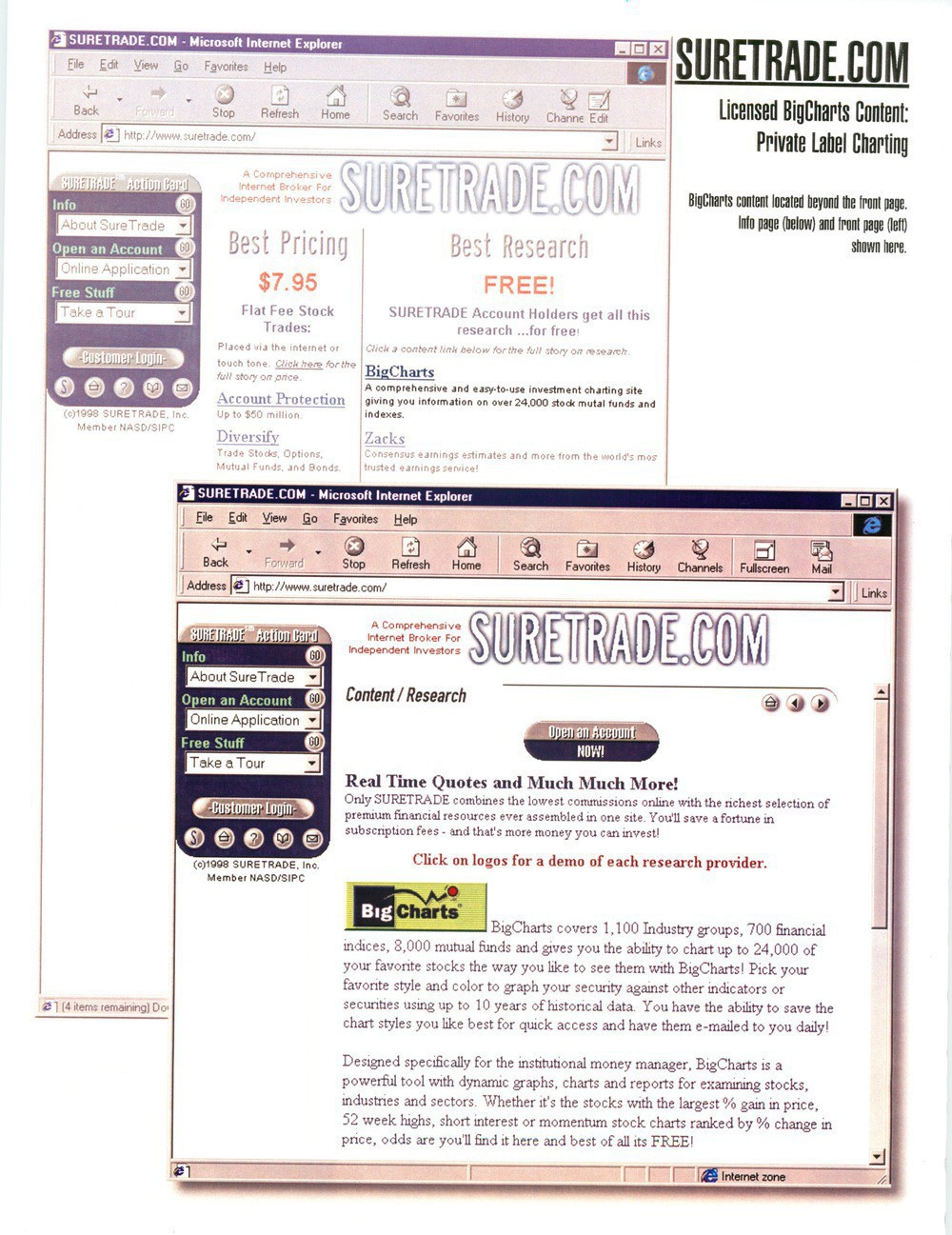

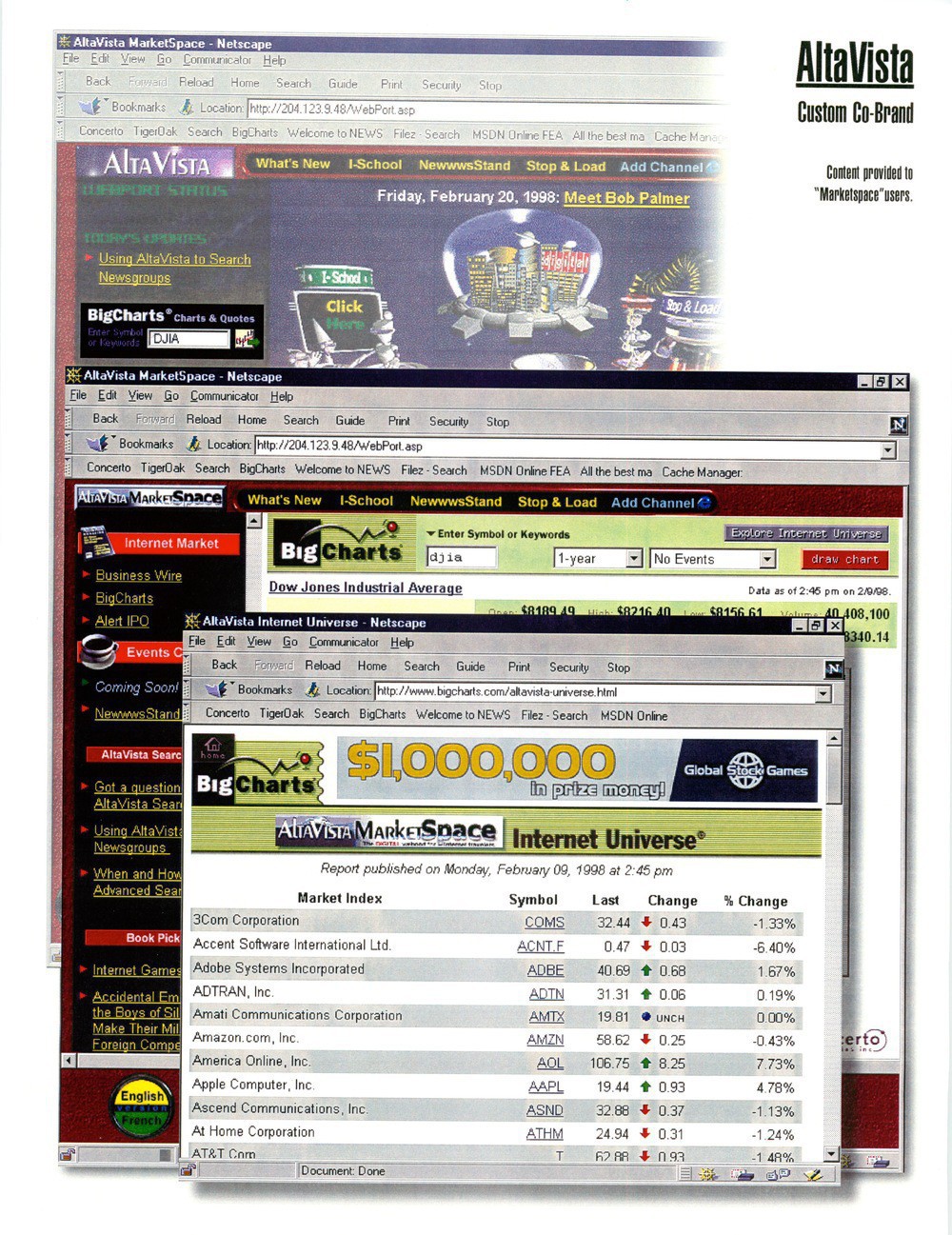

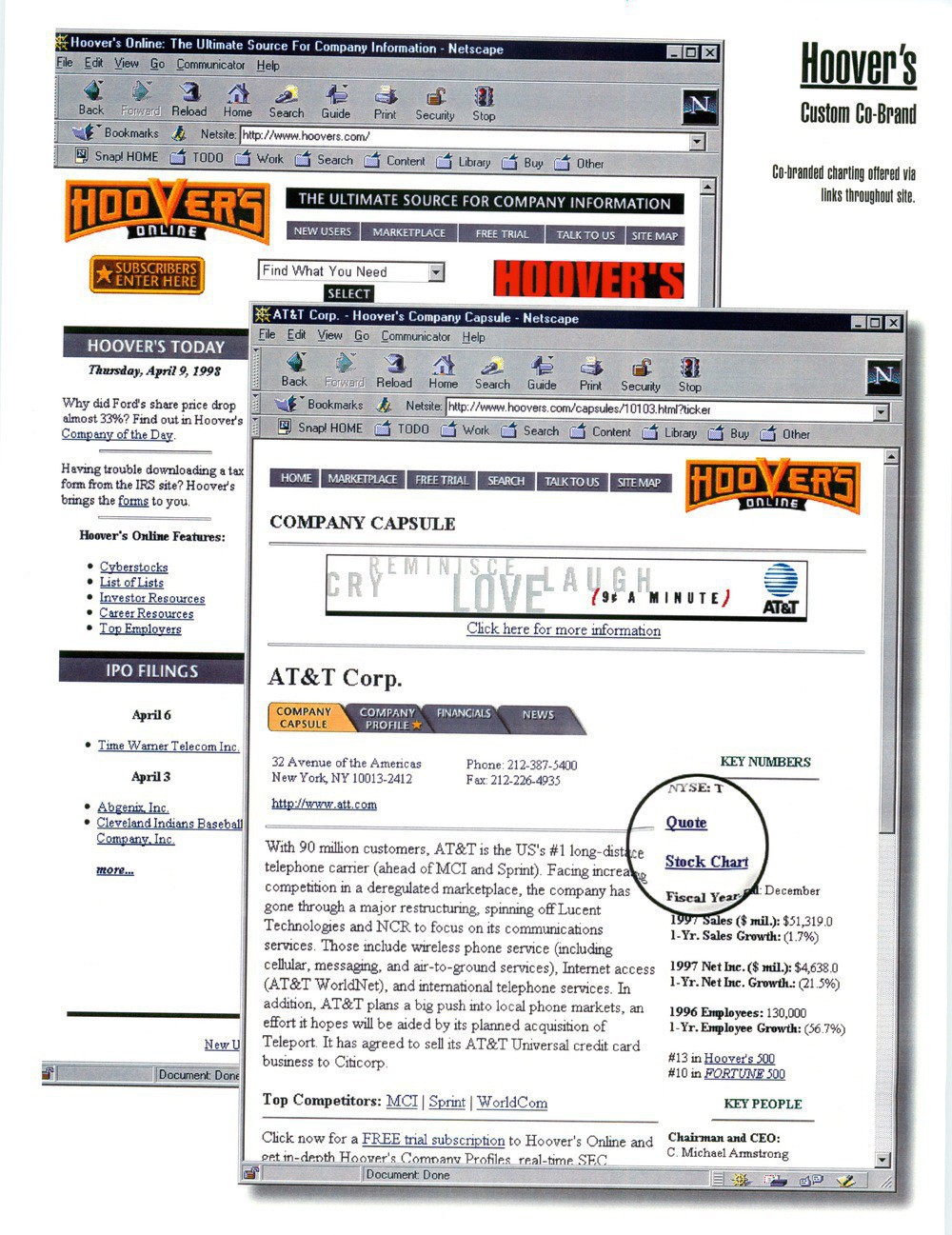

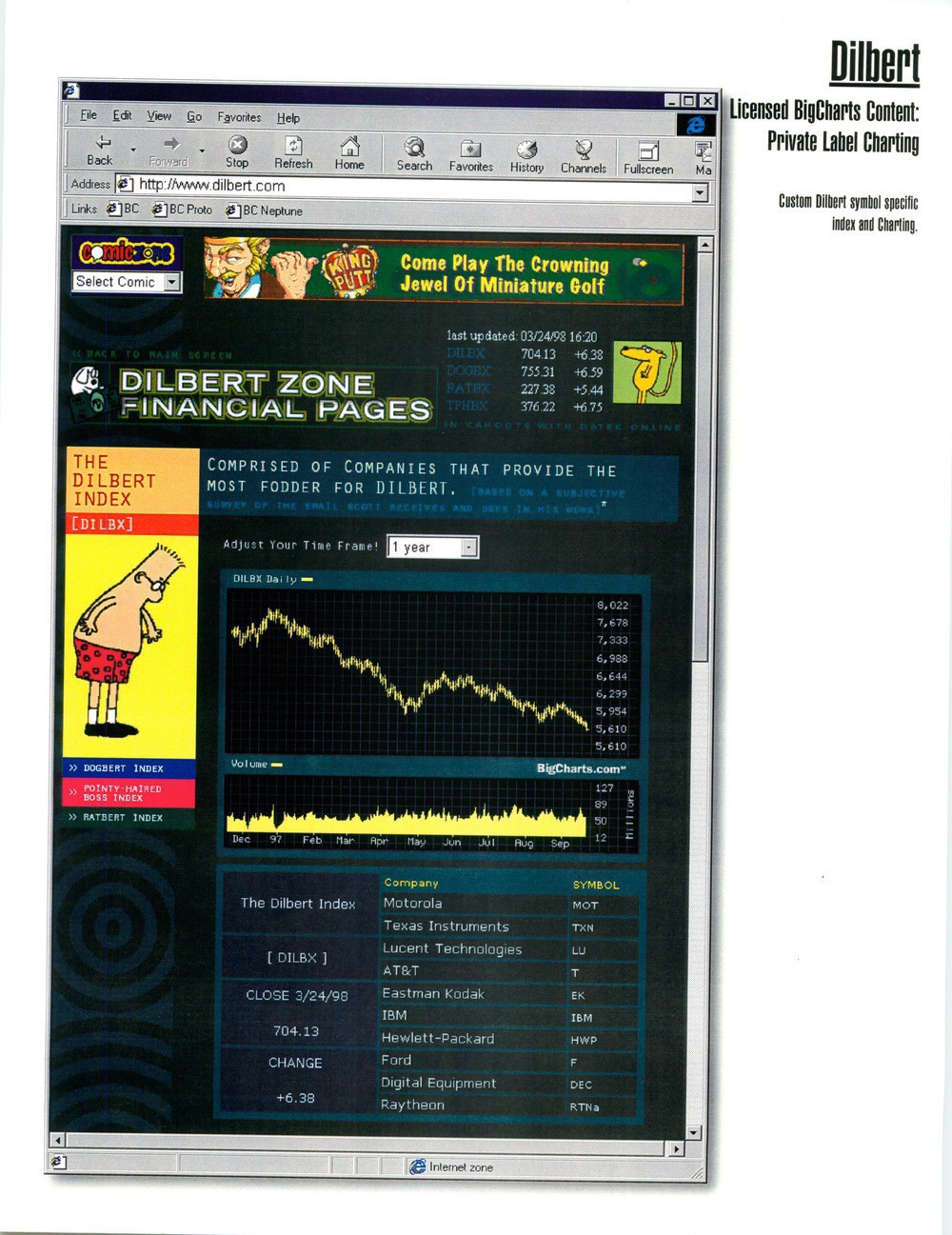

Flashback: BigCharts Partnership Portfolio from 1997

We recently converted my home office to hardwood flooring from carpet. Doing this required that the room be emptied, including a big filing cabinet. I decided it was time to do a filter through that filing cabinet and found some fun things from a many years ago. One of those items was the BigCharts Partnership Portfolio from 1997-1998. This was a printed, high-gloss, portfolio item that we shared with clients so they could see how people were using the products. It’s pretty fun to see all these screen shots of sites (many of which are long gone now) from a decade ago. I scanned a copy so others could enjoy.

Some highlights that gave me a chuckle:

Go Dollar!

As we are preparing for our trip to London I started watching, with great displeasure, the demise of the US Dollar. However, August has brought some pleasant changes. (Note, this is a chart of how many £ GBP’s you can get for $1 USD. Higher is better for us.)

Seeing these recent moves I’m feeling that I picked a good day to wire the 2nd half of our apartment payment as well as the £1,000 security deposit. We are at the best point of the entire year.

Charts are all from my alma mater BigCharts.com.

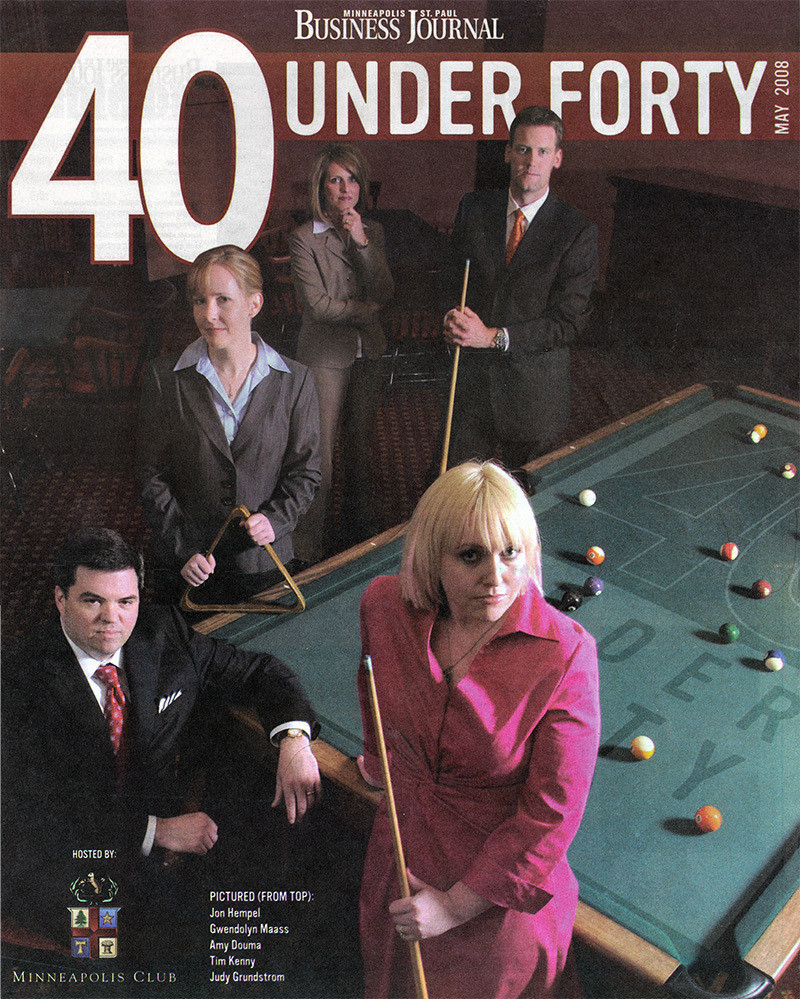

40 Under Forty Award

I got the exciting news a couple of weeks ago that I was selected to be one of the recipients of the Minneapolis St. Paul Business Journal’s 40 Under Forty awards. The process to be selected involves a nomination process. The editors receive letters from people and then sift through those to figure out who to pick. My sincerest thanks to Dan Grigsby who threw my name into the ring first, as well as everyone else who suggested me for this award. Lastly, thanks to John Riedl for taking the great quotes. Thank you! The Business Journal has been doing this award for at least 11 years now (2006 Winners, 2007 Winners). Dan Grigsby is also a winner this year. Looking in the past years I see Andrew Eklund of Ciceron. Going all the way back to 1999 shows my friend and founder of BigCharts, Philip Hotchkiss. It’s great to join such company.

This is a great way to cap off the last decade as I transition into the next chapter. A cherry on the top if you will.

There is a dinner tonight at the Minneapolis Club for this event. Looking forward to meeting everyone else!

Flashback: MarketWatch in Windows 2000 Launch

There are a few points in the history of BigCharts and MarketWatch that I’m especially proud of. Perhaps one of the most prominent ones, and most public, is the inclusion of the BigCharts BigArchitecture (the name we retroactively gave the COM-infrastructure behind MarketWatch and BigCharts) in the scalability demo at the Windows 2000 launch event. The video is a fun watch.

Prelude

We had been working with Microsoft pretty extensively at this point in part because we were trying to run our stuff on Windows NT 4.0 and it was horrible. We were having immense problems. We decided to throw a “Hail Mary” and upgrade to the unreleased beta of Windows 2000 Server. It worked! Our problems, which I can’t even remember now (anyone?) went away, and our sites stabilized.

Microsoft knew about the success we had had and was looking for the scalability demo for the launch. They called us about 10 days before the launch event to see if we could do it. We sent one of our systems team out that night. When he got there, Kristian Meier called me on my mobile saying “Dude! Do you know what they want me to do?! This is awesome!” We really hadn’t had time to brief him before his flight.

They made images, installed 500 clients, a bunch of servers, some databases and loaded it all up on trucks to drive from Redmond to San Francisco.

Event

Microsoft only gave us two seats on the floor for the event. Chris Tersteeg and I attended. The screen that they had MarketWatch on in the auditorium was immense. To this day I don’t think I’ve ever seen a screen projected bigger. They brought MarketWatch up live during the talk and at one point the page refresh kicked in. The whole screen went blank and Chris and I sat there with our heartbeat stopped waiting for the page to redraw. I don’t think there has ever been a more anxious page view to the site.

There is a funny editorial aside here. The newsroom was of course covering the launch of Windows 2000 and the theme of the coverage was that it was generally a non-event. We had a headline, above the fold that morning, called “Windoze 2000 Launch” and there was a picture of a guy sleeping next to it, if I remember right. Microsoft of course called me with panic since this wouldn’t exactly be the kind of headline you would want on the screen during the launch event. I called our editor to see what we could do. He appropriately suggested that we hope something new happens to take the headline off the site, otherwise, pound sand. Luckily some new news broke!

The demo was awesome in person. Seeing 500 client machines drive huge traffic to your code base was great. After the launch event we called it a day, rented a convertible and drove around the valley for the afternoon. We also made a stop at Fry’s to pick up some toys.

What a great event. Thanks to everyone who made it a reality!

Flashback: BigCharts on CNBC

Flashback to February 4, 1998! Here are a couple of videos that I stumbled upon on my machine recently. These are an extraordinary walk down memory lane for me, back to the early days of starting BigCharts.com.

We were still very early in the development BigCharts. There were only a dozen or so people in the company. I was sitting at my desk talking to our ISP about getting some more bandwidth. At the time we had a single T1 with a now trivial 1.5 Mbps of bandwidth, about what my cable modem at home does, and only used about a quarter of that. In those days I always had a TV with CNBC on in my office and this came on the screen with no warning.

I sat in my chair stunned in silence, and then hung up on the person I was talking to. At the time we served BigCharts off of a single Sparc 20 clone. The site ran with a clunky combination of Perl and CGI work sitting behind a very early version of Apache. With that clip on CNBC an avalanche of people started to come to the site. To be fair, back then that probably meant a couple of thousand. I really don’t know how many it was since we didn’t even have log analytics back then. Small numbers in 1998. I tried to get onto the server via console and it wouldn’t respond. The load average had spiked so high that I couldn’t get enough CPU to even get a prompt. We ended up pulling the ethernet cable to kill the traffic just to get onto the machine.

February 4th was a Wednesday. This was the first week that my friend Chris had joined BigCharts. We immediately got everyone together and I sat on the Sparc and figured out what, if anything, we could do. We realized our load average was up over 100 because we were forking Perl processes everywhere. Remember, this was old CGI stuff, no mod_perl here. So on his third day at work I started handing Chris Perl programs that he translated into C and gave me an executable for. As we replaced each piece the next one fell down, and we repeated the translation process.

After a couple of hours traffic subsided and we had converted enough things to native executables that we were okay. So the next day this video segment aired.

I love this bit. It is so quaint. I love how Bill Griffeth gives us a total pass on the site going down. It’s just taken as a given, when a lot of people go to a website, the server goes down. Few things highlight so starkly for me how the web has matured over the last decade.

Anyway, obviously with a mere 24 hour gap and being a startup with no real money we had the same issue. A ton of people pointed their browsers at us, the server got overloaded and we had a challenging couple of hours. If I remember right we just let the system ride through it on the second day since we’d already optimized as much as we could in that window.

Shortly after this we started a total revamp of our code. The final stage was a migration to Windows and distributing on multiple servers. But right away we started to push a lot of things that we were doing in CGI/Perl down into Javascript functions on the browser. If only the concept of a CDN existed back then that would have helped us a lot too.

Ahh… good times.

PS - Final comment. The “viewer” that sent the note into CNBC was our CEO and Founder, Philip Hotchkiss!